S&P 500, Nasdaq Turn Lower On Big Bank Burnout

Unable to hold their modest early morning gains, the S&P 500 Index (SPX) and Nasdaq Composite Index (IXIC) slipped, joining the Dow Jones Industrial Average (DJI) in the red at midday. Big bank behemoth JPMorgan Chase (JPM) is dragging the finance sector and blue-chip index, after posting earnings and joining the outcry against President Donald Trump's threat to put a 10% cap on credit card interest rates. Meanwhile, consumer price index (CPI) data for December came in line with expectations at 2.7%, while core CPI slightly missed, leaving investors guessing on how this will influence future Fed decisions.

Danish pharma stock Novo Nordisk (NYSE: NVO) is seeing an influx of attention in the options pits, as shares are trading near the flatline at $60.18, at last check. The company noted it did not find an increased risk for suicidal ideation and behavior with those taking its recently Food & Drug Administration (FDA) approved GLP-1 RA obesity drug, subsequently asking for removal of the warning from its label. NVO has slid 7% over the past nine months. So far today, 39,000 calls have crossed the tape, nearly 10 times the average intraday pace, with the January 2026 8.50-strike call seeing the most attention.

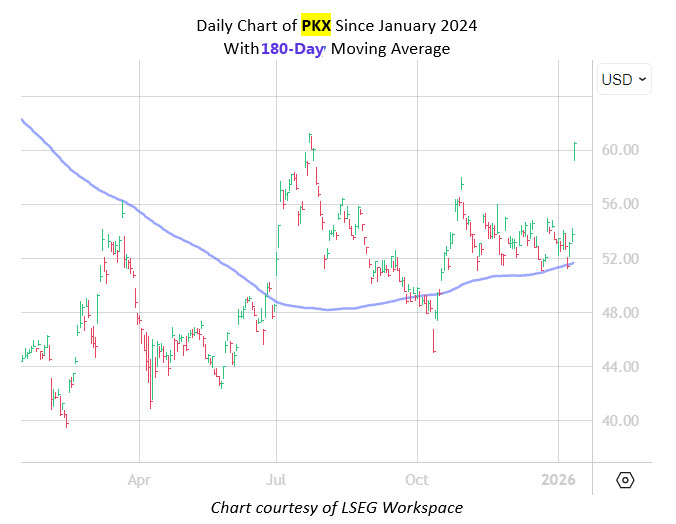

Iron and steel name Posco Holdings Inc (NYSE: PKX) is up 12% at $60.26 at last check, one of the best performers on the New York Stock Exchange (NYSE) today. The steelmaker said it raised $700 million via overseas global bond markets, with the intention to refinance its debt, and expectations for earnings to normalize in 2026. PKX is now eyeing its best daily pop since Nov. 6, 2023. Earlier this month, the shakes bounced off the 180-day trendline, which moved in as support back in October.

UiPath Inc (NYSE: PATH), is one of the worst names on the NYSE, last seen down 6.8% at $16.05. Sentiment shifted on the software stock after it was reported that Chairman Daniel Dines sold 45,000 shares of PATH, worth over $747,000. Today's pullback has the equity testing its near-term support at $16, as well as its 29.5% six-month lead.

More By This Author:

Dow, S&P 500 Notch Record Closes After Market Rebound

Bank Selloff Drags Dow; Nasdaq Shifts Higher

Stocks Start First Full Week Of 2026 Strong