Bank Selloff Drags Dow; Nasdaq Shifts Higher

Major indexes are mixed at midday, paring back early morning losses that followed news of the Department of Justice's (DoJ) probe into Fed Chair Jerome Powell. Former Fed Chair Janet Yellen suggested any threat on the Fed's independence should be more "chilling" to markets.

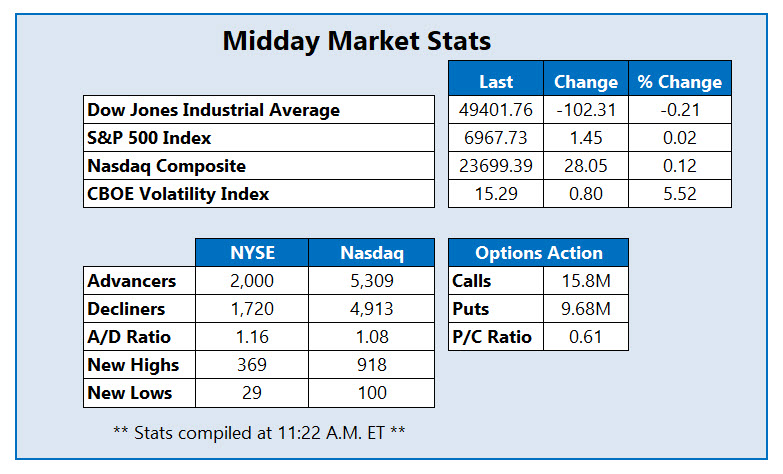

The Dow Jones Industrial Average (DJI) is the only loser at midday, as the S&P 500 Index (SPX) sits flat, and the tech-heavy Nasdaq Composite Index (IXIC) claws its way into the black. Bank sentiment has also moved into focus, after President Donald Trump said a 10% cap on credit card rates would be implemented

China-based Bilibili Inc (Nasdaq: BILI) is popular in the options pits today, with 42,000 calls exchanged so far, 1 8times the average intraday rate. Most popular are the January 2026 21- and 32-strike calls, with buy-to-open activity detected at the weekly 1/23 32-strike call. BILI is charging higher with Chinese stocks today, last seen up 6.8% at $31.16, now sporting an 79% nine-month gain.

Renewable energy name JinkoSolar Holding Co., Ltd (NYSE: JKS) is up 9.5% at $29.77 at last check, one of the best performers on the New York Stock Exchange (NYSE) today. Though the catalyst remains unclear, residual energy sector and AI volatility amid Trump's Venezuelan geopolitical tensions have been a recent driver in sentiment. JKS has added 18% over the past 12 months, with long-term pullbacks captured by the 160-day moving average.

One of the worst NYSE stocks today is Macy's Inc (NYSE: M), last seen down 5.4% at $21.92. Shares are lower with the broader retail sector after Abercrombie and Fitch (ANF) cut its fourth-quarter holiday sales outlook. Should these losses hold, M will be eyeing its lowest close since November, shaving more off its already 9% monthly deficit.

More By This Author:

Stocks Start First Full Week Of 2026 Strong

Stocks Eye Weekly Wins Amid Upbeat Economic Outlook

Nasdaq Snaps Win Streak As Tech Takes Heavy Hit