SOTU X 2

Both the State of the Ukraine and the State of the Union will hold the attention of markets today, the first day of March 2022.

Image: David Marshall

Ukrainian President Zelensky says the next several hours are crucial as a 40 mile long Russian army convoy moves closer to Kyiv and Russia's Defense Minister announces the offensive against Ukraine will continue until its "goals are achieved". In Washington, President Biden prepares for his first State of the Union address tonight, in which he is expected to focus on the economy and America and the world's response to Russia and the war it is waging in Ukraine. Originally, Biden had hope to focus on the U.S. domestic agenda.

Yesterday, U.S. markets were mixed with the S&P 500 closing down 11 points, at 4,374, the Dow closing down 166 points at 33,893 and the Nasdaq Composite closing up 57 points at 13,751. However in early morning trading market futures are treading red. S&P futures are trading down 30 points, Dow futures are trading down 213 points and Nasdaq 100 futures are trading down 112 points.

Overseas, in late night and early morning trading, Asian markets are mixed and European markets are down.

Charts: The New York Times

As the week unfolds TM contributor Craig Birk takes a stab at helping readers understand What The Ukraine Crisis Could Mean For Markets And Investors. Below are some of his thoughts:

"The past week’s events have changed the world order, restoring something akin to the Cold War. It’s hard to see a meaningful cooperative spirit between Russia and the West anytime soon. Russia and China will likely grow closer, though how and to what degree are impossible to predict. All of this is both sad and a little scary.

As for global capital markets, one should consider more important drivers of equity or bond prices to be earnings results, inflation trends, central bank policies, and COVID. Russia represents about 2% of global GDP. The other 98% is still growing. The Fed remains primarily focused on inflation and will begin raising interest rates in March. It is possible central banks will act with more restraint due to uncertainty stemming from Ukraine, a view that pushed U.S. growth stocks higher on the day of the invasion.

Stocks often fall around moments of crisis, only to post better than average returns over the next 6-12 months. Global prosperity is maximized by peace and open markets, but stocks fared quite well in general during the 1950s, ’60s, and ’80s, periods of peak tension between the U.S. and Russia.

Only Putin has a clue what his endgame is. Sanctions and reduced cooperation with Russia will have a significant negative impact on the Russian economy. The ruble is at a record low, having fallen roughly 26% to 105.27 per dollar, down from about 84 per dollar late Friday. Discontent at home could make Putin more volatile and willing to take bigger gambles.

Investors should expect higher volatility to persist, but fear, similar to greed, remains counterproductive and timing the gyrations almost impossible. In choppy times, diversification can help shield your portfolio from dramatic swings."

In a TalkMarkets exclusive, contributor Ricky Wang notes The Serious Situation Of Commodity.

"How sensitive commodity markets are to any disruption in supply. Currently, commodity prices have been fluctuating wildly. Inventories from copper to natural gas and soybeans are tight, which is disrupting the global supply chains and fueling inflation. Russia is a global center for the production of oil and gas, as well as the production of many industrial metals and food crops. Ukraine is also a major player, with its pipeline network that the most exports of Russia's oil and gas need to pass through, also a large amount of wheat and corn.

The physical flows of commodities have been disrupted. Oil traders are looking for alternative sources of Russian crude, according to one of the world's largest tanker companies. Ukrainian ports and railways were closed, and wheat and metal exports were in chaos...The severity of the shortages puts pressure on other suppliers to respond. But few countries have been able to quickly ramp up the production of metals and crops, or even gas and oil. Among these countries, OPEC, and Saudi Arabia in particular, are likely to come under intense pressure to stabilize global oil markets by adding spare capacity. But the decision will be complicated by the cartel's new alliance with Russia over the past few years."

Image: Explosive Options

Contributor Bob Lang in a short column offers these tips on How To Handle Current Market Uncertainty:

"Until the war ends, everyone will remain on edge. And don’t forget that Fed policy has turned hawkish. There’s little doubt they will be raising rates at their next meeting in March and beyond. How should we handle the current market uncertainty?

For one thing, don’t try to outsmart the markets or you may wind up in a world of hurt. I talk about it all the time, but I’ll say it again: the message of the markets can be viewed simply and honestly though the lens of technical analysis. The indicators will never lie to you.

Right now, few market trends have established themselves, which is why trading is so hard.

My best advice is to slow down and take your time.

While we wait for the uncertainty to pass, practice chart analysis and learn some new skills.

Let others take risks while you wait patiently for better market conditions."

Yes, the war in Ukraine is becoming more dangerous with every passing hour and President Biden is delivering his SOTU address this evening; however, TM contributor Michael Kramer says (Stocks Drop On February 28) But The Real Risk Doesn’t Come Until Wednesday.

"...the biggest threat to the market will not come until Wednesday when Jay Powell talks in front of Congress. Either wisely or foolishly, the Fed Fund Futures are now pricing in fewer rate hikes by December 2022, dropping by 20 basis points to 1.37%. That is a pretty significant move, and I suspect it will turn out to be wrong. His (Powell's) written text should come out Tuesday afternoon after the close of trading.

I think the market is getting ahead of itself in thinking that the Fed will be less aggressive, raising rates this year, and is making a huge mistake. I expect Jay Powell to be grilled on inflation and have a hawkish tone in his testimony, and I do not think the market has adequately priced in that risk. Based on the rising inflation expectation, it is likely to put even more pressure on tightening monetary policy."

See the full article for Kramer's latest graphs and comments on TIP, SPX, QQQ, SQ and C.

Switching gears, just a bit, contributor Jill Mislinski reports on the February Regional Fed Manufacturing Overview. Here is some of what she finds:

"Five out of the twelve Federal Reserve Regional Districts (currently) publish monthly data on regional manufacturing: Dallas, Kansas City, New York, Richmond, and Philadelphia. The latest average of the five for February is 12.6, down from the previous month."

"For comparison, here is the latest ISM Manufacturing survey."

Go to the full article for links to the individual surveys.

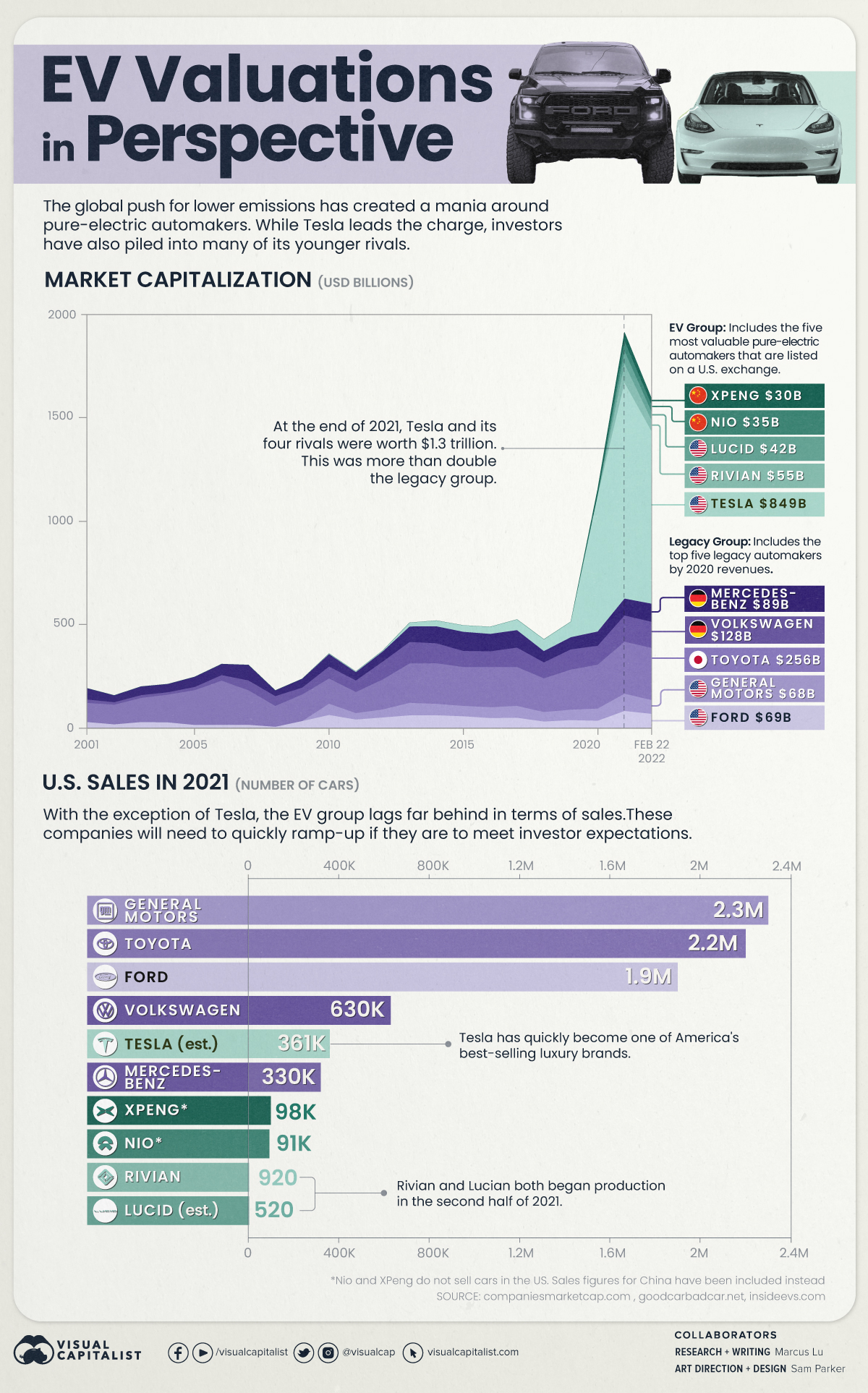

One of the new major sectors drawing the attention of investors in 2022 is the EV or Electric Vehicle sector. TalkMarkets contributor Marcus Lu provides a visual and factual rundown on "established" players and new entrants in his article Putting EV Valuations Into Perspective. Below are some highlights, but the article merits a closer look.

"Tesla (TSLA) is still the undisputed EV leader, but competition is rapidly heating up...With the entire auto industry moving towards battery-powered vehicles, will the market rethink its valuation of Tesla?"

In the "Where To Invest" Department, contributor Chris Katje takes a look at Zoom Q4 Earnings Highlights: Revenue Up 21%, $1B Buyback, Guidance Below Estimates And More.

"Zoom reported fourth-quarter revenue of $1.07 billion, up 21% year-over-year and ahead of a consensus estimate of $1.05 billion, according to Benzinga Pro. The company reported full fiscal year revenue of $4.1 billion, up 55% year-over-year. Zoom reported earnings per share of $1.29, beating the consensus estimate of $1.05 per share...The company ended the year with 509,800 customers, up 9% year-over-year.

Zoom (ZM) announced its Board of Directors authorized the purchase of up to $1 billion in shares. The stock buyback program will end in February 2024. Zoom is guiding for first-quarter revenue of $1.07 billion to $1.075 billion, below a street estimate of $1.1 billion. The company sees first-quarter EPS coming in a range of 86 cents to 88 cents per share.

For the full fiscal year of 2023, Zoom is guiding for revenue in a range of $4.53 billion to $4.55 billion. The estimate is currently $4.71 billion from analysts...Zoom shares are down 5% to $127.24 in after-hours trading Monday."

Caveat Emptor.

That's a wrap for today.