Something Big Happened In The Gold Market: Must See Charts

Something BIG happened in the gold market this year and very few investors understand the significance. While precious metal analysts debate whether the huge gold rally since the beginning of the year is sustainable, I am beginning to wonder if certain indicators are no longer reliable.

I’ll get into that in a moment, but wanted to share a few things as it pertains to my views on the precious metals.

A few weeks ago I was able to get away on a short vacation with my family. We stayed at a nice Bread & Breakfast and at night I enjoyed listening to several different guests talking about their jobs and past-times. In my experience, I have found out that the majority of people would rather talk about themselves rather than listen to others. This doesn’t bother me at all as I get to learn more things with my mouth shut than I do with it open.

Regardless, the most interesting chat I had was with the Bread & Breakfast owner’s son. He stated to talk about the Presidential race and it moved to different aspects of the economy and finance. It happens that the son went to college to study economics, so this was a huge treat for me as I had a good idea where this would lead.

Before I could mention the subject of precious metals, my wife (sitting next to me) asked the son, “If he had a nice chunk of change to invest, what would he invest in?” I knew where my wife was going with this because she knows a lot about gold and silver due to my 15 years of boring her to death with all the details.

Anyhow, his answer was quite interesting. He said, “I would buy travel Visa’s” I thought that was an interesting answer as I have never heard of it before. He explained why he would invest in that, then I asked him what he thought about the precious metals?? His answer was, “YOU CAN’T EAT GOLD.” He did not have anything good to say about the precious metals…. LOLOL.

I didn’t find this surprising at all, as I’ve heard that KNEE-JERK response over and over from supposedly intelligent individuals. Actually the next day, I thought it might be a good idea for a promotional precious metals T-SHIRT by having on one side of the shirt printed with, YOU CAN’T EAT GOLD, and on the other side, YOU CAN’T EAT YOUR 401K.

YOU CAN’T EAT GOLD… Oh Really??

Anyhow, this is the problem with most Americans. At some point down the line they heard “YOU CAN’T EAT GOLD” from someone and they continue to regurgitate it as if it makes some sort of sense. Well, of course you can’t eat gold…. what a stupid statement. On the other hand, humans actually do actually eat a little gold. Have you heard of Goldschlager Schnapps or chocolate cake with gold leaf?

So, people have been consuming gold for quite a while. Now, the question is… who would drink little pieces of their 401K in their schnapps or draped over their birthday cake???

Anyhow, I continue to come across silly or ignorant comments about the precious metals all the time because the individual is either repeating a stupid line they heard, or the person doesn’t understand the underlying fundamentals.

For example, a reader on another website made a comment about my article on The Fundamental Reason The Silver Price Will Explode Much Higher Than Gold. He said,“Ridiculous. why don’t you writers talk about something worthwhile, like the silver basis.”

First of all, my analysis is NOT BASED on short-term forecasts. Rather, I look to the mid-longer term trends. My analysis on comparing gold and silver scrap supply versus total demand of those metals shows how much more silver is lost in the market than gold. This supply imbalance will translate into a much higher silver percentage gains in the future. I never said this was going to impact the silver price this year.

Secondly, many market indicators are becoming less reliable today than they were years ago. This is due to the manipulation of the market by the Fed and Central Banks. Furthermore, the silver or gold basis may be flawed due to precious metal market manipulation. I will discuss this shortly.

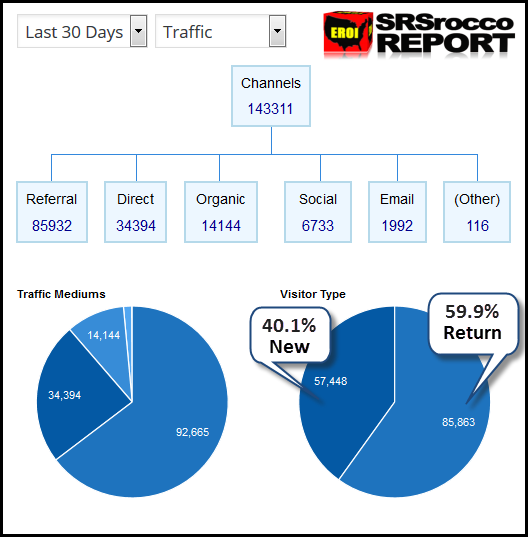

Lastly, MORE & MORE AMERICANS are finally waking up. I know this because 40% of my visitors are new EYEBALLS to my site each day. Here are the SRSrocco Report site Google Analytic stats for the past 30 days:

Of the 143,331 individuals who visited my site over the past 30 days, 57,448 were NEW visitors, while 85,863 were RETURNING. That’s a lot of new people stopping by the SRSrocco Report in a month.

As I have stated over and over, if just 1-2% more of the population moved into physical gold and silver, it would be game over. There just isn’t enough metal to go around… only a much higher prices.

Okay… let’s get back to really interesting information.

SOMETHING BIG HAPPENED IN THE GOLD MARKET

Most precious metals investors have read about the huge price move in gold and the large flows into Gold ETFs & Funds in the first six months of 2016. However, very few realize just how significant the changes have been in the gold market if we compare it to the past.

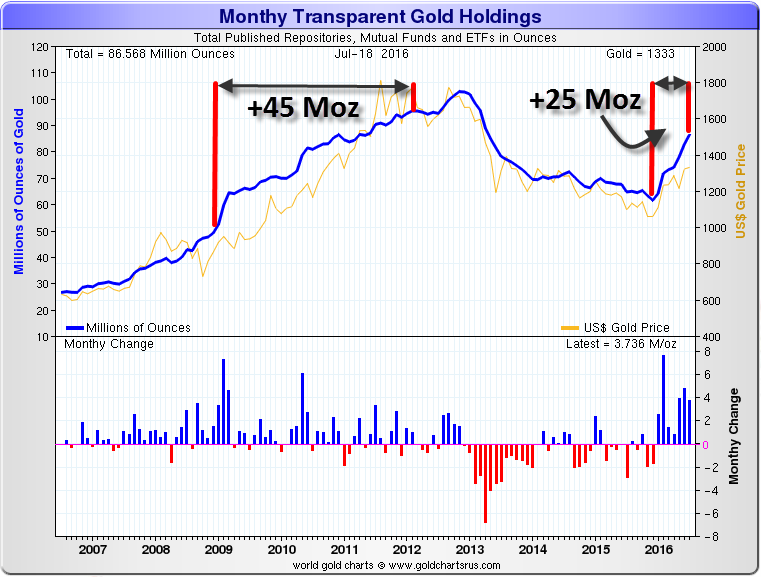

This chart is the Monthly Change of Transparent Gold Holdings from Sharelynx.com. These holdings represent Gold ETFs, Funds and Repositories, such as the Comex:

From the beginning of 2009 to the end of 2011, these total gold holdings increased approximately 45 million oz (Moz). So, as the price of gold moved up from a low of $780 at the beginning of 2009 to nearly $1,900 in September 2011, total gold holdings increased 45 Moz. Now, compare this to the massive 25 Moz increase of total gold holdings in the first half of the year as the price moved up only $300.

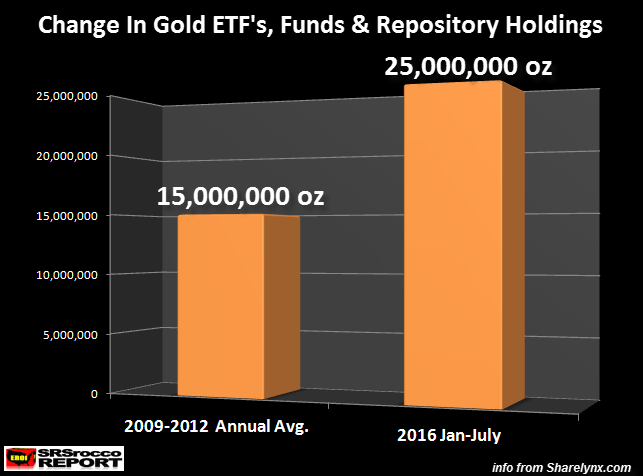

The significance of this present change in the gold market can be better seen in the chart below:

The average annual increase in total gold holdings during the 2009-2012 period was 15 Moz compared to 25 Moz for the first half of 2016!! If demand for gold continues as strong in the second part of the year, we could see upwards of 50 Moz move into these total gold holdings versus 45 Moz for the 2009-2012 period.

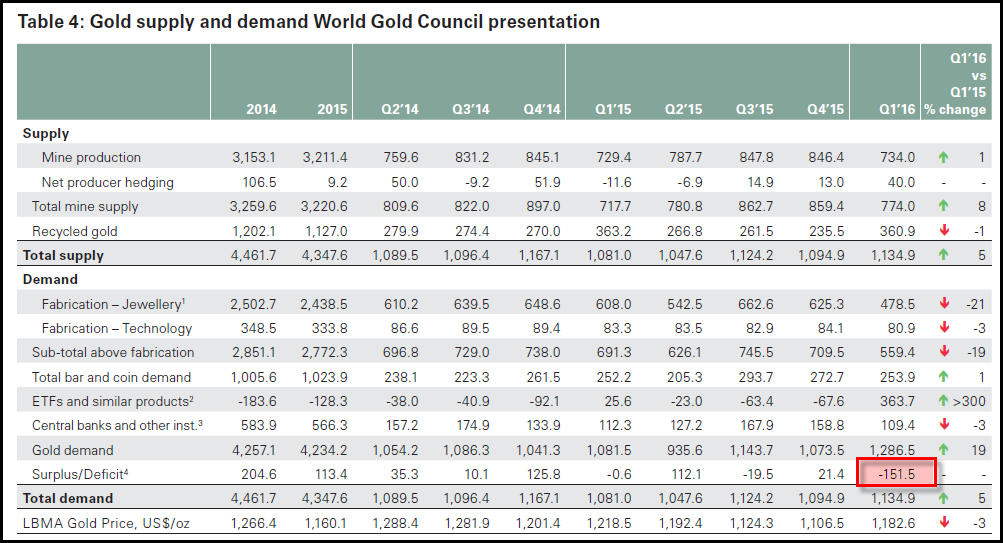

That being said, I highly doubt these Gold ETF’s, Funds and Repositories are receiving all the gold they report. Why? Well, if we look at the Gold Supply-Demand situation, the gold market will experience a large deficit for the first half of the year. According to the World Gold Council, the huge surge in Gold ETF & Fund demand caused a 151 metric ton (4.8 Moz) deficit for Q1 2016:

If we assume total Gold ETF & Fund holdings doubled to 700 metric tons (mt) in the first half of the year (they increased by 363.7 mt Q1 2016, shown in the table above), this will likely push the deficit to over 300 mt or 9 Moz for 1H 2016.

So, how does a net change of Gold ETF & Fund flows of 831 mt (-131 outflow 2H 2015 + 700 mt inflow 1H 2016) since the second half of 2015, not impact the gold basis as reported by Keith Weiner of Monetary Metals?? In Keith’s last update, he stated the following about gold:

What Keith is stating here is that if the gold price was set to really rise, the BLUE LINE (gold basis) would be trending down, not up. Even though it fell a bit recently, the trend has been moving higher since the beginning of March. When the blue line trends higher, according to Keith’s analysis, there is more abundance of gold.

So, how does 25 Moz more of gold demand into the Gold ETF & Fund Market during the first half of 2016 not impact the gold basis, as reported by Keith Weiner??? How much does an additional 25 Moz impact the market??? Global gold mine supply was a little more than 1,500 mt (48 Moz) in the first half of 2015. This new Gold ETF & Fund demand devoured 50% of global mine supply, not including gold jewelry, industry, bar-coin or Central Bank demand.

I will tell you how 25 Moz of gold moving into the Gold ETF’s and Funds doesn’t impact the gold basis….. because more paper gold is accounted for than the physical gold in their inventories, or some of the gold that is being reportedly held by these ETFs & Funds are owned by several parties. Thus, the gold basis would not be able to provide an ACCURATE reading if the supposed “abundance of gold” was due gold bars with several owners.

Again, how does a 25 Moz movement of metal in Gold ETF’s & Funds in the first half of 2016 not impact the market or gold basis when there was a 4 Moz outflow in the second half of 2015??

If You Can’t Eat Your Gold, Maybe You Can Sell The Same Bar To Several Owners

This is the issue we face today. The market is bathed in fraud from top to bottom. Nothing is as it seems. While I use certain data, information or indicators to forecast mid-long term trends, I try to stay away from short-term forecasts. Yes, I did publish a 20 year chart showing the 50 MA of Silver and how the $20.35 price was a huge trend line. This was not something I look at, but what other big traders pay attention to. If big traders are still controlling the market today, then it makes sense to see what they are doing.

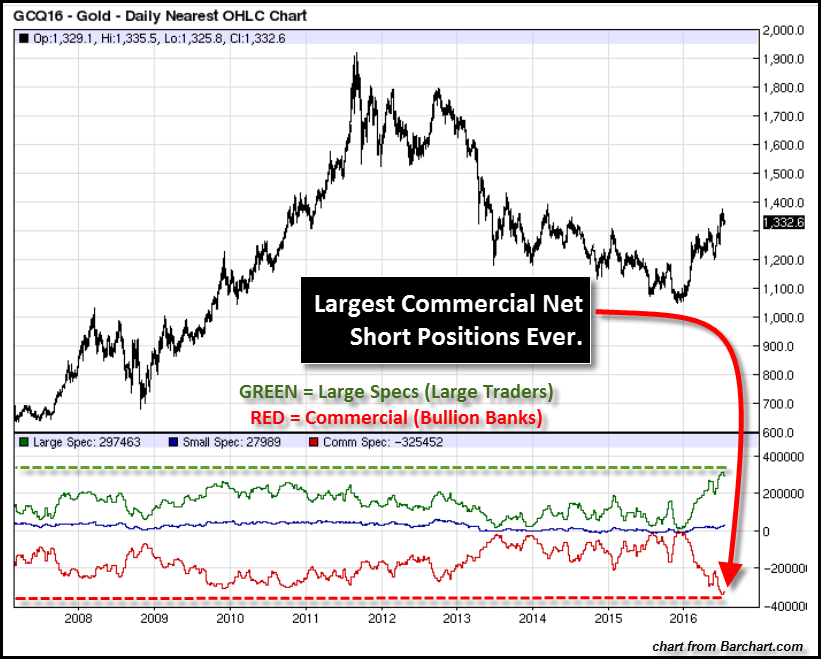

Regardless, the huge $300 price move in gold since the beginning of the year has set a record in another aspect of the market. The Commercials, which are the bullion banks, hold the highest net short positions ever:

The price of gold is shown by the BLACK LINE, while the COMMERCIALS are in RED and the LARGE SPECS are in GREEN. The Commercials have controlled the price of gold and silver forever it seems. When the Commercials hold a record high net short position, normally we see a reversal and correction lower in the gold price.

As you can see in the chart, the Commercials hold a record 325,462 net short positions. For those new to the precious metals market, short contracts are a bet for the price to go lower, while long contracts are a bet that the price will go higher. The LARGE SPECS are large traders and hedge funds (GREEN) that are betting on a higher gold price move, while the COMMERCIALS (RED) are banking on a much lower price.

Now, when I said, “The Commercials are banking on a much lower price”, I wasn’t just making a pun. Because the Commercials are the big bullion banks like JP Morgan and HSBC. If we go all the way back to 2006, the Commercial net short position (RED DASHED LINE) has never been higher. This is also the same for the LARGE SPECS. They hold the largest amount of net Long positions (GREEN DASHED LINE). Even when the price of gold surged to $1,900 in 2011, the Commercials net short positions were substantially less.

At some point, there will be a Commercial Short Squeeze, which would result in a skyrocketing gold price as the bullion banks scramble to buy back their positions. If the situation in the European banks continues to disintegrate, the Commercials may be forced to either ADD more shorts or COVER and buy back their positions. We will see….

So, there are several interesting questions we can ask.

- Why hasn’t a 25 Moz move into Gold ETF’s & Funds not impacted the gold basis as analyzed by Keith Weiner?

- Where is the extra gold coming from to supply this huge surge in Gold ETF and Fund demand?

- How much gold is actually moving into these Gold ETF’s & Funds, or how much of the reported gold is held by several owners?

- How long can Central Banks continue to prop up the market with QE and monetary stimulus before the system crashes?

- When will investors finally realize owning physical gold is better than holding a Sovereign Bond with a negative rate?

I will continue to come across individuals who tell me that “YOU CAN’T EAT GOLD” or write comments stating that the information in my articles is not worth reading. This doesn’t bother me a bit because I am concerned about the 5-10 year horizon. My next article will include some updated U.S. energy data. Let me tell you, WE ARE IN SERIOUS TROUBLE and there isn’t much we can do about it.

Unfortunately, most of the analysis out there is way too specialized so the analyst community falls victim to the LEFT HAND not knowing what the RIGHT HAND is doing.

I call this as INTELLIGENT STUPIDITY.

While it’s true you can’t eat a gold bar, you can’t eat a 401K either. That being said, I would bet anyone during the next financial and economic collapse that you will have a lot more options holding physical gold than a worthless 401k.

Disclosure: None.

Well done article