Soft 20Y Auction Tails As Foreign Buyers Shrink

In a day seeing another push higher in yields, moments ago the Treasury concluded the week's lone coupon auction and it could have been better.

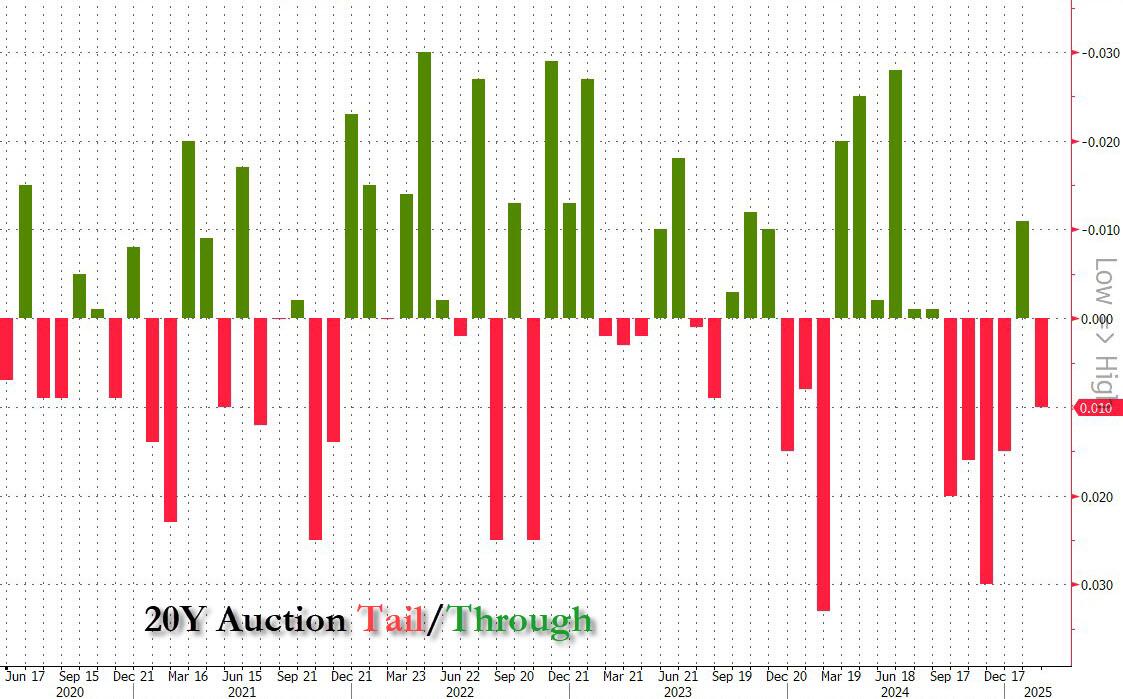

Pricing at a high yield of 4.830%, this was a 7bps drop from last month's 4.90%, but while January's auction stopped through the When Issued by 1.1bps, today we saw a 1.0bps tail to the 4.82% When Issued, the 5th tail in the last 6 auctions.

(Click on image to enlarge)

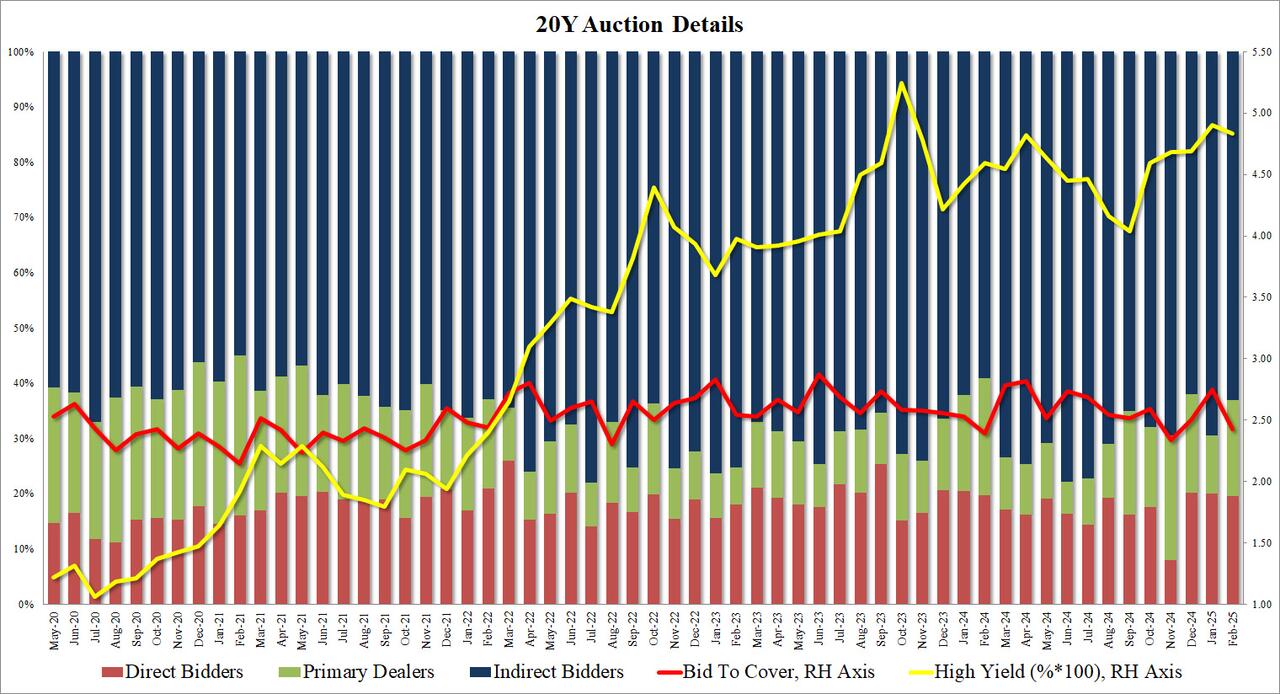

The bid to cover dropped from 2.75 to 2.43, the lowest since November and below the recent average of 2.54.

The internals were also disappointing with Indirect bidders taking down 63.0%, down from 69.5% in January and below the 67.5% recent average usually awarded to foreign buyers. And with Directs awarded 19.5%, Dealers were left holding 17.5%, above the recent average of 15.6%.

(Click on image to enlarge)

Overall, this was a soft and slightly disappointing auction, if nothing too dramatic, and despite the tail and soft internals, there was barely a move in the secondary market where yields continue to trade near session highs.

More By This Author:

US Housing Starts Plunged In January (Along With Homebuilder Confidence)

Trump Warns 25% Tariffs On Cars, Drugs And Chips Coming In April

China Furious After State Dept Changes Line On 'Taiwan Independence'

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more