So You Think We’re In A Recession As Of Mid-July?

Employment situation release data for July, Weekly data, and Google/big data through July 29th, on the US economy (follow up on Part I, Part II, Part III, Part IV, Part V, Part VI, as well as “So you think we might be in recession as of mid-June”, Part I and Part II) – a rejoinder to a reader’s view expressed (today!) “based on the indicators I track, yes, I think we are in continuing recession, and I expect a hard reset of the economy in H2.”

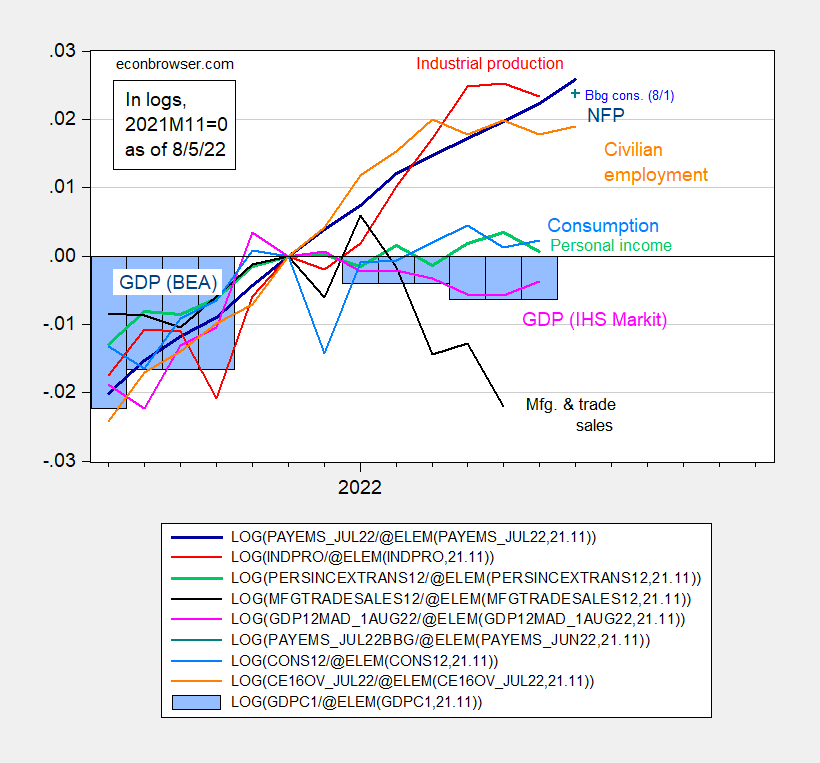

Here is a picture of series followed by the NBER’s Business Cycle Dating Committee, plus quarterly GDP and IHS Markit GDP.

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 8/1 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDP (blue bars), all log normalized to 2021M11=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (8/1/2022 release), NBER, and author’s calculations.

As seen above, the 528K increase in NFP far exceeded the Bloomberg consensus of 250K. In addition, the civilian employment series based on the household series also increased, 179K.

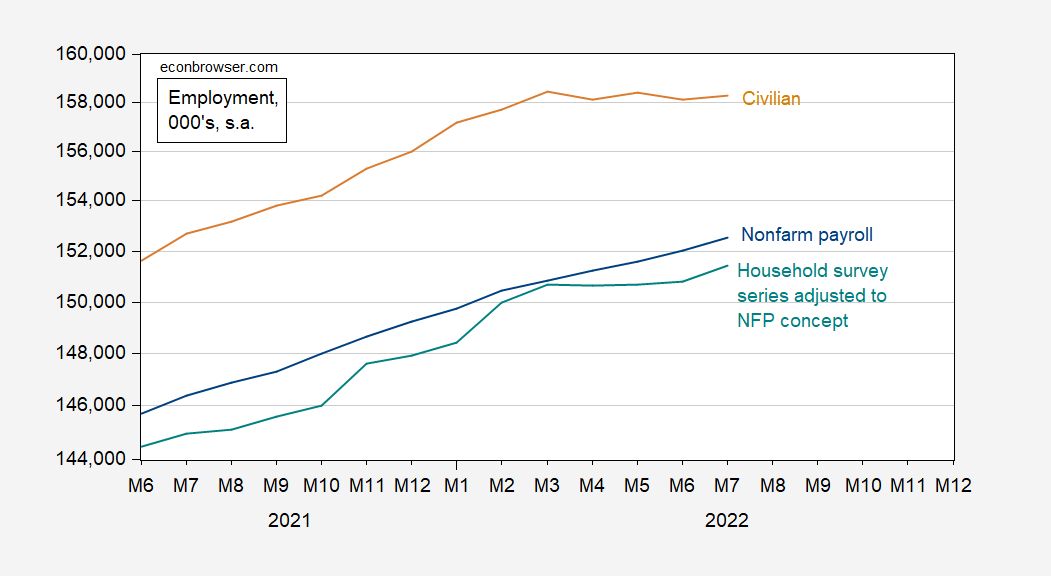

One is often worried about the effects of the BLS birth/death model for firms, which is a critical input into the sample adjustment process, around turning points. The civilian employment series adjusted to conform to the nonfarm payroll concept is not susceptible to this problem; it too moved upward, by 611K.

Figure 2: Nonfarm payroll employment (blue), civilian employment over age 16 (tan), and civilian employment adjusted to NFP concept (teal), all in 000’s, s.a. Source: BLS (July release), and BLS.

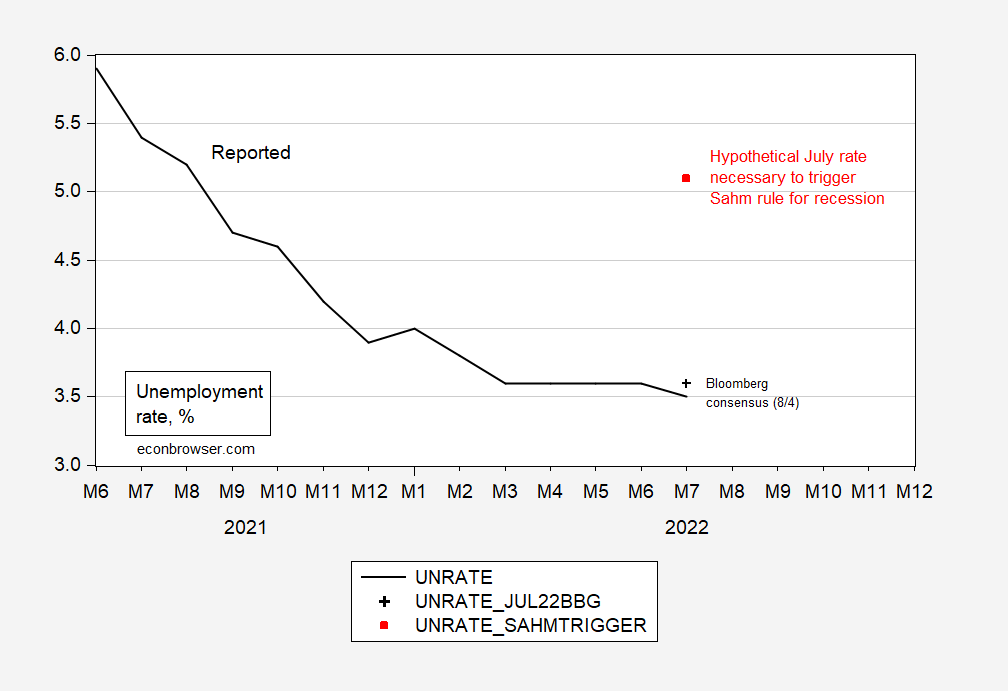

In fact, the unemployment rate dropped from 3.6% to 3.5%.

The unemployment rate, not a central factor in the BCDC deliberations, also does not signal a recession when using the Sahm rule.

Figure 3: Unemployment rate U6 (black), Bloomberg consensus of 8/4 (black +), hypothetical rate necessary to trigger Sahm Rule (red square). Source: BLS via FRED, Bloomberg, author’s calculations.

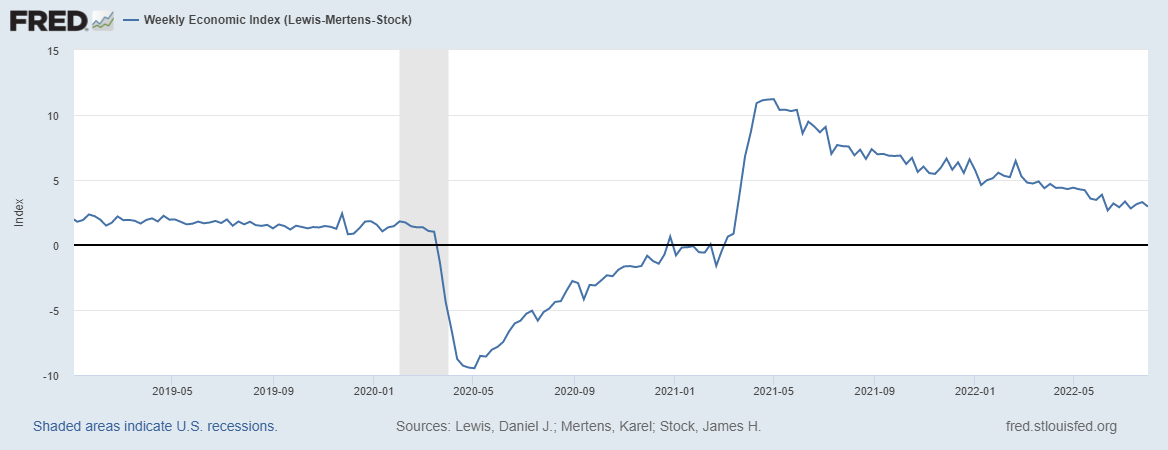

These data pertain to mid-July when the labor market survey is undertaken. For July overall, we can look to weekly data. The Lewis-Mertens-Stock Weekly Economic Index is still above trend:

Source: NY Fed via FRED, accessed 8/4/2022.

More By This Author:

CBO Assessment On A Current Recessionary EnvironmentHeavy Truck Sales And Vehicle Miles Traveled Growth As Coincident Indicators

Spreads Diverge As Inflation Breakeven Drops

Disclosure: None.