Small Business Sentiment Wild Ride

This morning was light for economic data with the only release of note being the NFIB's Small Business Optimism index. The headline number was expected to pull back following the post election surge, but the decline was larger than expected as it came in at 102.8 versus forecasts of 104.7. That being said, as shown in the chart below, small business sentiment is still up huge since last November's election.

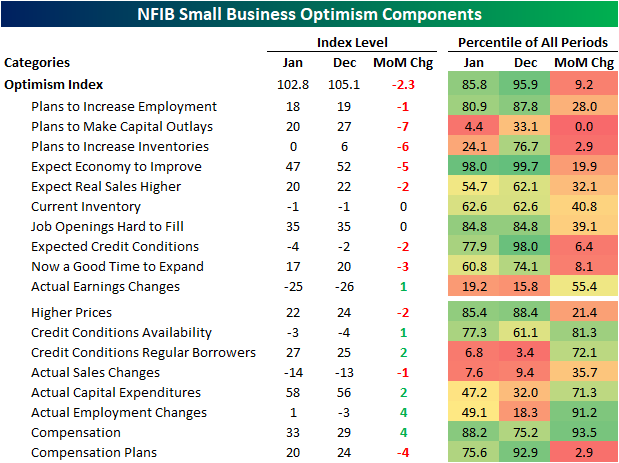

In the table below, we show the readings across the report's sub-indices for January and December, the month over month change, and how those all rank as a percentile of all periods. As shown, the Optimism Index's decline in January was actually quite large falling in the bottom decile of all months' moves. Playing into that were bottom decile declines in a number of inputs like: inventory plans, expected credit conditions, viewing now as a good time to expand, and capital outlay plans. For that last category, the 7-point drop was actually a record single month decline. That is also only one indicator of a number that point to softening capex and labor market conditions which we discussed in today's Morning Lineup.

As shown in the table above, breadth in January was weak on the whole. For all categories (both inputs and non-inputs for the headline index), there were ten indices that fell month over month versus six that rose while another two were unchanged. Looking at the decliners, most of the categories are expectation or plans based. Contrary to that weakness in soft data, hard data indices like actual earnings and employment changes were generally the ones that improved versus December.

In the charts below, we create indices tracking the strength of hard and soft data categories in the report. Following the election, the soft data index soared as expectations and optimism massively improved given small business sentiment has a tendency to favor Republicans. The historically strong readings in that index left more muted hard data in the dust. With that said, January saw the soft data index revert lower although it is still at solid levels in the 63rd percentile of readings. Meanwhile, hard data has continued to improve and is now at the highest level since September 2023.

Again, although the January report showed some moderation in small business optimism, reporting firms are still extremely optimistic. For example, the index of Outlook for General Business Conditions pulled back but remains in the top 2% of readings in the survey's history. Likewise, the share of respondents reporting now as a good time to expand is around some of the highest levels of the past few years.

The NFIB offers a breakdown of reasons given for expansion outlooks. As shown in the second chart below, the strength in positive expansion outlooks has been largely driven by politics. Similarly, those giving uncertain outlooks have less frequently been pointing the finger at politics, however, there was an identical share in January that said costs of expansion was the reason for uncertainty. Unchanged at 7%, that was the highest reading since February 2020. Perhaps most notably, for those reporting an uncertain outlook, a record 22% share blamed economic conditions.

As much as a shifting political landscape has benefitted small business optimism, January did also see an interesting spike higher in the percentage of businesses reporting taxes and government red tape as their biggest issues as the threat of tariffs were quickly introduced. That reading rose to 27% of responses which was the highest since November 2021.

One other indication that Trump's tariff plans have caused some trepidation among small businesses is the Economic Policy Uncertainty index. As shown below, during election years it is normal for this index to rise sharply. This most recent election was a prime example with the largest election year jump to date. While things moderated significantly in the wake of the election with a 24 point decline from the October report through December (also a record for all prior election years), the most recent reading for January showed a 14 point month over month rebound. Not only is that the largest jump of any inauguration month, but it is also the largest month over month increase in the index's history.

More By This Author:

Powell Heads To The HillMarkets and Super Bowl LIX - Go Chiefs

International Dividend Stocks Lag

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more