Skinny Tuesday?

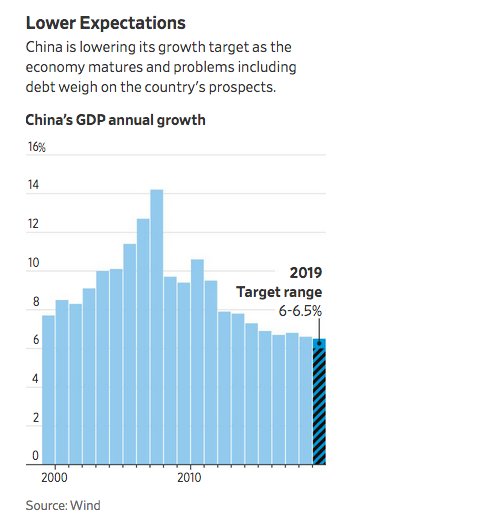

Trading markets is all about sequencing. You have to have a calendar and a keen sense of expectations to get through the noise of news and events. Today is Fat Tuesday, the end of Carnival, and the last day before the start of Lent with Ash Wednesday. While few will see this calendar as important to markets, it does make the number of people paying attention smaller if only because of the holiday atmosphere from Brazil to Germany. There is no joy for risk today as the unwinding of expectations about US/China trade deals and global growth hits the complexity of reality. China National People’s Congress started today and the 2019 GDP target released at 6-6.5% from around 6.5% last year. A CNY2trn tax cut was also announced with VAT reductions and a budget deficit increase goal of 2.8% from 2.6% in 2018. All that seems skinny not fat and while China shares gained, most of the rest of the world is in the red. The economic data today was all about services and most of them were better with Japan growing, Australia getting worse, China getting worse, Europe stabilizing and the UK getting worse. This makes the hope for a 1Q soft-patch continue but in a modest way leaving anyone looking for value hoping for something bigger out of the US. The barometer for today in FX is the CAD with the BOC next on the list tomorrow for sounding dovish against geopolitical issues like China/Huawei, commodities and politics. The data and the BOC stalwart tightening bias seem at odds and in play with markets expecting something to give and the escape value for pressure is the currency first with 1.34 the pivotal resistance.

Question for the Day: Does the China GDP target at 6.0-6.5% matter? There is a sense of expectations being met today but nothing more given the start of the China National People’s Congress and the announcements on plans to bolster the economic performance after a sharp slowdown – blamed on both US/China trade issues and the credit tightening induced by policy to deleverage the shadow banking sector. Markets are watching to see if the efforts by China work and with a nominally positive US trade deal expected, many are pricing in a recovery of sorts. This makes the 6% bottom seem almost modest except for the fact that the pressures on the Chinese continue to be about debt and the shift from corporate to government exposures maybe something to also fear particularly if foreigners don’t help with enough capital inflows.

What Happened?

- Australia February AIG Services PMI improves to 44.5 from 44.3 – better than 43.8 expected – 2nd month of contraction. By sectors, 5 trended lower and 3 were higher with retail trade off 2.9 to 39.9, hospitality -6.4 to 41.9, health/education -3.8 to 42.7, wholesale trade -0.1 to 45.2 and transport/storage up 0.6 to 49.1 while recreation rose 1.9 to 54.9, finance/insurance held flat at 50.4 and business/property services fell 0.8 to 50.2

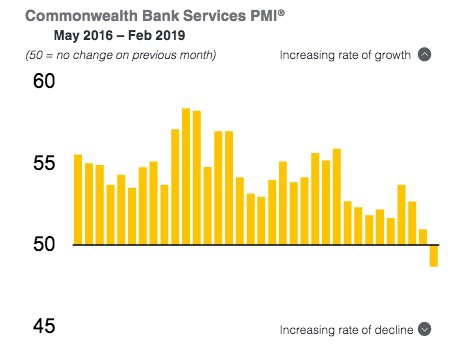

- Australia February CBA Services PMI drops to 48.7 from 51 – weaker than 49.3 expected – first contraction on record. The drop was linked to drought-related impacts and bank regulation changes. New business inflows contracted for the first time on record. The business outlook remained strong at 56. The Composite PMI fell to 49.1 from 51.3 – also weaker than 51 expected.

- Australia 4Q Current Account deficit narrows to A$7.2bn from A$10.7bn in 3Q – better than A$9.2bn expected– even with trade drag. Trade surplus narrowed by A$781mn to A$1.241bn from A$2.022bn in 3Q as exports fell 0.2% of GDP after +0.4% gain in 3Q – worse than the -0.1% drop expected. The net IIP liability also widened to A$975.7 in 4Q from A$939.1bn.

- Australia RBA no change in cash rate at 1.5%- as expected – notes downside risks. On the global front, the RBA statement said: “The outlook for the global economy remains reasonable, although downside risks have increased. The trade tensions remain a source of uncertainty. In China, the authorities have taken further steps to ease financing conditions, partly in response to slower growth in the economy.” On the domestic front, addressing housing, the RBA noted: The adjustment in the Sydney and Melbourne housing markets is continuing, after the earlier large run-up in prices. Conditions remain soft in both markets and rent inflation remains low. Credit conditions for some borrowers have tightened a little further over the past year or so. At the same time, the demand for credit by investors in the housing market has slowed noticeably as the dynamics of the housing market have changed.”

- Korea February CPI 0.4% m/m, 0.5% y/y after -0.1% m/m, 0.8% y/y – less than 0.5% m/m, 0.7% y/y expected. Ex-food and energy, CPI rose 0.5% m/m, 1.1% y/y.

- Korea 4Q final GDP unrevised at 1% q/q, 3.1% y/y after 0.6% q/q, 2% y/y – as expected.

- Japan February Nikkei Services PMI rises to 52.3 from 51.6 – better than 52.1 expected – best gain since November 2018. New business rose at the best rate since May 2013. New orders outstanding grew at the fastest pace in 18-months, supporting employment. Outlook for firms remains optimistic. The composite index fell to 50.7 from 50.9 reflecting the weakness in manufacturing production – the sharpest drop since May 2016.

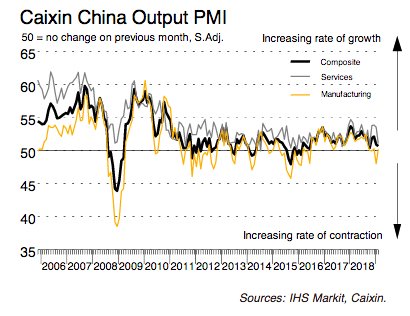

- China February Caixin Services PMI slips to 51.1 from 53.6 – weaker than 53.8 expected – worst since Oct 2018. New orders were the worst since Oct 2018, new export orders slowed to 5-month lows but employment rose for the 5th month if only marginally. The Caixin Composite PMI slips to 50.7 from 50.9 – better than 50.4 expected – but still the slowest in 4-months. Infrastructure spending appears to have helped offset weakness in Services and some manufacturing. The outlook for companies continued to be optimistic and linked to new products, more investment plans and expectations for market improvement.

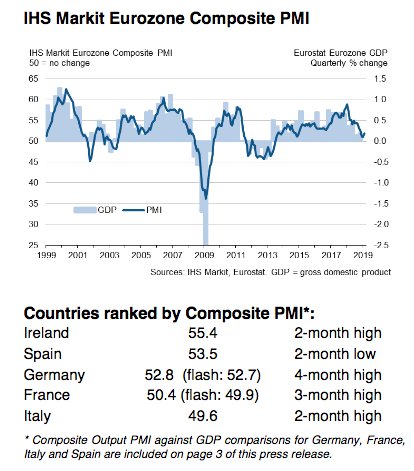

- Eurozone February final services PMI 52.8 from 51.2 – better than 52.3 flash – 3-month highs. The composite PMI rises to 51.9 from 51 – also better than 51.4 flash. Service orders helped offset manufacturing weakness but overall new work was unchanged. Employment was up in all major economies. Confidence improves to 5-month highs despite political and economic uncertainty.

- Spain services PMI slips to 54.5 from 54.7 – better than 54.2 expected. New work supported growth, jobs continued to rise despite minimum wage cost push.

- Italy services rises to 50.4 from PMI 49.7 – better than 49.5 expected. New orders fell for the first time since Feb 2015. Input costs rose to 3-month highs.

- France final services PMI rises to 50.2 from 47.8 – better than 49.8 flash. First gain since November 2018 but new orders decline. Employment gains from 2-year lows. The composite PMI rises to 50.4 from 48.2 – also better than 49.9 flash.

- German final services PMI rises to 55.3 from 53 – better than 55.1 flash. New orders, employment and business confidence all improve. Inflationary pressure remains elevated. The composite PMI rises to 52.8 from 52.1 – better than 52.7 flash – four month highs as services offset manufacturing weakness.

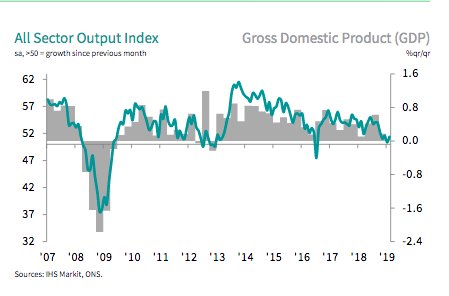

- UK February services PMI rises to 51.3 from 50.1 – better than 49.9 expected – up from 2½ year lows. The 1Q average still on pace to be the worst since 4Q 2012. New work fell and was linked to Brexit. Employment fell with pace the worst in 7-years. The Composite PMI rose to 51.4 from 50.3 – a marginal expansion even with new work lower and employment cuts.

- Eurozone January retail sales up 1.3% m/m, 2.2% y/y after revised -1.4% m/m, 0.3% y/y (preliminary -1.6% m/m, 0.8% y/y) - better than +1.2% m/m expected. Non-food sales rose 1.7%, auto fuel rose 1.6%, food/drink rose 0.6% m/m. The biggest gains by nation were in Germany and Malta up 3.3% m/m while weakness was in Finland -2.1% m/m, Denmark and Austria both down 0.7% m/m.

Market Recap:

Equities: The US S&P 500 futures are up 0.15% after losing 0.39% yesterday. The Stoxx Europe 600 is off 0.1% while the MSCI Asia Pacific fell 0.3% despite China gains.

- Japan Nikkei off 0.44% to 21,726.28

- Korea Kospi off 0.52% to 2,179.23

- Hong Kong Hang Seng up 0.01% to 28,961.60

- China Shanghai Composite up 0.88% to 3,054.25

- Australia ASX off 0.33% to 6,281.40

- India NSE50 up 1.14% to 10,987.45

- UK FTSE so far up 0.35% to 7,159

- German DAX so far off 0.1% to 11,582

- French CAC40 so far off 0.1% to 5,282

- Italian FTSE so far flat at 20,726

Fixed Income: The better Services data, the focus on central banks and the risk mood – all driving with bonds mostly lower globally – core EU focused on ECB next with German 10-year Bund yields up 2bps to 0.18%, French OATs up 2bps to 0.58% and UK Gilts up 1bps to 1.29%. Periphery mixed with Italy off 3bps to 2.71%, Greece up 2bps to 3.70%, Spain off 1bps to 1.17% and Portugal off 2bps to 1.45%.

- US Bonds are lower with equities recovering– China focus continues – 2Y up 1bps to 2.56%, 5Y up 2bps to 2.55%, 10Y up 1bps to 2.74%, 30Y up 1bps to 3.10%.

- Japan JGBs flat despite good auction, curve steeper –2Y flat at -0.14%, 5Y flat at -0.14%, 10Y up 1bps to 0.01%, 30Y up 1bps to 0.65%. The MOF sold Y1.790bn of 10Y #353 0.1% JGBs at -0.002% with 4.25 cover – previously -0.013% with 4.8 cover.

- Australian bonds rally with focus on GDP next, RBA on hold– 3Y off 2bps to 1.67%, 10Y off 2bps to 2.17%.

- China bonds mixed with GDP target/tax cut focus– 2Y off 1bps to 2.75%, 5Y up 1bps to 3.07%, 10Y off 1bps to 3.22%.

Foreign Exchange: The US dollar index is up 0.05% to 96.73. The emerging markets are mixed – EMEA: ZAR up 0.5% to 14.136, RUB off 0.1% to 65.805, TRY up 0.1% to 5.368; ASIA: INR up 0.55% to 70.50, KRW off 0.1% to 1126.

- EUR: 1.1330 off 0.1%.Range 1.1316-1.1341 with focus on better Services PMI helping and ECB Thursday – 1.1250-1.1300 key support.

- JPY: 111.95 up 0.15%.Range 111.71-111.99 with EUR/JPY 126.80 up 0.1%. Focus is on 110-112 still with equities driving. BOJ tapering talk.

- GBP: 1.3155 off 0.15%.Range 1.3150-1.3199 with EUR/GBP .8615 – data still less important than Brexit with 1.3050-1.3300 keys.

- AUD: .7080 off 0.2%.Range .7066-.7097with NZD .6795 off 0.4% - both hit by weaker China PMI and commodities with A$ focus next on GDP and .7050 pivot.

- CAD: 1.3340 up 0.3%. Range 1.3300-1.3350 with BOC the key again and 1.3450 breakout in play.

- CHF: 1.0005 up 0.15%.Range .9984-1.0014 with EUR/CHF 1.1335 flat. Nothing new here 1.00 pivot with .9880-1.0080 keys.

- CNY: 6.7020 flat.Range 6.6950-6.7070. PBOC fixed 6.6998 from 6.7049. Focus is on People’s Congress and GDP target 6-6.5%.

Commodities:Oil off, Gold off, Copper up 0.3% to $2.9430.

- Oil: $56.51 off 0.15%.Range $56.09-$56.58 with focus on equities, data - $55-$58 consolidation. Brent off 0.45% to $65.39 with $65 pivot in play.

- Gold: $1285.90 off 0.1%.Range $1284.30-$1290.60 with $1268 target in play still focus is on risk mood/USD. Silver $15.11 flat. Platinum $839.90 up 0.1%. Palladium $1474.80 off 0.7%.

Economic Calendar:

- 0900 am Mexico Feb consumer confidence 112p 109e

- 0945 am US Feb final services PMI 54.2p 56.2e / composite 54.4p 55.8e

- 1000 am US Mar IBD/TIPP economic optimism 50.3p 50e

- 1000 am US Dec new home sales 16.9%p -8.7%e / 0.657m p 0.593m e

- 1000 am US Feb Service ISM 56.7p 57.2e

- 0200 pm US Jan monthly budget -$14bn p +$48bn e

- 0430 pm US weekly API oil inventories -4.2mb e +2mb e

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.