Six Of Eight Fed Inflation Categories Are Above The 12-Month Trend

This analysis takes the BLS inflation data and recalculates the percentage changes at the category level to get unrounded numbers. The total number ties to the BLS, but it gives more detail at the granular level.

April CPI

Below is the inflation data that has been taken from the BLS. After bottoming in October of last year at 0.08%, the monthly number is now at .31% which is below the last 3 months but also still running at an annualized rate of 3.7%. While the monthly number was below expectations, it’s very clear to see that we are at a new level of sticky inflation.

(Click on image to enlarge)

Figure 1: Month Over Month Inflation

The YoY CPI has been near the low 3% range since June of last year but it has picked back up over the last two months. This is not unexpected as the 0.09% monthly increase from March of last year fell off. Next month will also likely see an uptick in the annual number as the 2023 May 0.11% falls off.

(Click on image to enlarge)

Figure 2: Year Over Year Inflation

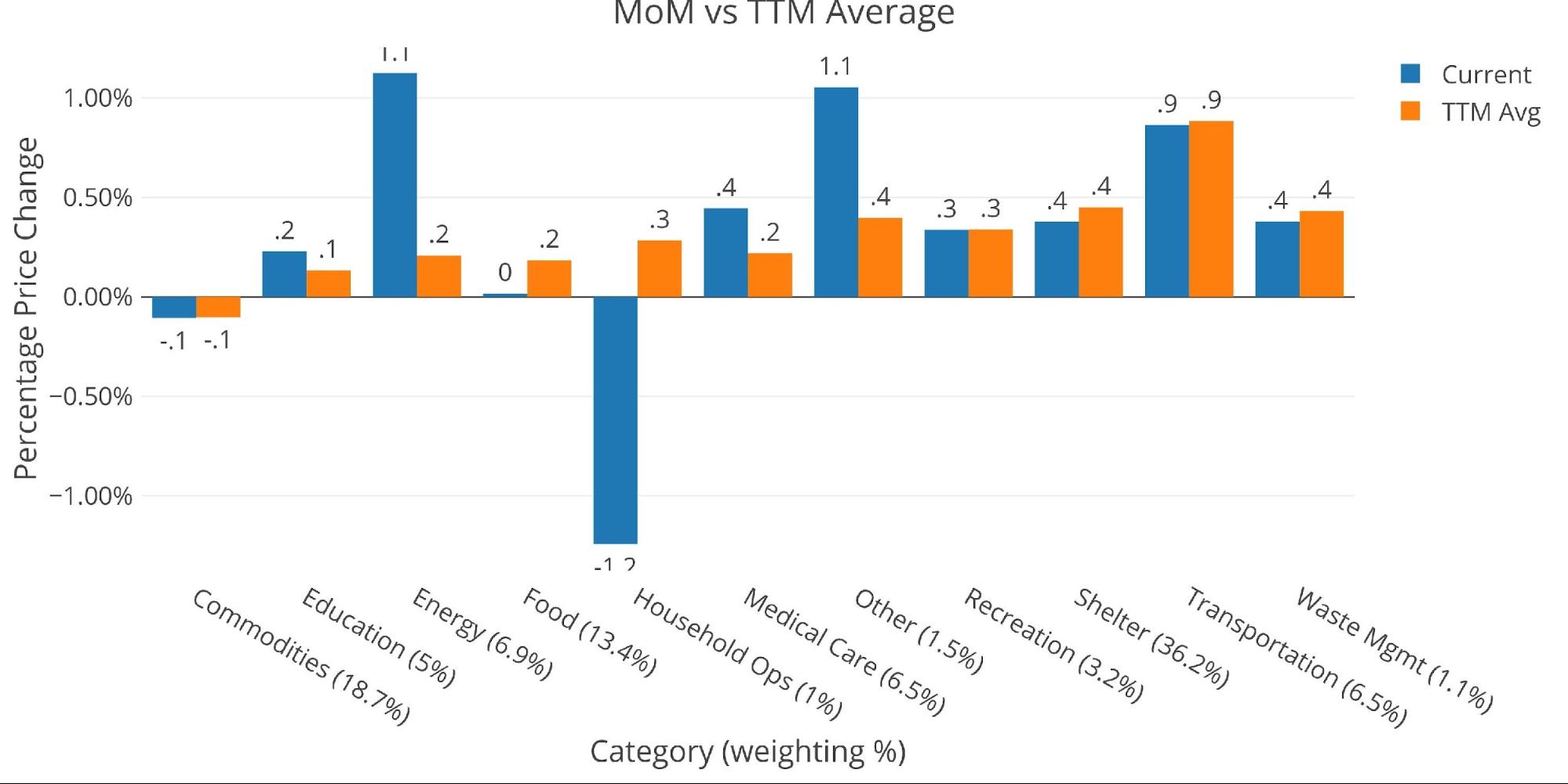

Looking at the individual categories relative to history, it is clear that Energy is having an outsize effect and that shelter remains elevated at 0.38% which is 4.7% annualized rate.

(Click on image to enlarge)

Figure 3: MoM vs TTM

The table below gives a more detailed breakdown of the numbers. It shows the actual figures reported by the BLS side by side with the recalculated and unrounded numbers. The weighted column shows the contribution each value makes to the aggregated number. Details can be found on the BLS Website.

(Click on image to enlarge)

Figure 4: Inflation Detail

Looking at the Fed Numbers

The Fed uses a different category methodology than the BLS, but the total number ties. Below is the number as reported by the Fed. According to the Fed categories, 6 of 8 categories are above the 12-month trend. Apparel had a massive upward move in the latest month. Only Food and Shelter are below the 12-month trend.

(Click on image to enlarge)

Figure 5: Current vs History

Historical Perspective

Below is a much longer view of inflation and interest rates from the Fed and BLS (at the aggregate level, the data is the same).

(Click on image to enlarge)

Figure 6: Fed CPI

The BLS categorical data can be seen below. Again, this does not look like a wave that is ready to drop to 3% anytime soon. It looks more like a drop before another increase.

(Click on image to enlarge)

Figure 7: Historical CPI

Data Source: https://www.bls.gov/cpi/ and https://fred.stlouisfed.org/series/CPIAUCSL

Data Updated: Monthly within first 10 business days

Last Updated: Apr 2024

Interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

More By This Author:

Soaring Inflation Is Making Home And Car Insurance Unaffordable

South Korea’s New Way To Pursue Safety

To Prevent A Banking Crisis, The Fed Must Cut