Soaring Inflation Is Making Home And Car Insurance Unaffordable

Image Source: Unsplash

American car owners are facing a wall of bad debt to finance vehicles they can’t afford — especially pandemic buyers who took on huge loans to buy overpriced used vehicles that are now depreciating in value. With inflation running hot and poised to get even hotter if the Fed is forced to cut rates, it turns out that Americans can’t afford to insure those cars either.

Used car and truck prices have come significantly back down to earth since rocketing up between 2020 and 2022, but still have a long way to go to reach pre-2020 levels. Meanwhile, the number of loans in default has risen (defined by being at least 90 days delinquent), and the average borrower is facing a loan balance of about $23,945 according to TransUnion.

CPI: Used Cars and Trucks in the U.S. City Average

(Click on image to enlarge)

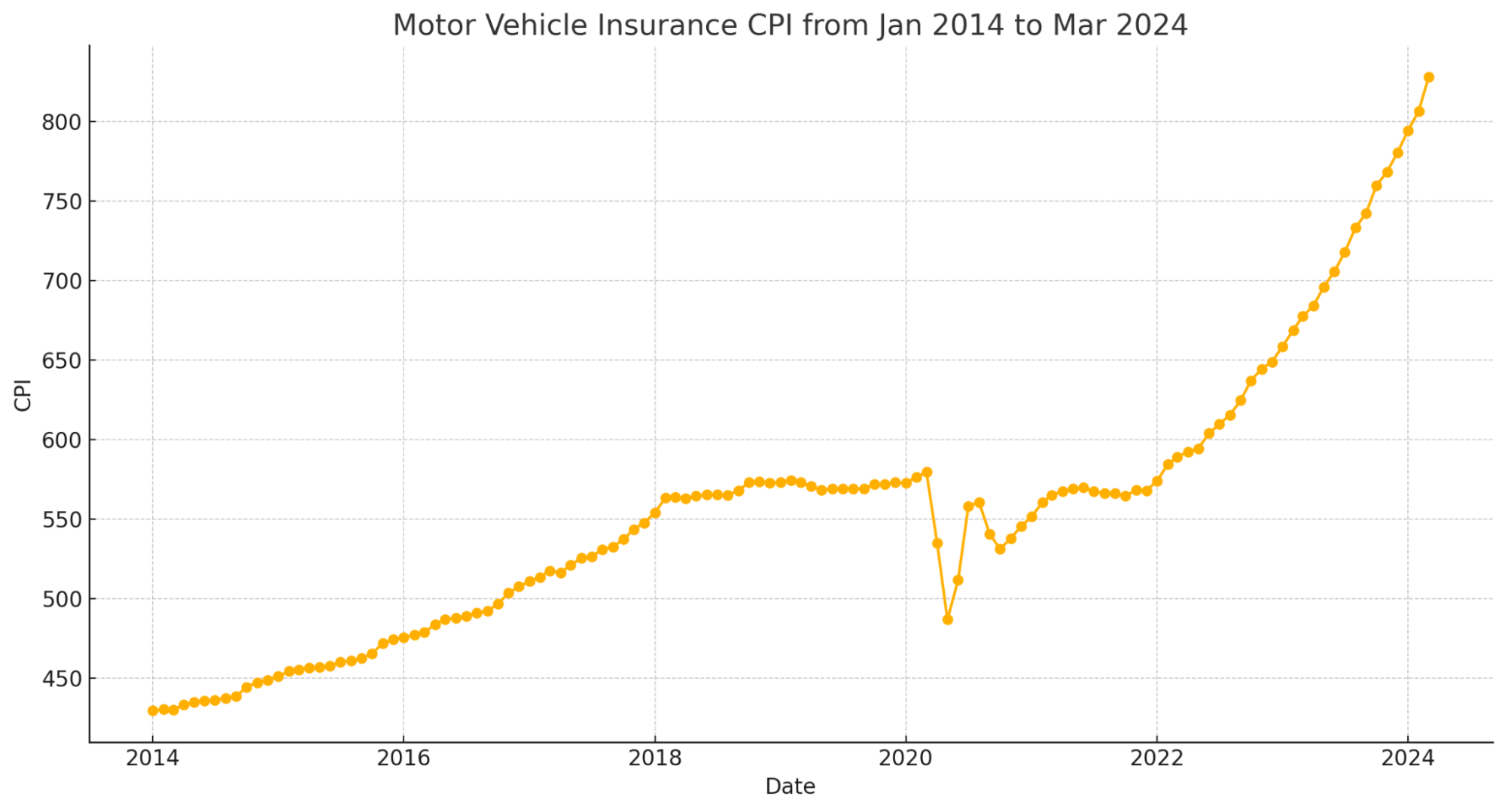

The potent cocktail of high interest rates and high inflation is making owning the car itself unaffordable — but it’s drastically driving up car insurance premiums as well:

(Click on image to enlarge)

Data Source: US Bureau of Labor Statistics

Mainstream media and Keynesian economists love claiming that high prices cause inflation, but they have it backwards. Higher prices are primarily an effect of inflation because your purchasing power is being diluted.

While higher prices and inflation can become a vicious cycle where the former helps feed the latter once it gets going, the prices are higher to begin with because your dollar is buying less than it used to. That includes not just food, gas, and gold, but insurance for things you already own, like your car and your house. If the cost of repairing damage or replacing a totaled car is drastically higher than it was a year ago (or five years ago), insurers have to charge you more to compensate for that increase.

There’s also the problem of fewer mechanics in the labor market to service and repair vehicles. A shortage of qualified mechanics and technicians is worsened by the rising popularity of EVs that many mechanics aren’t properly trained or experienced enough to fix. Mechanic shops already struggling with higher prices are under pressure to offer higher wages to get (and retain) good help.

With even good old-fashioned gasoline cars now dependent on software to run, an increasing number of repair jobs have to be referred to dealers or require costly software troubleshooting, adding delays to the repair process. All those factors are conspiring right now to keep pushing car insurance premiums even higher.

When gas, repairs, insurance, and debt itself all become too expensive for Americans to own cars, it implies a dire economic scenario. The Fed is screwed if it raises interest rates, and it’s screwed if it doesn’t: It can hike rates to reign in inflation and bring prices back down (sending any indebted car owners with variable-rate loans into default, and making fixed-rate loans unaffordable for Americans with aging and breaking-down cars. Or, it can lower rates to encourage Americans to take on more debt and let inflation rip, sending the price of car insurance — and car ownership in general — further into the stratosphere.

More By This Author:

South Korea’s New Way To Pursue SafetyTo Prevent A Banking Crisis, The Fed Must Cut

What Will CBDCs Mean For Gold?