Shorts Getting Squeezed

The Monday Short Squeeze

For a couple of months now, Monday’s on have represented bloodshed on Wall Street. But today, you have the bulls taking off, and squeezing the shorts in the process.

For now, I consider this a dead cat bounce, but a dead cat bounce that could squeeze the shorts for days. While the market is doing a good job of working off some of the oversold conditions of late, it still has a long ways to go before I would consider it overbought in the short-term.

Couple of things you want to watch for on this short squeeze:

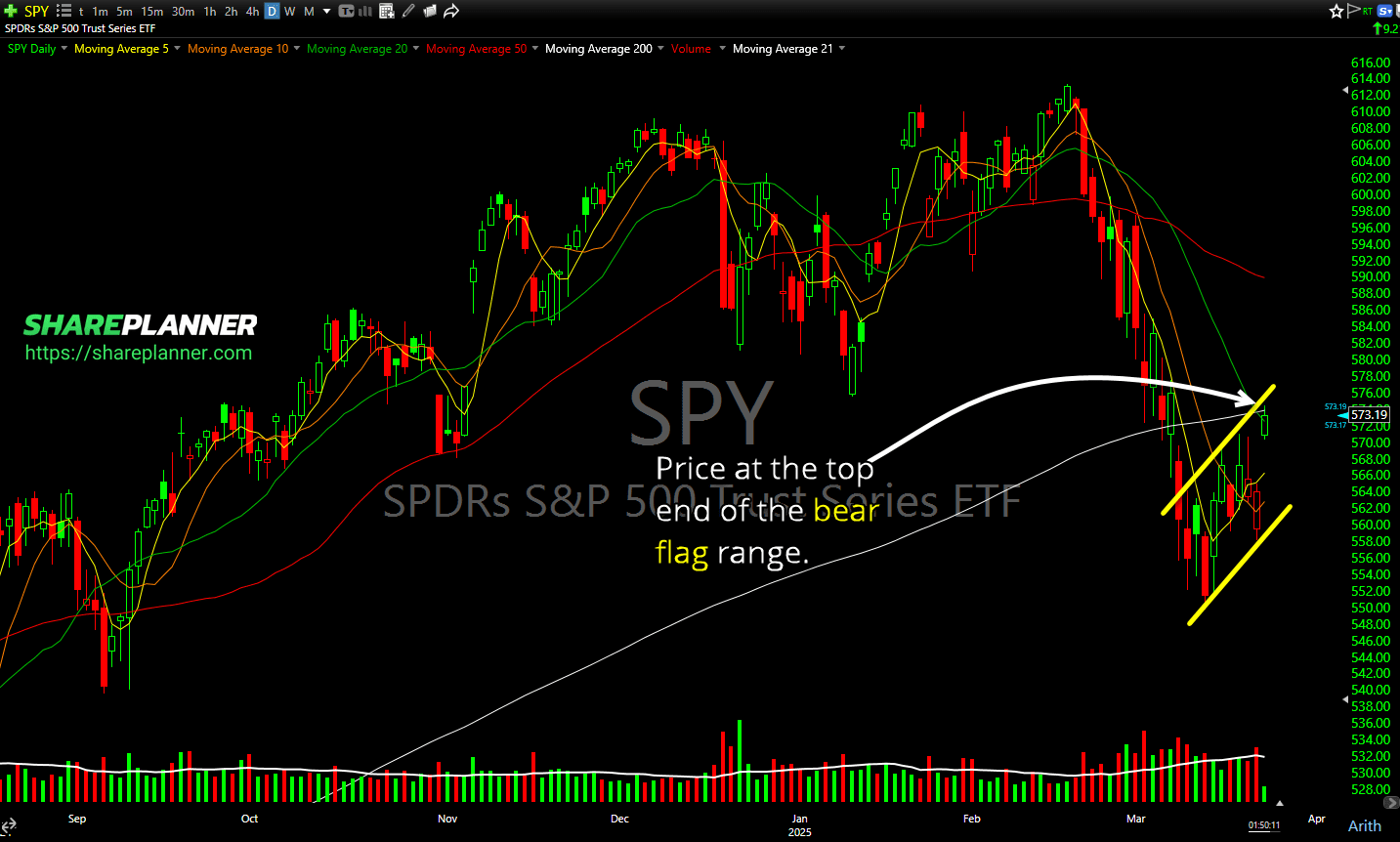

The bear flag on SPY – we’re at the top end of this pattern, does the bounce proceed further and nullify this pattern?

(Click on image to enlarge)

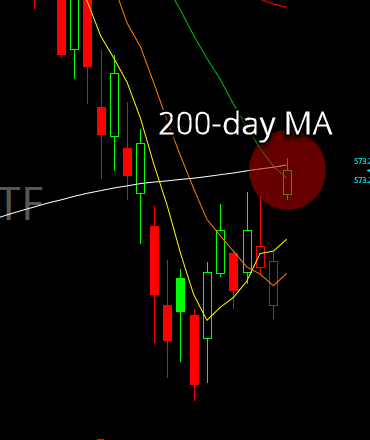

The 200-day moving average – some push back on it so far today. Not a sharp rejection, but worth watching (white line) as price interacts there. Also not a lot of history of late where it interacted with the 200-day MA, so not a lot of precedent here.

I’m not expecting there’s a ton of juice left in this rally for today, as SPY is already hitting up against the R3 pivot level, and will need to extend the rally into tomorrow, for gains beyond what we are seeing so far today.

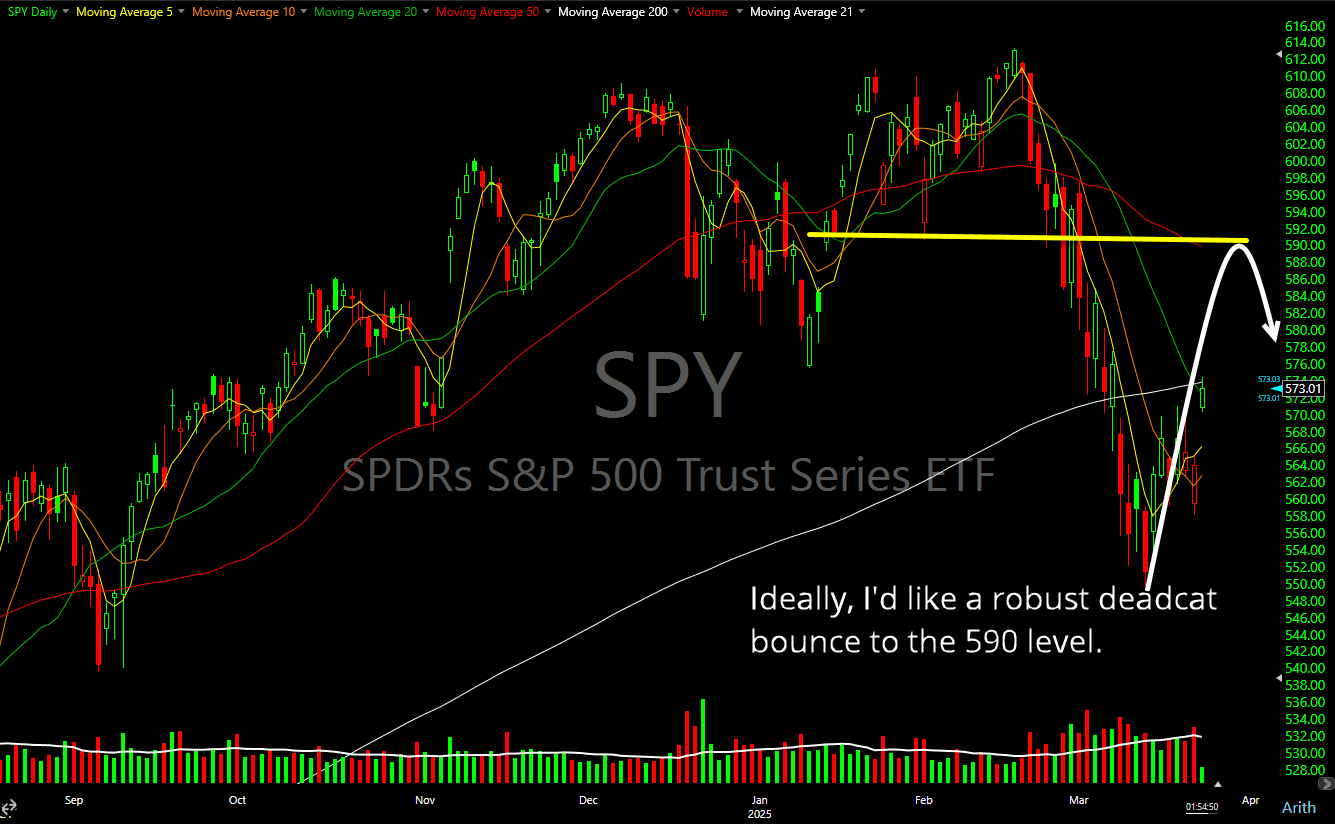

For this bounce on SPY, I want to see the bulls take it to 590, which is where I would start looking to get short again, once the market showed signs of reversing.

(Click on image to enlarge)

Also, keep an eye on the Mag 7 stocks. These guys will need to lead. If you don’t have NVDA, META and AMZN leading, that would be a cause for concern for me. But so far, the only area of concern has been AAPL and MSFT and their very tepid response to today’s bullishness. Beyond today it is possible too that rotations continue between AAPL and NVDA.

Overall, the market internals are holding up good. SPY bounce looks healthy. Breadth is solid, and the VIX is below 18. Everything you want to see in a healthy short squeeze.

More By This Author:

Micron Technologies Setting Up For A BreakoutRivian Stock Crashing? Major Warning For RIVN Investors

SPY At The Downtrend

Click here to download my Allocation Spreadsheet. Get all of my trades ...

more