Sentiment Slumps On U.S. Stagflation Fears

Image Source: Unsplash

Confidence plunges as households worry about inflation and jobs

The Consumer Confidence Index published by the University of Michigan dropped 6.2 points to 50.8 in early April, below the 53.8 consensus with expectations falling 5.4 points and current conditions down 7.3. There was a marked deterioration in every sub-component across all income, age and political affiliation demographics. The survey was conducted 25 March-8 April so the cut-off was just ahead of President Trump’s latest tariff announcement changes that switched more of the focus to China.

The big move was in price expectations with 1Y ahead inflation predictions jumping to 6.7% from 5% and 5-10Y ahead now at 4.4% versus 4.1% in March. The bond market really doesn’t like this and Treasury yields are spiking. It also likely limits the Federal Reserve’s ability to cut interest rates anytime soon despite the worrying outlook for consumer spending that today’s data underscores.

Prices, incomes and wealth are moving in the wrong direction

Consumer are facing problems on three key fronts: 1) tariffs will put up prices and squeeze spending power, 2) government spending cuts are raising concerns about jobs and entitlements, and 3) falling stock and bond markets are eroding household wealth. So that means prices, incomes and wealth are all moving against the household sector and it is understandable why they are feeling anxious.

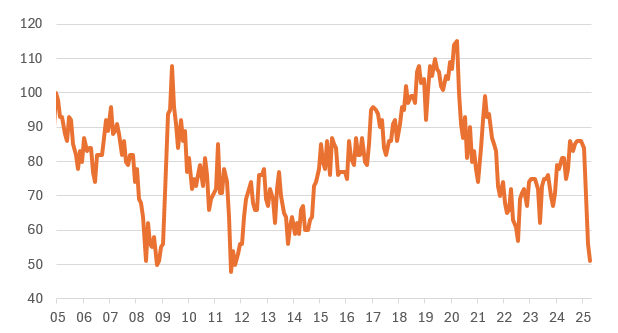

Consumers expect unemployment to rise

Source: Macrobond, ING

Regarding expectations for unemployment the balance held at +53% saying unemployment will rise over the next 12M. That is 67 percent expecting a rise (on a par with 2009 levels) less 14% expecting a fall. We have only been at these levels on four occasions in the past 50 years. This paints a terribly gloomy picture for the outlook for consumer spending, which accounts for 70% of all the spending in the US economy. Next week’s retail sales is likely to be strong as consumers apparently spent large in March to get ahead of tariffs based on auto, iphone and consumer electronic sales evidence, but will likely crater in subsequent months as higher prices kick in. Recession risks are real.

Index reading for the question "Is government doing a good job fighting inflation and/or unemployment"?

Source: Macrobond, ING

Interestingly, President Trump appears to be getting much of the blame with 67% of respondents saying the government is doing a "poor job" on fighting inflation and unemployment. Only 18% say it is doing a "good job". Those are 2008 GFC levels of unhappiness about government's performance and worse than when inflation spiked under President Biden's tenure in 2022.

More By This Author:

FX Daily: Dollar Crisis Can ExtendAsia Week Ahead: Upbeat Data From Japan And China, But Coming Bite From Tariffs Keeps Markets On Edge

Rates Spark: U.S. Yields Not For Turning, So Spreads Widen

Disclaimer: This publication has been prepared by the Economic and Financial Analysis Division of ING Bank N.V. (“ING”) solely for information purposes without regard to any ...

more