Sentiment Can Change… Fast

“Davidson” submits:

If there is one truism of investment markets in terms of achieving a lower risk but higher return, it is that one should own what others do not find attractive. Markets have always cycle with investor psychology and buying cheaply has always proven better than paying dearly for the consensus favorites. Couple buying cheaply with identifying the better management teams in a favorable economic environment and the odds of market psychology turning diamonds in the rough back to main line favorites is a pattern repeated time after time. The metric of Pr/Sales at the lows of the past 10yrs is one which has served well over multiple cycles. A company’s sales do not fluctuate nearly as much as does cash flow or earnings which are downstream of sales but Pr/Sales can vary more than 5x during periods of investor pessimism. To position capital when this metric is applied to a well-managed company reduces price risk because low pricing means fewer owners remain to sell. Significant gains can occur when it returns to investor favor. Low Pr/Sales is many instances accompanied by insider accumulation and if those insiders have a good business record, they become an affirming signal to which it is worth paying attention. In the current marketplace, pessimism still reigns as the dominant influence. The opportunities remain quite attractive for the consensus being shocked into the realization that economic activity is better than perceived.

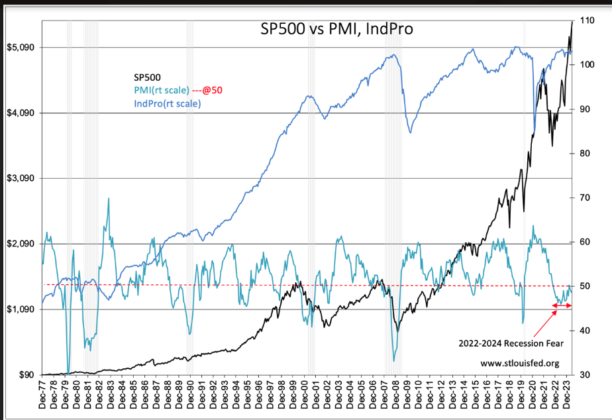

Never underestimate the ability for investors to change their minds. Every time the consensus is all in on a specific theme, they change their minds. You see this in every market correction/recession and in every correction non-recession. The investing consensus seems to miss the human nature’s ability to recover from every perceived crisis. The SP500 vs PMI, IndPro from Feb 1977 demonstrates the consistency of investor fears vs declines in the SP500 and the many recoveries large and small since. The lesson missed in this history is that in every crisis or perceived crisis we find a solution and the business of the country recovers. Shown is our history from Feb 1977 but the pattern goes back to the first stock market of 1400s in Amsterdam. The PMI is relatively new, dating from Jan 1948. It is viewed as indicative of recession any time it declines below 50 but, it is clear, only 1/3rd of the time was this associated with recessions. The PMI often declines when there is no decline in IndPro(Industrial Production that it is supposed to predict). There are multiple instances when the PMI’s predictive signal occurred after a recession had initiated. Even so, the PMI has been a very good signal to buy well run companies at relatively low prices using it as a market psychology indicator which is the essence of savvy investing. Most rely on news of recovery before investing. But, the PMI and SP500 correlations amply demonstrate that making new investments during periods of stress has always proven positive especially if companies are well managed.. And there it is, abysmal news with no public guidance of better times ahead makes creates the best climate for adding capital to portfolios. Reliance on current news is how most investment decisions are made and is in my opinion the wrong focus. The economic cycle and markets have a consistency over hundreds of years. Recovery is something one can count upon as are the better management teams.

In my opinion, the correct investment focus is on people and their ability to adjust to difficult situations. There was some focus like this in the 1980s when I began my career but today it is nearly absent but for a few pockets. By ‘people’, I mean specifically corporate management, not well-known portfolio managers. One must invest opposite to consensus to achieve better than consensus outcomes. The investment focus should not be on what companies offer and whether those products and services are what consumers want. Consumer choices evolve constantly and the popular today is frequently tomorrow’s also-ran. The focus should be on people skills that have made some businesses successful through years of offering continuously competitive products and services. In short, it is how management operates, not what the company offers that is most important. Such managements have worked through prior recessions recovering multiple times to generate good returns in the next upcycle. It is management teams with this history that should be one’s focus. Management teams who make the correct decisions in the past are likely to continue doing so.

The rediscovery of former ‘winners’ can change price to business metrics, i.e. Pr/Sales, Pr/Earnings, Pr/Cash Flow etc., by several multiples even though a company is only recovering its prior financial performance. It is the Value Investor who is the early investor in these situations. The Momentum Investor follows once a price trend reflects the news headlines.

We are in a market dichotomy today. The PMI registers high pessimism but IndPro is rising. Because of the concentration of capital into a few dominant high-tech issues, the SP500 is making unusual new highs. Normally the SP500 is in decline when pessimism is this elevated but instead it has resulted in over-crowding those issues believed to be fail-safe in recession. Much of today’s news interprets every nuance as headed towards recession and rate declines revealing just how strong recession is anticipated. Key economic measures disagree. This is what a stock market buying opportunity looks like.

This is an environment of pricing extremes. High-tech multiples are so over-extended to make nonsense of actual economic returns. For example, Nvidia (NVDA) has a Pr/Sales of 41x and a Pr/Earnings of 74x. This places the actual return of earnings per share of $1.73 divided by the share price of $125.00 at 1.30%. There are many decent companies with higher dividend rates and extraordinarily good growth recovery trajectories that dwarf NVDA’s likely return from current levels. These issues are among the 490 SP500 issues that are for the most part ignored. Ignored that is till investors suddenly turn from their recession-focus fears towards recognizing the current economic growth trend. The recent headline fits well with recent economic trends and hundreds of earnings reports:

“Sell Big-Tech & Bitcoin, Buy Everything Else…”

Add capital to accounts. This continues to be an unusual market buying opportunity for the recovery of ignored but well managed companies.

More By This Author:

Construction Spending Rises To Record

Self-Employment Collapses

Retail Cash Rises

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more