Semiconductors: The Key To Unlocking Today’s Global Economy

There are certain commodity resources that will help the world transition to greener sources of energy. There are certain food resources, necessary to feed a growing global population. There are certain monetary resources that allow different economies to secure different standards of living for their populations.

But one thing that events of 2022 made clear was that access to one type of thing—semiconductors—might be the key that unlocks further participation in the world’s economy.

Follow the Money

“Follow the money” is an expression frequently used as a tool to help an observer better understand what is important in a given economic system. A quick look back at 2022 shows us1:

• In September 2022, Intel pledged to invest at least $20 billion in two new factories in Ohio to make semiconductors.

• In October 2022, Micron indicated it expected to spend $20 billion by the end of the decade—and eventually perhaps $100 billion over time—on a new manufacturing site in upstate New York.

• In December 2022, Taiwan Semiconductor Manufacturing Co. (TSMC), indicated a plan to increase investment in Arizona to around $40 billion and build a second factory to create advanced chips.

• U.S. companies, generally, have pledged nearly $200 billion for chip manufacturing projects since early 2020.

• China is working on a more than 1 trillion yuan (roughly $143 billion) support package for its semiconductor industry, seeking to counter the impact of U.S. restrictions.2

On September 30, 2022, we had Chris Miller, author of the recent bestselling book Chip War, on the Behind the Markets podcast. Chris’ book gives an excellent historical foundation to help in understanding where we are today—that access to cutting-edge semiconductors is deemed to be the primary determinant in participating in the next phases of global economic growth during the 2020s. In his book, you see how this dynamic impacted3:

1. The Cold War—namely how the U.S. was able to allocate resources in ways that promoted the miniaturization of semiconductor technology, while the Soviet Union was unable to keep up.

2. The current dynamics we are seeing with China versus the United States—there are certain links in the semiconductor value chain that are currently in U.S. control, which means the U.S. can denote certain types of technologies that it doesn’t want to end up in China. While it doesn’t mean that China will never gain these technologies on its own, the degree of expertise required to attain them is expected to take both massive financial resources and years of time.

3. Japan’s rise in the 1980s and subsequent stagnation, more or less, since then—Japan’s companies went all-in on memory chips, which was deemed prescient in the 1970s and 1980s. Intel CEO Andy Grove’s move toward logic chips—what we think of as central processing units (CPUs) today—was viewed as an existential bet. When the market shifted to valuing CPUs more highly and memory chips became commoditized, Japan was flat-footed.

4. Weapons—in recent military conflicts, one can see a notable difference, for instance between the NATO-supplied weapons Ukraine is using and Russia’s standard arsenal. There is a reason why Ukraine has had the success that it has, despite its apparent disadvantages in terms of military might.

Illustrating the Cyclicality of Semiconductors

Even if people read the above and agree about the world’s focus on semiconductors, the recent equity market performance of many of the stocks has been quite poor. While we wouldn’t say we could pick the bottom, be it in the performance of semiconductor companies or really any others, it is always important to consider the larger context. Figure 1 looks at the PHLX Semiconductor Sector Index (SOX Index) to give an illustration of the valuation of semiconductor stocks.

• The run up in valuation of semiconductor stocks between roughly January 2019 and roughly January 2021 was significant. We see the trailing price-to-earnings (P/E) ratio go from a bit below 15.0 times to a bit about 35.0 times. This is possibly one reason why we’ve seen such a correction. The market seems to fluctuate around an average somewhere between 20.0 and 25.0 times—in each case when it has gotten above those levels, it has ultimately come back.

• The last time the P/E ratio of semiconductor companies was below that of the S&P 500 Index for a bit of time, it was followed by a run up in valuation. We cannot say for sure that this will always be the case, but we can note that the business activity of the companies does tend toward a boom-and-bust pattern. Demand outpaces supply, there is capital spending, capacity increases, and then eventually supply outpaces demand. Then, prices drop, capital expenditures go down and inventories eventually drop. And the cycle repeats and repeats.

• The difference, now, if there is one, is that interest rates are much higher and we are faced with what may be a general global recession. It doesn’t mean we need semiconductors any less in the medium to long term, but it may impact the speed with which we work through this cycle. Short term, we may see a lot of volatility, even if we believe in the long term, we could be looking at a strong opportunity.

Figure 1: Semiconductors Have a History of Trending Ups and Downs with Respect to Valuation (4/1/13–1/6/23)

Thematic Universe or Semiconductor Universe?

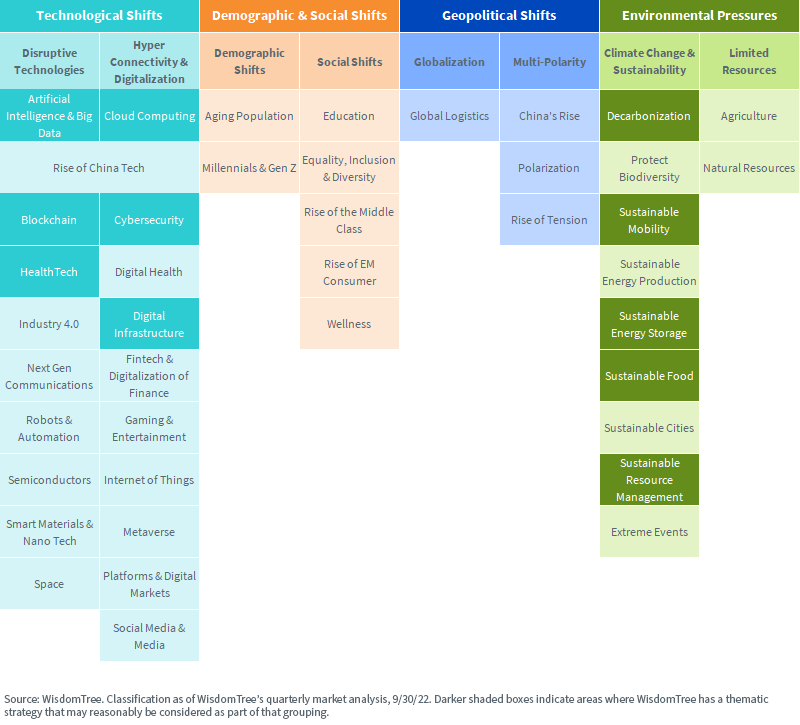

In 2021, WisdomTree put together its Thematic Universe—a classification system through which we are able to look at sensible groupings of thematic investment strategies. This is really our attempt to bring orderly updates to the gigantic menu of options that growth-oriented equity investors face today.

Among our more than 40 different thematic sub-clusters, shown in figure 1, we pose one simple question: Can you find even one of these topical areas that could bring scale and excel WITHOUT making use of semiconductors?

The diversity of semiconductors is truly astonishing. Certain parts of our daily lives are being facilitated by older, less capable semiconductors, while other parts are being powered by chips much closer to the cutting edge. If anyone is thinking about smartphones, the more capable models of the iPhone 14 are running 4 nanometer chips, which is close to the most advanced level the world can currently make.4

Figure 2: WisdomTree’s Thematic Universe

We would make sure to note, even if each of the clusters requires semiconductors, that not all of the clusters would require access to the world’s MOST ADVANCED semiconductors. You might have seen the articles about the U.S. restricting Nvidia from selling its A100 chips to China. But when people are unable to source new vehicles because of a lack of semiconductors, it wouldn’t be correct to assume that most chips in cars are on the same level of the A100. There are chips that could cost more than $1,000, and there are chips that can cost closer to $1—and everything in between.

2023—An Entry Point for Semiconductors (or Related Thematic Strategies)?

In 2022, we spent a lot of time talking about cybersecurity. Even if the share prices of the companies, generally, did not perform well, the story of cybersecurity being a necessity was and remains very clear. We argue that, if we continue to live in a world where electronics are touching our lives many times daily, the story of semiconductors being a necessity is even clearer. However, even if we can make a case that we always need semiconductors, the share price performance of the companies is still not always positive.

As we noted earlier, semiconductors have historically been characterized by a high degree of cyclicality—meaning lots of booms and busts as opposed to a path of steadily increasing returns. Both 2019 and 2020 were quite positive years, leading to companies increasing capital expenditures, which leads to increasing the supplies of semiconductors, which eventually leads to supply outpacing demand and prices of different chips falling. All semiconductors are not created equal—there is one source of demand for the Nvidia A100 (NVDA) chips used in datacenters to train the most advanced artificial intelligence (AI) models, whereas there is a different source of demand for the inexpensive chips used in high volumes in the automotive industry. There were different arguments advanced about how in or out of sync the different types of semiconductor demand might or might not be,5 but the general trend of share price performance was more negative than positive in 2022.

Then, suddenly, in November 2022, we (and many others) saw Warren Buffett’s Berkshire Hathaway place an investment of more than $4 billion in TSMC.6 Any investment in TSMC can have myriad underlying drivers, but, broadly speaking, most modern conveniences that we enjoy in the Western world would face significant headwinds without the benefit of TSMC’s products.

We can’t say we can call the bottom on semiconductors, but we can say that few things capture as much of the world’s focus…and money. We tend to like semiconductors tied to specific, advanced functions, like semiconductors specifically designed for autonomous driving applications or to aid in training advanced AI models. While people can decide on individual companies, we think that AI cannot exist without semiconductors, so it’s possible for those interested to gain diversified exposure to semiconductors participating in this specific area.

The WisdomTree Artificial Intelligence and Innovation Fund (WTAI) includes within its strategy a focus on specific semiconductor companies aiming to use their hardware to advance AI and deep learning.

1 Source: Unless otherwise stated within these bullets, Don Clark & Ana Swanson, “U.S. Pours Money into Chips, but Even Soaring Spending Has Limit,” The New York Times, 1/1/23.

2 Source: Julie Zhu, “Exclusive: China Readying $143 billion package for its Chip Firms in Face of U.S. Curbs,” Reuters, 12/14/2222.

3 Source: Christopher Miller, Chip War: The Fight for the World’s Most Critical Technology. Simon & Schuster, Inc. 2022.

4 Source: Cheng Ting-Fang, “TSMC Reaffirms ‘Commitment to Taiwan’ Despite U.S. Chip Push,” Financial Times, 1/3/23.

5 Source: Sundstrom et al, “Semiconductors: A Less Cyclical Future,” PIMCO Blog, 6/10/22.

6 Source: Eric Platt, “Warren Buffett’s Berkshire Hathaway Buys $4bn Stake in Chipmaker TSMC,” Financial Times, 11/15/22.

More By This Author:

The WisdomTree Q1 2023 Economic And Market Outlook In 10 Charts Or LessTime To Dive Deep Into Value

What Could Possibly Go Wrong?