Seadrill Partners Could Offer An Intriguing High-Yield Opportunity

A very interesting opportunity for dividend investors emerged as a result of the recent earnings announcement of a formerly Norwegian, now United Kingdom-headquartered offshore drilling company Seadrill Limited (SDRL) and its related companies. It is not Seadrill itself that provides this opportunity, however, but rather one of its affiliated companies. That company is Seadrill Partners (SDLP).

Seadrill Partners was formed in September 2012 when offshore drilling giant Seadrill performed a partial spin-off of four of its rigs into a new entity (Seadrill Partners). Since that time, Seadrill Partners has purchased several more rigs from Seadrill, resulting in it becoming one of the fastest growing companies of its class. Exactly what this class is is somewhat ambiguous though. Seadrill and many in the media refer to Seadrill Partners as a master limited partnership or MLP. However, in its strictest sense, Seadrill Partners is not a master limited partnership, it is a publicly-traded limited liability company that is taxed as a corporation. From the perspective of an individual investor, this structure is beneficial as it makes filing United States income taxes much simpler.

Now, on to the purpose of this newsletter - discussing the dividend opportunity being offered by the company. At the time of writing, Seadrill Partners paid a quarterly distribution of $0.5675 per share. This equates to a 16.33% yield at the current price! What’s more, Seadrill Partners has consistently grown its distribution since the company’s formation.

Source: Seadrill Partners

Thus, investors in Seadrill Partners will not only be obtaining a yield that is likely to be unmatched in the market today but they are likely to see this yield increase should the company continue its historic growth. However, yields of this level are typically an indication that the broader market believes that the dividend will soon be cut. So, let us examine the possibility of this.

Offshore drilling companies have a relatively simple business model. Essentially, the company (Seadrill Partners in this case) owns a fleet of offshore drilling rigs that are then contracted out to an oil and gas company that will use the rig for an agreed upon period of time. In exchange for this, the oil and gas company agrees to pay an agreed upon price per day to the owner of the rig, called a dayrate. This dayrate typically does not vary over the term of the contract, meaning that any given drilling rig will enjoy relatively stable revenue and cash flow over the term of the contract. Seadrill Partners exploits this characteristic to great effect. You see, the company was created as essentially a branch of Seadrill that focuses exclusively on long-term contracts. This is evident by both the way Seadrill’s management described Seadrill Partners in various investor presentations as well as the fact that, upon its formation, Seadrill Partners was given the right, but not the obligation, to purchase any offshore drilling rig in Seadrill’s fleet that is awarded a contract that is at least five years in length.

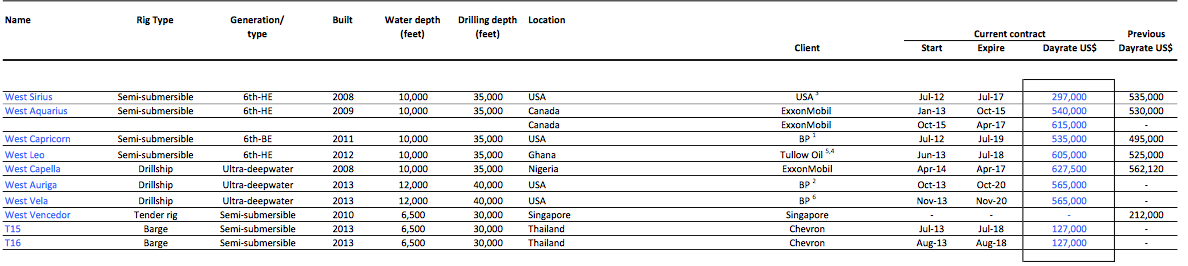

As you may have noticed though, the contracts for Seadrill Partners’ rigs are all contracted for a period of five years or longer when the company acquires then. They do not last indefinitely. Therefore, the rig contracts will eventually run out. Therefore, in order to determine how long the company’s revenues and cash flows, and by extension distributions, are sustainable, we need to know what the expiration dates are on the current contracts for Seadrill Partners’ rigs. This chart shows the current contracts on every one of Seadrill Partners’ rigs along with their expiration dates:

Click on picture to enlarge

Source: Seadrill Partners

As this chart shows, the first rig contract to expire is the contract for the West Aquarius ultra-deepwater rig, which expires in October 2015. However, ExxonMobil (XOM) has already contracted the rig out at a higher dayrate following the end of the contract. Therefore, we do not need to worry about the expiration of this contract until the second one expires. This second contract expires in April 2017.

The first rig in Seadrill Partners’ fleet whose contract will expire without a replacement contract is the contract for the West Capella ultra-deepwater drilling rig. This contract will expire in April 2017, just like the second contract for the West Aquarius. Therefore, Seadrill Partners’ revenue and cash flow should be secure until that point. This should enable the company to maintain its distribution until at least that time.

With that said, there does exist the possibility that an oil company will cancel an existing rig contract. This has occurred a few times over the past nine months or so. However, it is exceedingly rare for an oil company to cancel a contract if the rig has already commenced operations, as all of the rigs in Seadrill Partners’ fleet have. Rather, nearly all of the rig cancellations that have occurred over the past several months have been for rigs that have not begun work on their contracts. However, in the case that a contract cancellation does occur, the rig contract includes a number of provisions to minimize the negative impact on the rig’s owner. This happened recently when oil major BP (BP) cancelled its contract for the West Sirius in March. BP will continue to pay for the rig over the remainder of the contract term, albeit at a reduced rate. Since Seadrill Partners’ costs also decline as a result of the rig not working, this unfortunate scenario results in virtually no impact on the company’s cash flow. A full analysis of this can be read here. The figures in the chart above do reflect the contract cancellation.

Seadrill Partners has sufficient headroom to absorb a decline in cash flow. This is evident by looking at Seadrill Partners’ distribution coverage ratio. The distribution coverage ratio is defined as,

“The coverage ratio is used to determine the amount of actual cash distributions an MLP makes, relative to the amount it could potentially pay out. The amount of distribution which could be paid out is referred to as ‘Distributable Cash Flow’ and is defined as:

Net Income + Depreciation, Depletion, and Amortization + Other Non-Cash Items – Maintenance Capital Expenditure

The coverage ratio is then calculated by dividing DCF by the actual cash distribution. Since MLPs will typically hold onto some DCF, this ratio will be greater than 1. Investors view a favorable coverage ratio as greater than 1.3, as this indicates that the business has ample cash to continue paying distributions to unitholders.”

As this definition states, a distribution coverage ratio over 1.3 is typically considered sufficient to provide confidence in its ability to maintain the distribution. Seadrill Partners currently has a distribution coverage ratio of 1.48. This is well above the 1.3 level that confirms adequacy and tells us that Seadrill Partners is generating more than enough cash to maintain its distribution.

The biggest risk to Seadrill Partners’ distribution will come in a few years when the current contracts on its rigs begin to run out. At that point, the company will need to find replacement contracts for its rigs and there is no guarantee that will happen, particularly given the current weakness in the offshore drilling industry. However, the industry could also strengthen by that time.

Unlike many companies discussed in this newsletter, it is remarkably easy to invest in Seadrill Partners. The company trades on the New York Stock Exchange under the symbol SDLP. You should be able to purchase it with any brokerage account.

Disclosure: I am long Seadrill as of the time of writing.

This report originally went out to paying subscribers to my Phat Dividends newsletter ...

more

Seadrill hit a 52 week low yesterday down over 7% on the day at $3.37. Can it go any lower, or is this a buying opportunity? Annual yield is an incredible 61% but that can't compensate for the drop of almost 80% in the past year, can it?

Hi again, just checking in. So it seems the situation for oil since June has continued to decline and along with it the well being of SDLP and companies like it. Since June the stock is nosedived over 40% and that attractive dividend that I spoke about last time, well its now up to 24% but honestly when one loses going on for half the value of an investment even a juicy dividend isn't going to soften the blow. The problem is that when a stock loses so much value it rarely bounces back to the pre-collapse levels. SDLP would not have been a safe investment in June. The place to stack money was or probbaly still is in oil refinery stocks. I particularly like PSX (Philips 66) which in the same 6 month period is UP over 16%. If in doubt, follow the Buffett! He bought the stock for around $75 in late August this year. PSX has a low P/E of 10.8, and an annual dividend of 2.4%

Who knows the future of oil, its all up to Allah apparently anyway to quote the Saudi OPEC oil minister, but if oil prices continue to stay depressed for the foreseeable future, SDLP will see its cash flows decline significantly as it negotiates contracts with lower rates than the company has now. Lets see if OPEC will be making any drastic announcements about curtailing oil supply? Wouldn't put money on that horse!

Agreed. That is the biggest risk here. Although, the so called oil glut is pretty much just limited to the United States. The world as a whole is no more oversupplied with oil than has been the average over the past decade, per Rosneft's CEO. We have begun to see oil inventories decline in the United States, so it's uncertain what will happen at this point.

At the outset SDLP looks like an amazing investment opportunity. The stock jumped more than 3% post positive earnings last week and with a more than 16% annual yield alone this stock would seem like a great place to stash one's money. Should the savvy investor be concerned though? Other than what you mentioned about the effect that rig contracts will have on the company, are there other factors influencing this stock? Does it rise and fall along with the price of crude? Doing a bit of research, I found the following information on Investopedia.com that could be a cause for concern:

1. Seadrill has $4.8 billion in total funding requirements over the next two years, assuming there are no revisions in delivery dates.

2. Management also expects earnings to slip in 2015, with second-quarter EBITDA forecast to be $70 million lower than the $711 million earned in the first quarter. This decline is being driven by idle time for the West Taurus, West Eclipse, and West Gemini rigs, as well as the deconsolidation of its recently completed SeaMex joint venture.

Thoughts?

That's Seadrill... not Seadrill Partners. They are two different companies.

Seadrill Partners does not have any stake in any of the rigs you mentioned.

Finally, everybody talks about the funding commitments, but they aren't as big a worry as everyone thinks. First of all, Seadrill has already begun discussions with shipyards to postpone the delivery of newbuild rigs for a few years. This means that the company won't have to pay for them on the original schedule. Second, the CEO of DNB ASA, the largest bank in Norway, recently stated that his bank is willing to postpone installment payments for drilling companies due to the industry downturn. I expect other banks to follow suit, meaning that Seadrill won't actually have to pay that money if it runs into financial trouble (but at the moment, it can afford to carry its debt). Once again though, this is Seadrill, not Seadrill Partners. My suggestion is that it's Seadrill Partners offering the good opportunity.

As for the stock moving in sync with the price of crude... yes, it does, to a point. But the company's cash flow doesn't.