Rug Pull After Record Close

Image Source: Pexels

As they did yesterday morning (and most others in recent weeks), we saw early morning futures bounce from overnight lows to point to a roughly unchanged market open.While yesterday saw initial declines after Oracle’s (ORCL) poorly received earnings report, a bout of early selling abated thanks to a lack of follow-through selling and a fierce rotation out of tech and into financials, materials, and small caps.Today we found Broadcom (AVGO) bearing the brunt of the market’s woes before ORCL once again contributed its own set of bad vibes.

It is quite telling to see a -10% selloff after a market leader like AVGO reported solid earnings and guidance but nonetheless got punished for failing to offer an outlook that matched the most optimistic forecasts.This is a sign that the AI enthusiasm that has powered the current bull market is getting stirred, if not shaken.

But then we received a report that some ORCL data centers for OpenAI will be delayed from 2027 to 2028.This adds to the concerns that ORCL has begun to borrow to finance data centers that may not eventually prove necessary.In a time of more robust market sentiment, this might be interpreted as good news – that they are not as quick to get ahead of themselves as feared.But the current market psychology has become far less forgiving and more willing to take a “glass half-empty” approach to news of that sort.

ES December Futures, 2-Days, 2-Minute Candles (with annotations)

(Click on image to enlarge)

Source: Interactive Brokers

As noted earlier, the S&P 500 (SPX) was able to achieve a fresh all-time closing high yesterday thanks to a powerful move from tech stocks into more cyclical and rate-sensitive sectors.That rotation not only pushed SPX to a record, but Russell 2000 (RTY), S&P Midcap 400 (MID), and Dow Jones (INDU) also notched all-time closing highs. The Nasdaq 100 (NDX) was the key laggard, closing -0.35% lower on the weakness in tech.Today, amidst more broad-based selling, RTY and MID (though not INDU) are underperforming SPX, though only slightly.

About that NDX underperformance: note that NDX is more than 2% below its all-time high. This reflects the recent underperformance of tech stocks versus the rest of the market.

December Futures, ES (Daily Candles) and NQ (blue line)

(Click on image to enlarge)

Source: Interactive Brokers

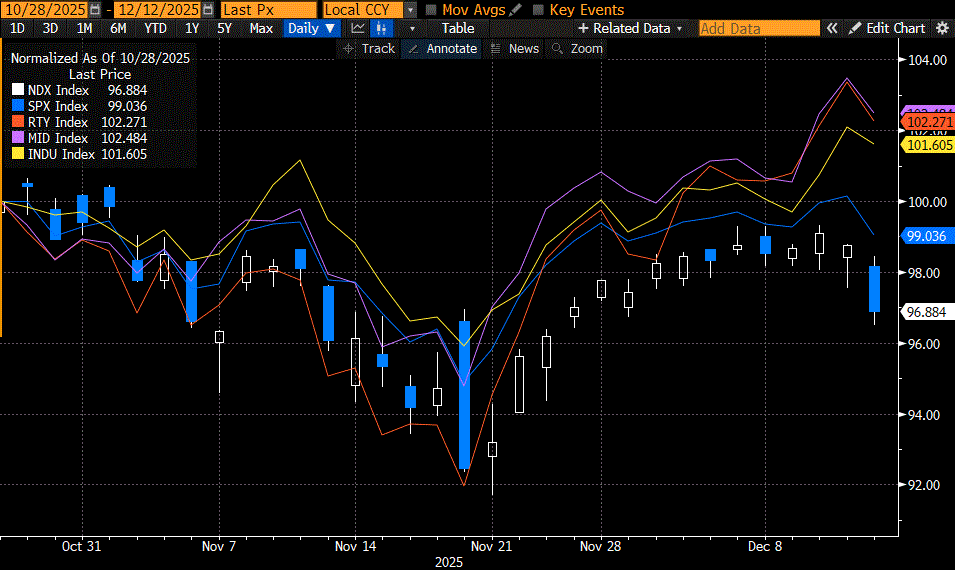

When we view NDX’ performance on a normalized basis since the day prior to its last record high, October 29th, the date of the FOMC meeting prior to this week’s, we see that it has lagged behind its record-setting counterparts.

Normalized From October 28th, 2025: NDX (white/blue daily candles), SPX (blue line), RTY (red line), MID (purple line), INDU (yellow line)

(Click on image to enlarge)

Source:Bloomberg

To be sure, this could be nothing more than a minor bit of temporary underperformance by a key industry sector.Unfortunately, that sector is extraordinarily heavily weighted not only in key indices like SPX, and to a greater extent NDX, but also in many investors’ portfolios.Despite yesterday’s performance, it is difficult to imagine a sustained rotation that would be large enough to overcome a prolonged selloff in the megacap tech stocks that have powered the bull market.Unfortunately, I can’t shake the memory of a similar setup at the end of 2021, when NDX topped out in November, SPX topped out on the first day of 2022, and those highs were not recovered until roughly two years later. We’re not at that point, and frankly, I hope that past performance doesn’t predict future results.

More By This Author:

Let’s Get This Over With

Options Market Expectations For The FOMC

Fed Funds Drove SPX. Now What?

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC ...

more