Options Market Expectations For The FOMC

Image source: Wikipedia

For the past few days, global stock and bond investors have been keenly focused on tomorrow’s FOMC meeting. Fed meetings are one of the key “known unknowns” that affect markets. Even when we have a strong sense of what is likely to transpire – in this case, there is a strong consensus for a 25-basis point cut in the target rate – we still look eagerly for clues about the future path of monetary policy. We discussed several of those considerations yesterday.Today we focus on how index options traders are positioning ahead of the meeting.

Some of you might be noting that we have typically published this sort of analysis on the morning of the upcoming meeting.I have decided to move that one day forward because our publication timing does not always offer enough readers sufficient time to consider this analysis in their own positioning. Thus, even though the options market might move between this morning and tomorrow, it seemed more valuable to offer these viewpoints a day prior.

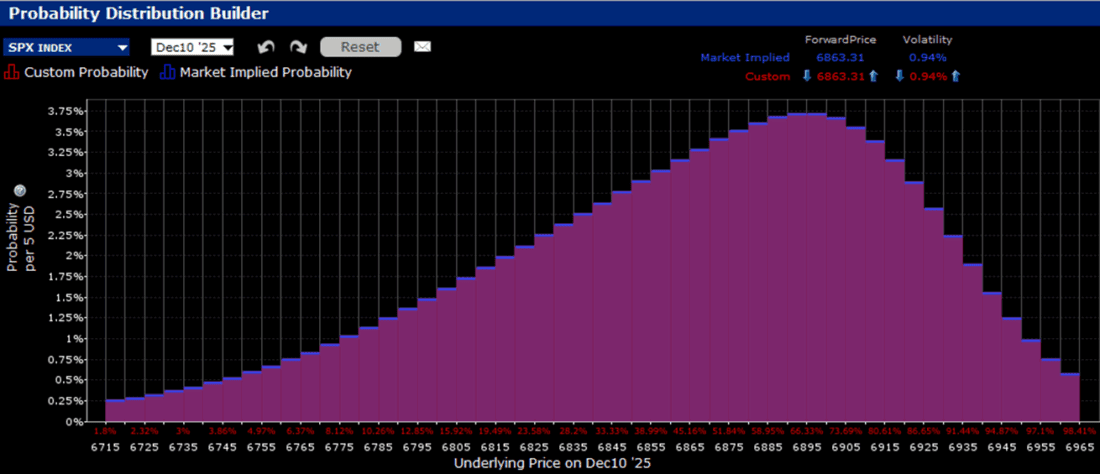

Once again, we see the probability distributions for S&P 500 (SPX) options expiring tomorrow and Friday showing an upside bias. That has been a typical occurrence in recent months.One can think of this as “FOMO insurance”, a way for relatively cautious investors to hedge their caution with out-of-the-money calls.Or, one can simply think of it as playing the odds.Over the past three years, it is more typical to see stocks rise than fall.It is not unreasonable for daily expiring options to expect that pattern to persist.

There may be fundamental logic behind the current bias too. As we pointed out yesterday, expectations for cuts at the next three meetings are in the 20-30% range.Thus, there is more room for excitement about increasing odds for a cut than there is room for disappointment about rhetoric implying otherwise.

For options expiring tomorrow afternoon, we see a peak probability around the 6,900 level. That would be above the current record close of 6,890.89, set on October 28th, the day prior to the last FOMC meeting, but below the intraday record of 6,920.34, which was set on the subsequent morning, about four hours prior to the rate announcement.

IBKR Probability Lab for SPX Options Expiring December 10th, 2025

(Click on image to enlarge)

Source: Interactive Brokers

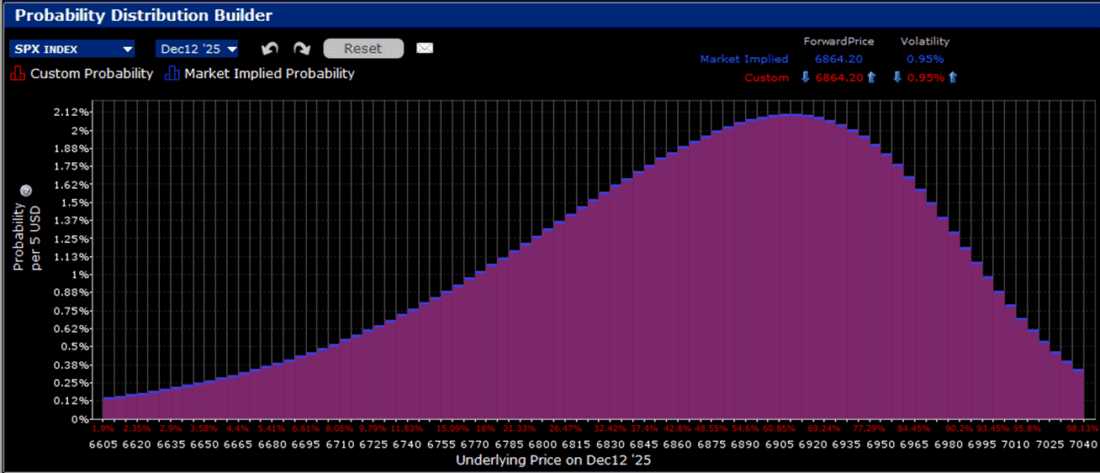

Options expiring on Friday show a slightly higher peak probability centered around the 6,910 level.That too would be above the current record close but below the intraday record high.

IBKR Probability Lab for SPX Options Expiring December 12th, 2025

(Click on image to enlarge)

Source: Interactive Brokers

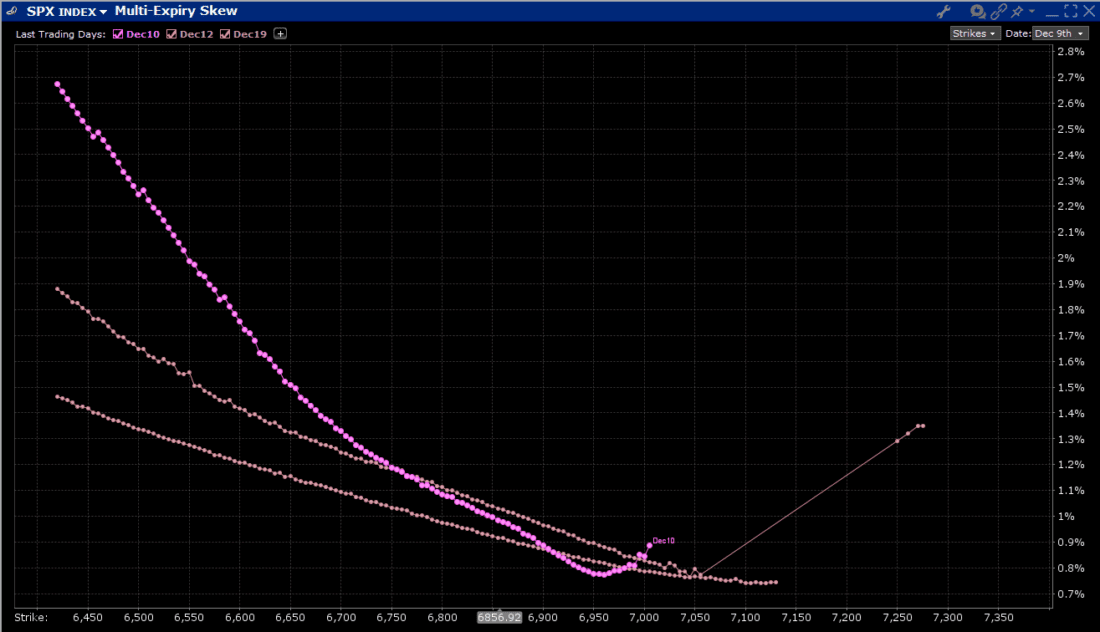

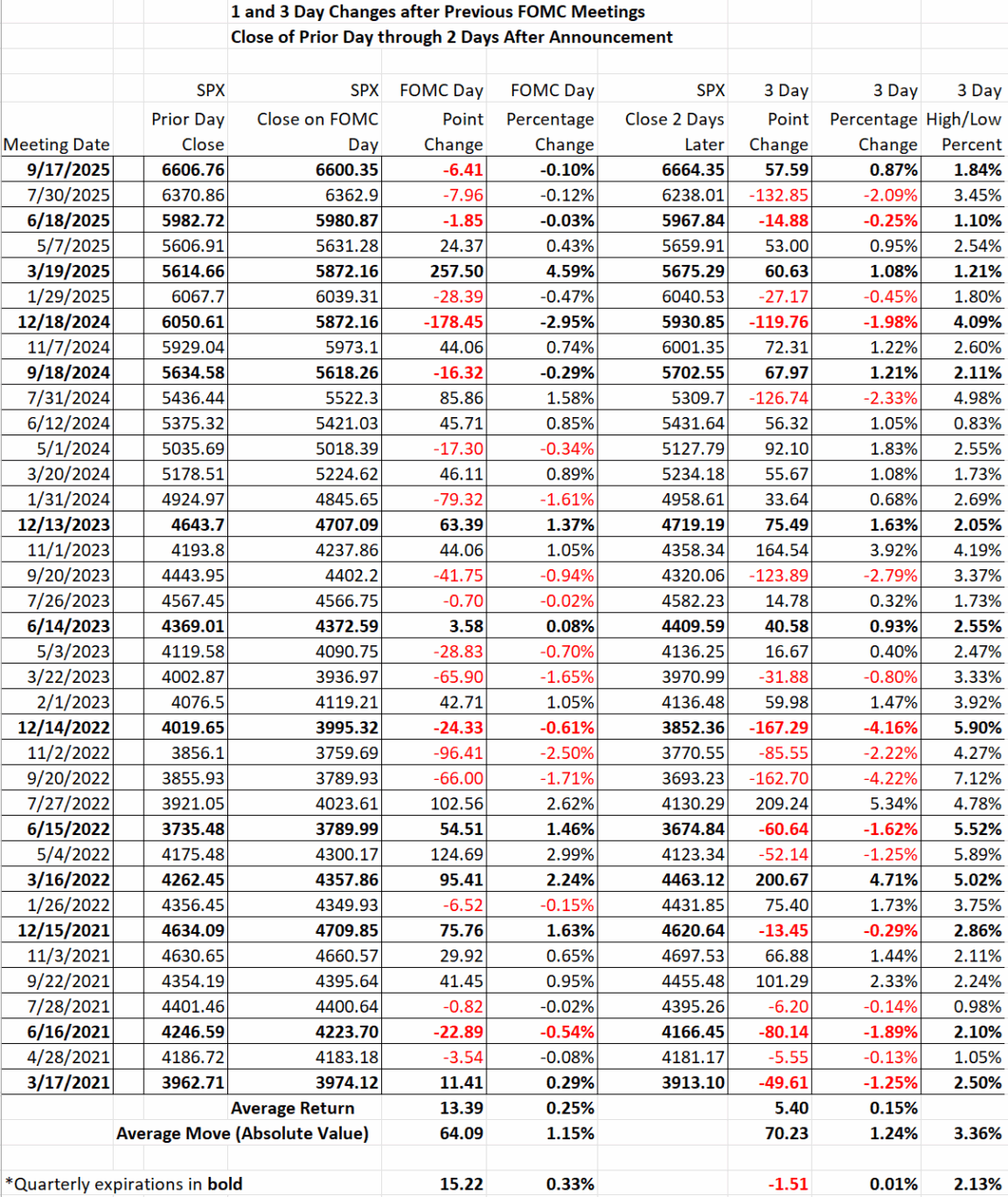

For the most part, implied volatilities for at-money options are generally in line with the long-term historical one- and three-day moves around FOMC meetings, though well above the very small moves that occurred on the last four FOMC announcement dates (see table at bottom).We see daily implied volatilities for at-money options expiring tomorrow, this Friday, and next Friday at 1.02%, 0.98%, and 0.92%, respectively. The relevant comparison in the table below is to the average absolute value daily moves – remember volatility doesn’t measure direction, just movement – of 1.15% for FOMC day and 1.24% for the three-day period.Skews show a relatively typical amount of risk aversion, with a pronounced asymmetrical steepness in options expiring tomorrow that diminishes over the coming expirations.

Skews for SPX Options Expiring December 10th (top), December 12th (middle), December 19th, 2025 (bottom)

(Click on image to enlarge)

Source: Interactive Brokers

With another day to trade ahead of the announcement, things can indeed change between now and then.This afternoon’s 10-year Treasury note auction can certainly influence equity market perceptions, and crypto traders seem to be taking advantage of the relative torpor in other markets to gun prices in their favorite currencies.Yet barring major exogenous news, it is difficult to foresee expectations differing too much in the ensuing period.

(Click on image to enlarge)

Source: Interactive Brokers

More By This Author:

Fed Funds Drove SPX. Now What?

Looking Ahead To December And Beyond

John Williams Changes The Tune

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing ...

more