Rough Year For Dogs And Dividends

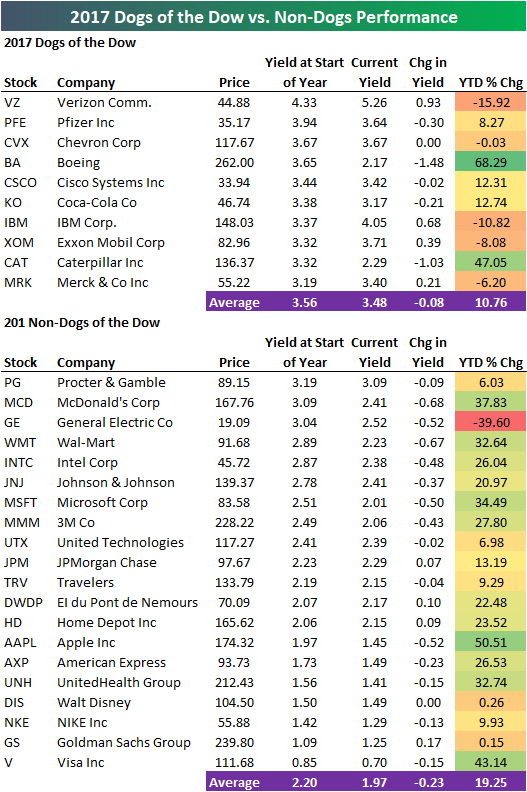

There are now less than 50 calendar days left in 2017, and below is an updated look at how the “Dogs of the Dow” strategy has been performing so far this year. The “Dogs of the Dow” strategy says to simply buy the 10 highest yielding stocks in the Dow at the start of each year. So far this year, the Dogs strategy has had two big winners in BA and CAT, but on average, the ten stocks are up 10.76%. That’s just over half the 19.25% gain that the 20 non-Dogs have averaged.

(Click on image to enlarge)

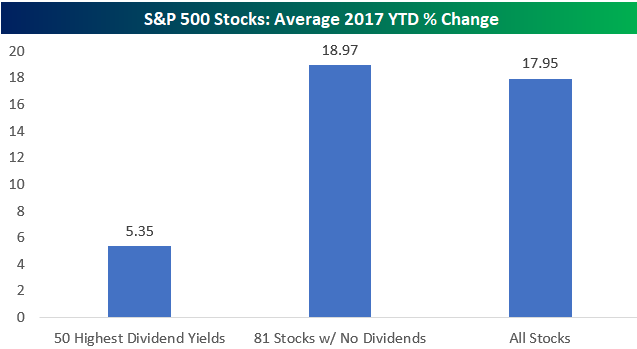

The Dogs strategy highlights a trend we’ve seen throughout 2017 of underperformance from higher yielding stocks. As shown below, the 50 highest yielding stocks in the S&P 500 at the start of 2017 are up in price by just 5.35% YTD, while the 81 stocks in the S&P 500 that paid no dividends are up 18.97%.

Investors in more conservative equity strategies that invest mostly in higher yielding stocks have had a rough 2017 compared to the returns of the S&P 500 or Nasdaq 100. The weakness can’t last forever, though, so if you’ve managed to avoid this area of the equity market, it may be time to take a look.

(Click on image to enlarge)

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more