Risk-Off Sentiment Hit Most Markets Last Week

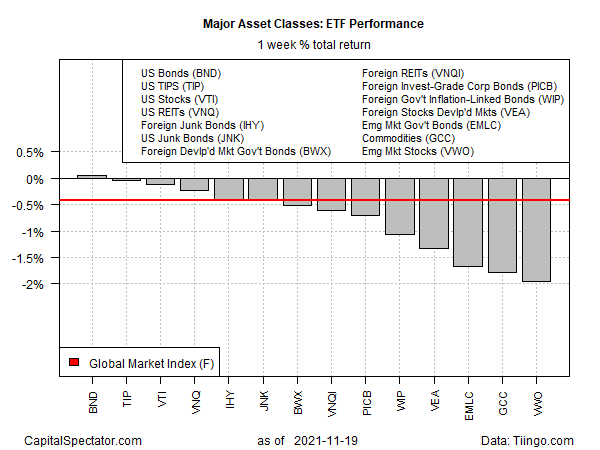

US bonds edged higher for the trading week through Friday, Nov. 19, but red ink took a toll on the rest of the major asset classes, based on a set of ETFs.

Vanguard Total US Bond Market (BND) bucked the selling and edged up 0.1% last week. Despite the gain, the fund still looks caught in a trading range (with a slight downside bias) as the market continues to process the conflicting signals for inflation, interest rates and the economy, which may be vulnerable this winter amid a rebound in the coronavirus cases.

(Click on image to enlarge)

By some accounts, however, favoring stocks is still warranted, if only because the possibilities elsewhere look worse, says a prominent market pundit.

The rest of the major asset classes posted losses last week, ranging from a mild dip in US inflation-indexed Treasuries (TIP) to a hefty 2.0% weekly decline in emerging markets stocks (VWO).

Widespread losses last week took a bite out of the Global Market Index (GMI.F) — an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETF proxies. GMI dropped 0.4%, the second straight weekly loss.

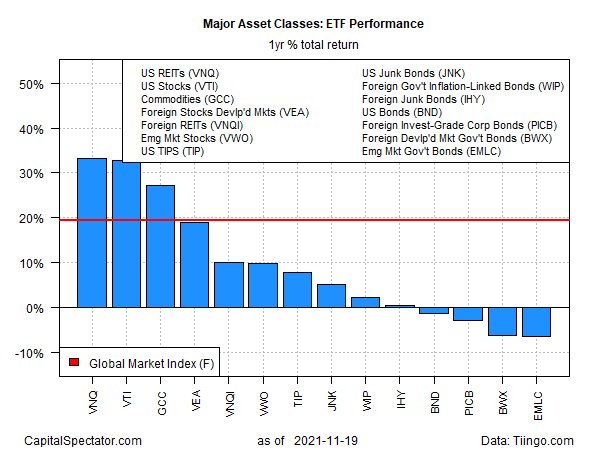

Profiling the major asset classes through a one-year-performance lens continues to show an upside bias, although red ink is starting to creep into the picture.

US real estate investment trusts (REITs) and US stocks are currently neck and neck for leading one-year results with roughly 33% gains each.

Meanwhile, four slices of the bond world are posting one-year losses through last week’s close. The biggest decline: fixed income in government bonds in emerging markets: VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC), which shed 6.4% as of Friday’s close vs. the year-earlier level (including distributions).

GMI.F is up 19.3% for the trailing one-year window.

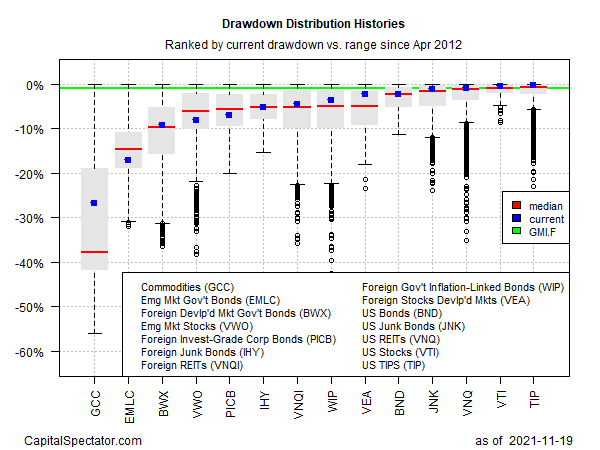

Monitoring asset classes via drawdown shows that US assets are posting the smallest peak-to-trough declines, led by iShares TIPS Bond ETF (TIP), which has a fractional drawdown of just -0.4%.

GMI.F’s current drawdown is a mild -0.9%.

Disclosures: None.