Risk Assets Rallied Last Week

Risk-on sentiment expanded across global markets last week, led by a rebound in US shares, based on a set of ETFs representing the major asset classes through Friday’s close (Dec. 10).

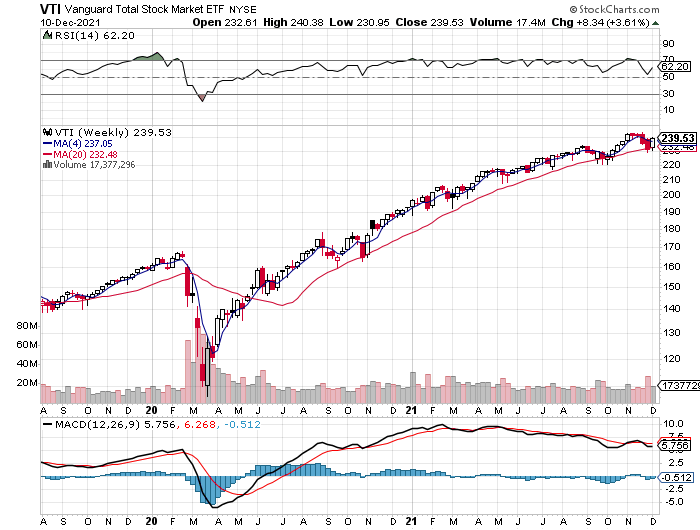

After four weekly declines, Vanguard Total US Stock Market (VTI) rallied 3.6% — the biggest weekly gain for the ETF since February.

The rally in US equities contrasts with Friday’s news that inflation continued to accelerate in November. Consumer prices rose 6.9% for the year through last month – a 39-year high. But if accelerating inflation is a headwind for stocks, it wasn’t obvious in last week’s trading.

“The fact is that inflation is likely to remain on the higher side for a while and risks of sticky inflation remain, although we believe that the passing of base effects and the easing of supply chain constraints by the end of the first quarter of next year should slowly bring inflation down to more comfortable levels,” advises Rick Rieder, BlackRock’s chief investment officer of global fixed income, in a research note.

Another line of analysis assumes that the stock market has already priced in rate hikes and so inflation risk is old news for equities. Jan Hatzius, Goldman Sachs chief economist, explains:

A hike at the March meeting is possible, but we think the FOMC is more likely to wait until May for a few reasons. First and most simply, a turnaround from tapering to rate hikes of just a few days seems uncharacteristic of the Fed. Second, waiting a bit longer would give the labor market more time to progress toward an outcome that Fed officials might more comfortably describe as maximum employment. Third, virus cases might be high in March due to the effects of both colder temperatures and the Omicron variant, which could make a rate hike seem awkwardly timed.

The only losers on our ETF list last week: US bonds. The investment-grade benchmark (BND) and inflation-protected Treasuries (TIP) shed 0.7% and 0.9%, respectively.

The return of risk-on sentiment lifted the Global Market Index (GMI.F) — an unmanaged benchmark (maintained by CapitalSpectator.com) that holds all the major asset classes (except cash) in market-value weights via ETF proxies. GMI.F rose 2.4%, the benchmark’s first weekly gain in five weeks.

US real estate shares continue to lead for the one-year window by a wide margin. Vanguard US Real Estate (VNQ) is up a red-hot 35.8% vs. the year-ago level (after factoring in distributions). US stocks are in second place, but VTI’s 27.4% one-year gain is well behind real estate’s rally.

Among the one-year losers, bonds issued by governments in emerging markets are posting the deepest shade of red. VanEck Vectors J.P. Morgan EM Local Currency Bond ETF (EMLC) lost 9.0% over the past year.

Current drawdowns continue to vary widely among the major asset classes. The smallest peak-to-trough decline (as of Friday’s close) is found in US junk bonds (JNK): -0.8%. That contrasts with the steepest drawdown via commodities (GCC), which are nearly 30% below the previous peak.

GMI.F’s current drawdown: -1.6%.

Disclosures: None.