Rising Long-Term Interest Rates: Be Careful For What You Wish For

The surge in U.S. long-term interest rates has long been desired as a sign of strong economic growth, yet it does not come about without consequences. Central banks are constrained by the limits on how much they could reduce short-term interest rates to promote growth. They were forced to develop policies that would affect long-term rates. While the financial markets look to changes in short-term rates as a sign of changing financial conditions, the more important action takes place in the long end of the yield curve. Long-term interest rates determine business spending decisions on capital investments and consumer decisions on home purchases. To combat the effects of the 2008 financial crisis, the Fed zeroed on the need to lower long-term interest rates to encourage asset purchases.

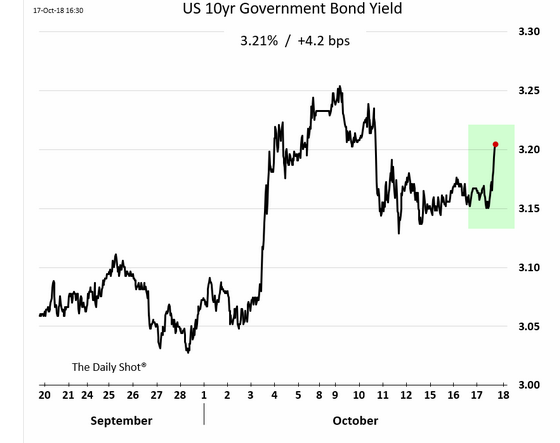

Now, the Fed is reversing course. It is both tightening short-term borrowing costs and, at the same time, shrinking its balance sheet. Although these forms of tightening have been underway over the last 2 years, the bond market has been slow to react with higher long-term rates, until this month (Figure 1). The Fed wanted to encourage investors to buy risky assets when it introduced quantitative easing. Now it seems the Fed wants to rein in risk-taking and welcomes the significant increase in the 10-yr bond yield.

(Click on image to enlarge)

Figure 1 US Long Rates

One school of thought argues that the rise in long-term rates is a positive development as it signals that the economy is strong enough to withstand higher borrowing costs. Normalization can take place without harming the economy. Rising nominal and real rates of interest reflect investors’ confidence in future growth. However, we are now witnessing another side of this story.

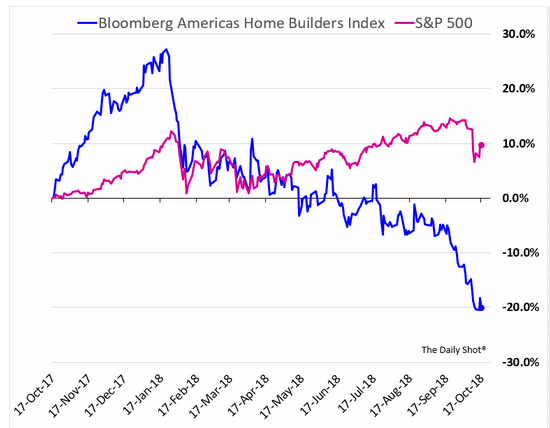

A Weakening Housing Industry. Housing starts fell 5.3 percent to a seasonally adjusted annual rate of 1.201 million units in September. The Homebuilders Index, already sagging during the summer, took another leg down in October and now resides some 40% lower for the year as a whole (Figure 2). As mortgage rates top 5%, housing affordability has become the major challenge to sustaining residential investment. In terms of impact, rates have increased by 90bps this year, denying thousands of first-time buyers an opportunity to purchase homes.

(Click on image to enlarge)

Figure 2 Home Builders Index

Equity Markets Recoil. Worldwide equity markets have been declining throughout the month. The S&P index is down 4% from its high at the beginning of October. Across the board, indices are under pressure with successive daily declines. Some observers say this is to be expected given the length of the current bull market. Nonetheless, the spike in long-term rates plays a significant part in dragging the market down.

Higher Trade Deficits. The rise in U.S. interest rates pushes up the value of the US dollar and, in turn, weakens exports. The U.S. trade deficit increased by 6.4% to $53.2 billion in August, widening for a third straight month. When adjusted for inflation, the trade gap widened to $86.3 billion in August, the highest level since January 2006. This deficit could subtract as much as one percentage point from the gross domestic product in the third quarter.

Higher Federal Government Borrowing Costs. The U.S. federal deficit is expected to reach $1 trillion in 2019. Interest costs on the deficit is the fastest growing item in the U.S. budget. Currently, interest costs run at $300 billion a year but are estimated to reach $900 billion within a decade, jeopardizing other major federal programs in social services and healthcare.

Almost without exception, it seems that many find it far easier to take risks with other people's (borrowed) money. This is somewhat similar to my observation that it is always easier to be generaous with other people's money. Our government's spending offers absolute proof of that assertion.