Riding Carl Icahn's Coattails

What has Carl Icahn been up to recently? He appears to be in fewer fights than usual at the moment if only because so many companies appear to be giving in without a fight. I don't know if that makes Icahn happy or sad.

In the fourth quarter of 2014, he sold out of CVR Refining (NYSE:CVRR) and took a position on Manitowoc (NYSE:MTW). He met with their management team, which he probably enjoyed more than they did. They accepted his plan, which is to split into two via a spin-off its foodservice business. Icahn will serve on both boards.

EBAY threw in the towel, too. They are giving Icahn a board seat, which can be conveyed to PayPal after it is spun-off. PayPal might not stay independent for long as it is probably going to be a target for Microsoft (NASDAQ:MSFT), Google (GOOG/GOOGL), Discover (NYSE:DFS), or Apple (NASDAQ:AAPL).

Speaking of Apple, their management half surrendered. Icahn recently wrote a letter about that investment. He likes their buyback buy is not satisfied at its scale. Fellow AAPL owners have benefitted alongside Icahn since he began pushing for the buyback.

Icahn increased his position in Hertz (NYSE:HTZ). HTZ is working on restating its past financial statements, integrating Dollar Thrifty, and separating its equipment rental business.

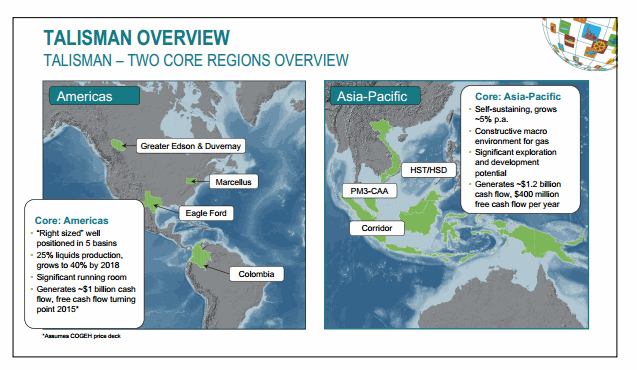

Another one of Icahn's key investments is Talisman Energy (NYSE:TLM) which is being bought by Repsol S.A. for $8.00 in cash. The $0.30 spread represents an opportunity to capture a 19% annualized net yield between now and mid-May 2015 when the deal is expected to close. The deal awaits clearance from Investment Canada, HSR and CFIUS in the US, as well as EU and Norwegian clearances. None are expected to be problematic. More importantly, the contract explicitly carves out industry conditions from their definition of a material adverse effect that would allow the buyer to walk.

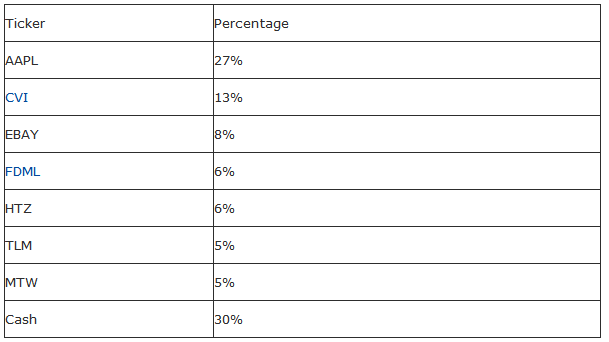

Here is a simplified portfolio that will correlate closely with Icahn's. I would consider long positions in each:

You can use the cash to purchase new positions as Icahn adds them.

Icahn's publicly traded company, Icahn Enterprises (NASDAQ:IEP) currently offers an NAV of about $69 for a price of $97.90. As a hedge against the above portfolio, you can short IEP at a premium of around 42%. Another way to hedge the Icahn portfolio is to write IEP calls. For example, September 18, 2015 $100 calls last traded at $4.10 and have a current bid of $3.60 and ask of $4.00. You could write such contracts twice a year and potentially end up short IEP at a premium of fully 47% above the value of its portfolio.

It is unfriendly to take advantage of this great investor's ideas without paying him an incentive feel? On that question, I will let Icahn have the last words. As he says,

If you want a friend, you buy a dog.

Disclosure: The author is short IEP.

Additional disclosure: Chris DeMuth Jr is a portfolio manager at Rangeley Capital. Rangeley invests with a margin of safety by buying securities at deep ...

more

I see that CVRR has been climbing recently - any idea why?