Revised Paper: No, We Haven’t Been In A Recession Since 2022

EJ Antoni and Peter St. Onge argue we have been deceived by incorrect deflators. Rebuttal, showing the irreproducibility of their results, and non-deflator sensitive indicators, downloadable here, with new data.

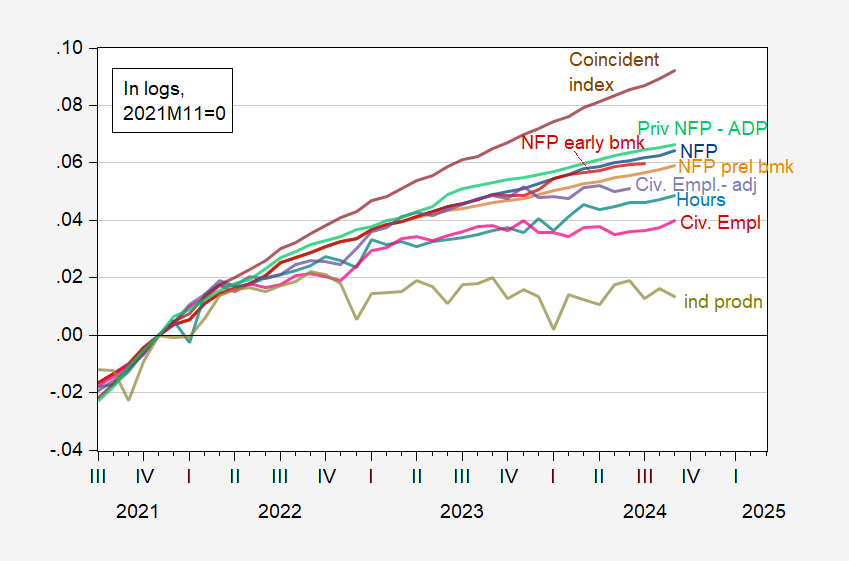

(Click on image to enlarge)

Figure 9 from Chinn (2024): Nonfarm payroll (NFP) employment (blue), preliminary benchmark NFP (tan), early benchmark (red), aggregate hours in private sector (light blue), private NFP employment from ADP (light green), civilian employment (dark red), civilian employment using population controls implied by CBO estimates of immigration (lilac), industrial production (chartreuse), coincident index (purple), in logs 2021M11=0. Source: BLS, Federal Reserve Board via FRED, Philadelphia Fed, and author’s calculations.

In this new version of the paper, I document that these non-deflator sensitive indicators are all above end-2021 levels, indicating that we have not been in a recession — defined as NBER’s BCDC would — since 2022.

Even industrial production — which has declined less than 0.9% since September 2022 peak — is up relative to end-2019. Note that industrial production value added accounts for about 17% of GDP, and 8.1% of nonfarm payroll employment as of September 2024. Hence, while this indicator is not quickly rising, it is not a particularly broad indicator of economic activity.

More By This Author:

September Coincident IndexesIf The Official Inflation Rate Is Correct, The Real Policy Rate In Russia Is Now 12.4%

The Leading Economic Index, The Term Spread, And Historical Correlations