Resisting Financial Sentinels

Investment banks are having a rough year. Sharply higher interest rates are taking a toll. Falling asset prices since 2021 have reduced fees tied to assets under management just as bad debts are rising. Underwriting fees are not helping: year-to-date investment banks have sold 22% fewer Initial public offerings (IPOs) to the public than in 2022, and 2022 had 82% fewer IPOs than in 2021. Birkenstock was this week’s big thud see Birkenstock shares sink 13% in first day of trading after what was supposed to be a red-hot IPO.

Most of the investment industry sees client accounts as product distribution channels. To hit revenue targets, they pump and dump the highest-risk securities onto their customers.

Even where clients pay a fee for asset management, most firms reserve the right to collect additional, often hidden compensation from product creators. If clients own the least-risk securities like government bonds and cash equivalents, investment fees are relatively little, so, unsurprisingly, these assets are rarely recommended.

The finance sector moves with the economy and leads overall markets, especially in Canada, where financial shares comprise 33% of the 60 largest companies that make up the bulk of Canadian equity portfolios and funds.

Since peaking in February 2022, the basket of Canadian financial shares (XFN) has dropped 20 percent, evaporating more than five years of dividend income in 20 months. This is typical price performance heading into economic downturns, but it’s early days yet. Past recessions have seen financial shares drop more than 40% before they bottomed.

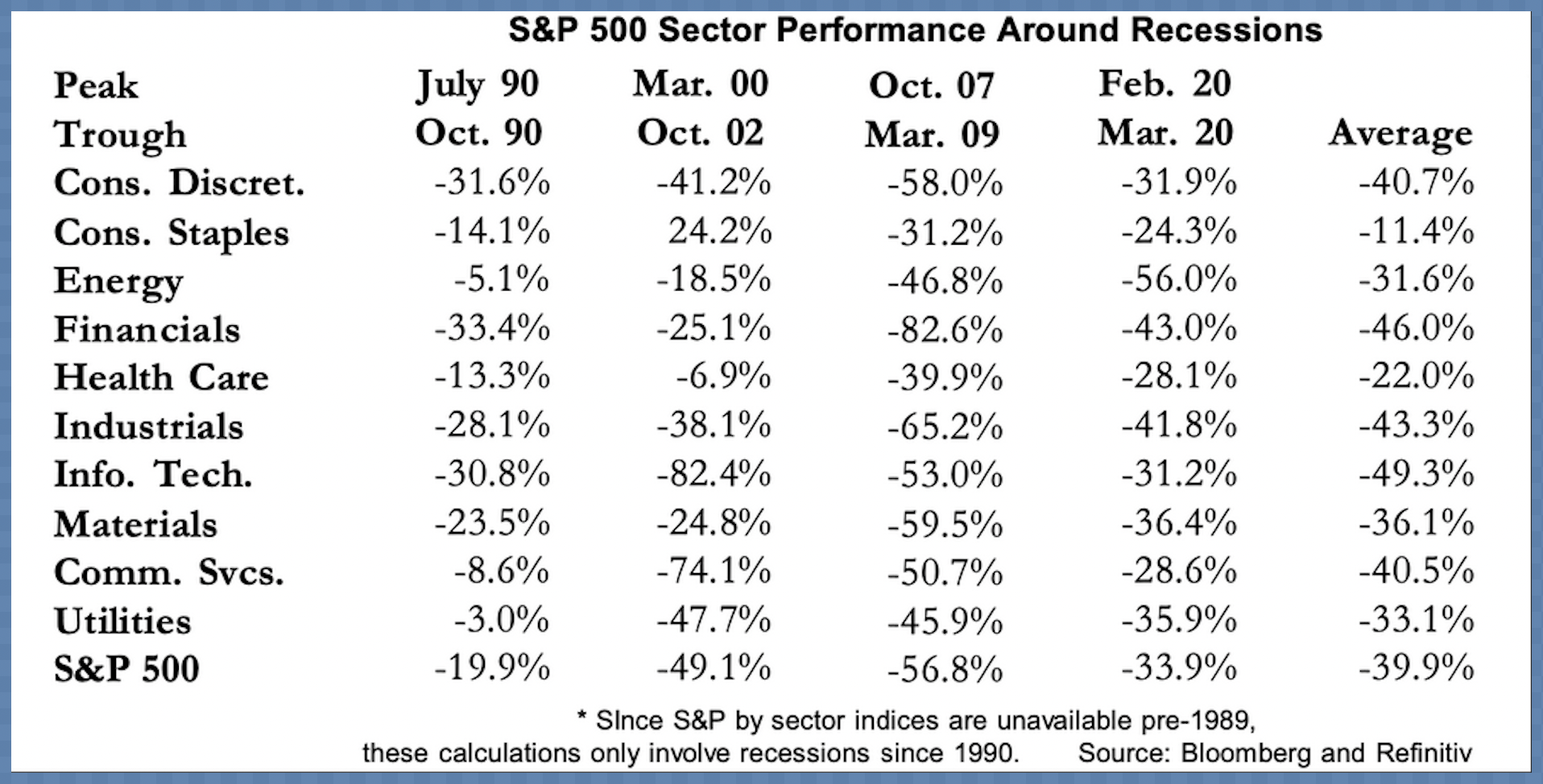

The table below (courtesy of A. Gary Shilling) shows the peak-to-trough price decline for all equity sectors during past recessions (1990, 2000-02, 2007-09 and 2020), as well as the average loss over all four (5th column). Mind those “defensive” dividend-paying sectors! Defensive for whom, you should ask.

(Click on image to enlarge)

Remember, recessionary bear markets have seen the lion’s share of equity and corporate debt losses happen in the months after the Fed ends tightening efforts and returns to easing. So, with central banks still in a tightening bias, it’s probable that risk assets have significant downside work yet to be done.

It’s true that government bond prices have sold off as interest rates have risen, but terms under 10 years have fared better than stocks, and unlike equities, treasuries have defined maturity dates where the face value is returned to the holder. They are also one of the only assets that have typically rebounded as equities and the economy contract into a bottom. But don’t expect the fee-maximizing financial industry to tell you this.

Like the sentinels in The Matrix, financial firms exist to protect the Matrix, not the humans in their midst. As markets deflate, financial sentinels intensify their marketing attacks to suck in new cash. With discipline, understanding and concentration, we can summon the power to resist and protect ourselves. It takes effort, but it’s possible to prosper through recessions and be among the few ready and able to buy near-cycle lows when most others are liquidating in losses. Yes, we can.

More By This Author:

Buying Power Has Halved, Do The Math

Housing-Led Downturn To Rival 2008

Bond Market Tightens Noose On Highly Indebted Economy