Housing-Led Downturn To Rival 2008

A decade of levered fiscal and monetary incentives has enabled yet another epic capital misallocation cycle. Now, we are in the takeback period once more. Heads up.

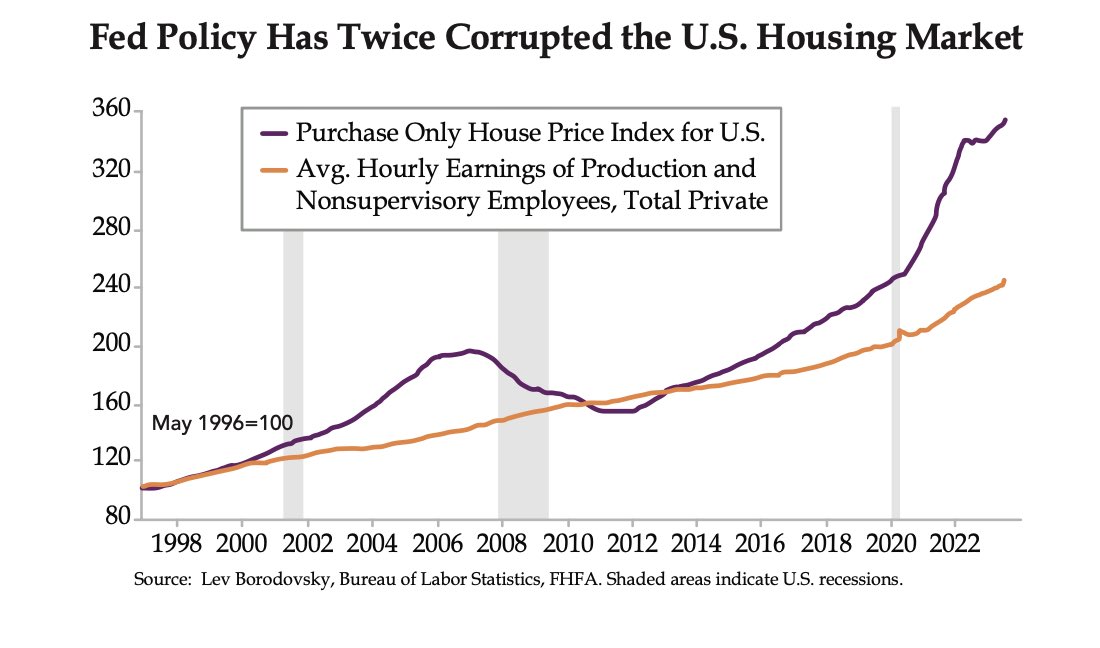

Housing-led economic downturns have historically been the most severe, and the price of homes (US in purple below since 1996) enters this downcycle more elevated relative to income (orange line) than at the 2006/07 bubble peak.

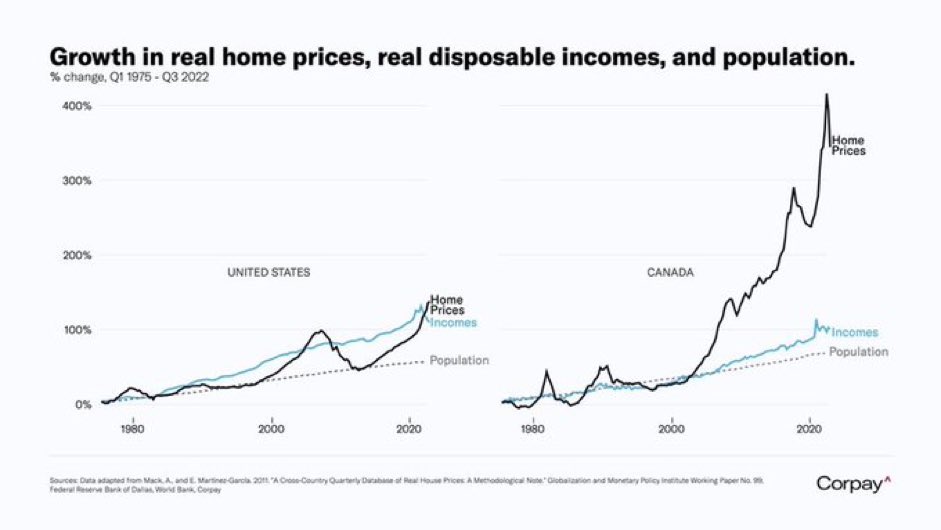

The price-to-income bubble in Canadian housing (lower right in black since 1975) is truly grotesque and much worse than in America (lower left). Population growth (shown in dotted lines for both countries) is neither the cause nor the solution from here. The compounding cost of all this will become increasingly evident as prices mean-revert back in line with income. #painful process. Motivated/desperate sellers are on the rise.

Who are you going to believe, all of the commissioned salespeople in the financial sector or facts and figures on the ground? See “We’re barely making it: Eight Canadians Reveal the Pain of Soaring Mortgage Costs and Consumers Starting to buckle for the first time in a decade, Former Walmart US CEO and China’s Golden Week Doesn’t Glitter: “Chinese consumers spent and travelled less during the holiday period that ended on Friday than the government had projected, figures showed, while home sales in key cities were weaker than last year.”

The segment below illuminates realty trends unfolding in America.

Housing market is poised for a major mortgage default (bigger than 2008), according to Mortgage Analyst, Melody Wright. Here is a direct video link.

Video Length: 00:34:56

More By This Author:

Bond Market Tightens Noose On Highly Indebted EconomyHarsh New Reality For Homeowners As Listings Rise And Buyer-Pool Shrinks

Oh Canada