Repeast Sales Ouse Prices Show Signs Of Re-Acceleration In The Last Data Of 2024

I was on vacation through the weekend, and since there has been no significant economic data in the post-Christmas lull, I decided to continue to play hooky. After tomorrow, on Thursday the 2025 data will start in earnest, so expect a return to form later this week.

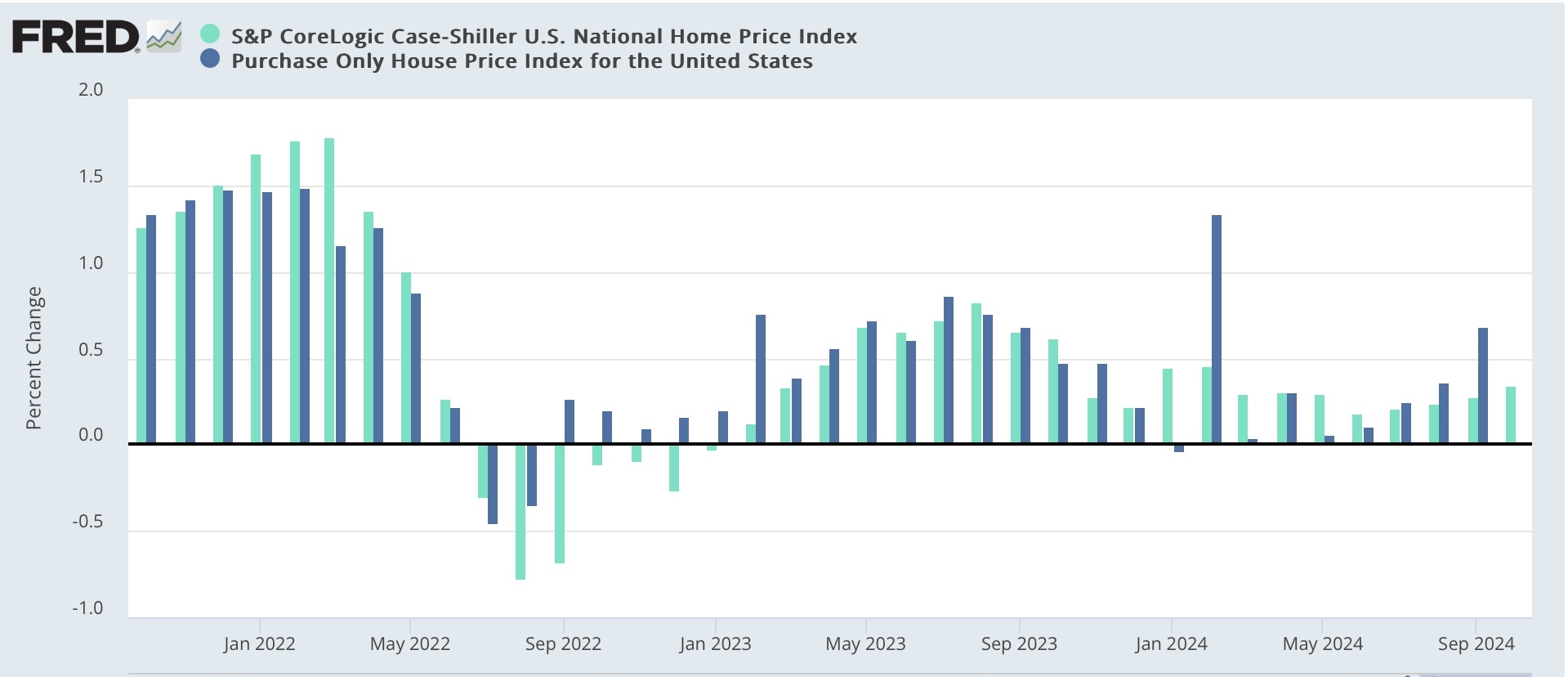

In the meantime, this morning’s repeat house price indexes from the FHFA and Case Shiller show a somewhat worrying re-acceleration in house price appreciation. Specifically, on a seasonally adjusted basis, in the three month average through October, U.S. house prices according to the Case-Shiller national index (light blue in the graphs below) rose 0.3%, and the somewhat more leading FHFA purchase only index (dark blue) rose 0.4% [Note: FRED hasn’t updated the FHFA data yet]:

(Click on image to enlarge)

On a YoY basis, the Case Shiller index decelerated to a 3.6% gain, while the FHFA index accelerated slightly to a 4.5% YoY increase:

(Click on image to enlarge)

Finally, because house prices lead the measure of shelter inflation in the CPI, specifically Owners Equivalent Rent by 12-18 months, we can use this morning’s data to calculate its trend which is 25% of the entire CPI. Despite the increase in the YoY reading in the FHFA in the past several months, this indicates that OER should continue to trend towards 3-3.5% YoY increases in the months ahead:

(Click on image to enlarge)

The deceleration in OER has been very slow, but has finally fallen below 5.0% YoY. The most leading rental indexes, including the Fed’s experimental all new rental index, indicate that YoY rent increases should decline further, which adds to the evidence for continued deceleration in that huge component of consumer price inflation.

Additionally, because prices generally follow sales, and existing home sales have been stagnant for almost 2 years, while new home sales have only increased slightly:

(Click on image to enlarge)

this also suggests that there is very little in the way of increased price pressure in the housing market going forward into 2025. Indeed, although I won’t bother with the graph, the median sales price for new houses has continued to *decrease* in the past year.

More By This Author:

Initial Jobless Claims Continue Neutral Trend, While Continuing Claims Make A 3 Year High

November Home Sales Rise Amid Mixed Price Trends

Personal Income And Spending Continue Their Positive Trend In November

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.