REITs: Pipeline Dividends Got You Beat

Long time MLP investors fondly recall the days before the Shale Revolution, when yield comparisons with REITs and Utilities made sense. This ended in 2014 when the energy sector peaked. Cumulative distribution cuts of 34%, as subsequently experienced by investors in the Alerian MLP ETF (AMLP), convinced income-seeking investors that pipelines were a hostile environment.

During the 2014-16 collapse in crude oil, yield spreads on energy infrastructure blew out compared with sectors that were formerly peers. It might be the only period in history when companies have slashed distributions primarily to fund growth opportunities and not because of an operating slump (see It’s the Distributions, Stupid!)

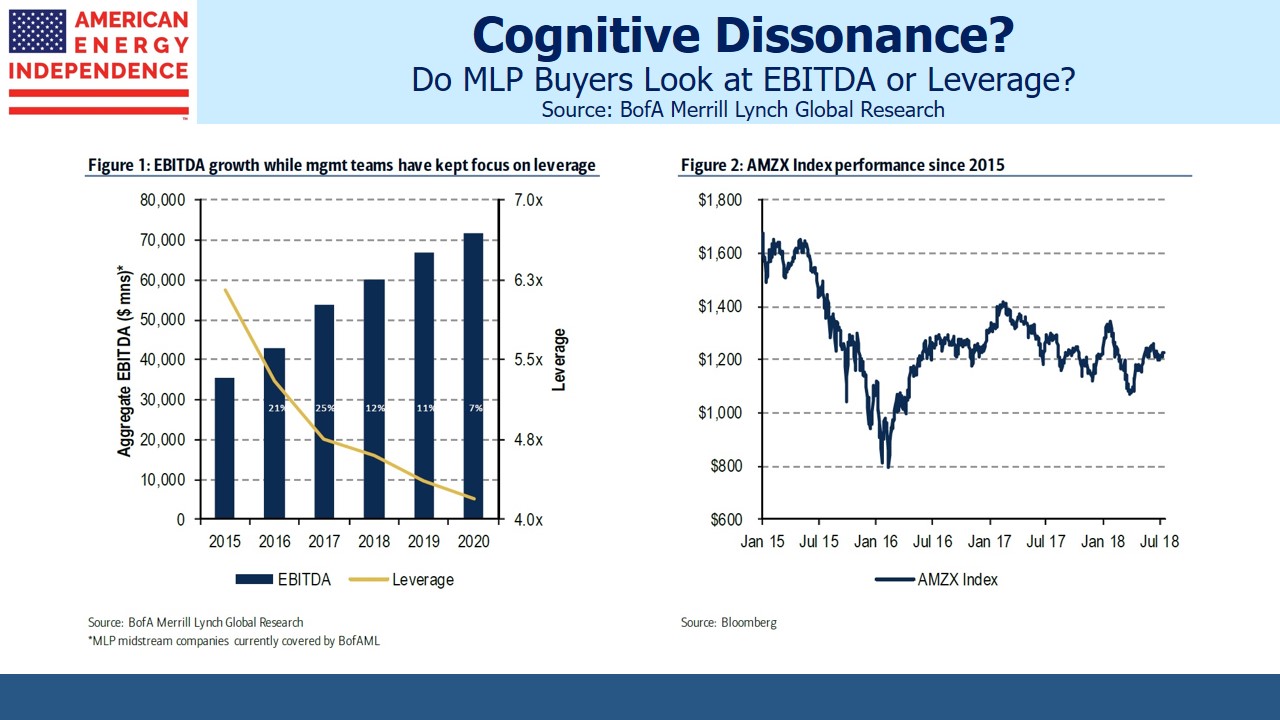

Several months ago, Bank of America published this chart showing that EBITDA for the sector grew steadily through the energy collapse, and leverage came down. Persistent weakness in the sector can best be explained by the betrayal of income-seeking investors. Distribution cuts were unacceptable to many, regardless of the reasons.

2019 should be the first year since crude oil bottomed at $26 per barrel that payouts will be rising (see Pipeline Dividends Are Heading Up). Because falling distributions are so clearly the reason the sector has remained out of favor, increasing payouts could provide the catalyst that will drive a strong recovery.

Income-seeking investors who return to the pipeline sector will find much to like. Funds From Operations (FFO) is a commonly used metric for REITs. It measures the net cash return from existing assets. The analogous figure for energy infrastructure businesses is Distributable Cash Flow (DCF).

We’ve found that comparing pipelines with real estate resonates with many readers. Differentiating between cash earned from existing assets and cash left over after investing in new assets is intuitive when applied to an owner of buildings.

As we showed in Valuing Pipelines like Real Estate, looking at Free Cash Flow (FCF), or net cash generated after new initiatives, doesn’t present an accurate picture if a company is investing heavily. And because dividends have been declining, it’s been hard for investors to get comfortable that current payouts are secure. Since neither FCF nor dividend yields have been enticing, capital has often avoided the sector.

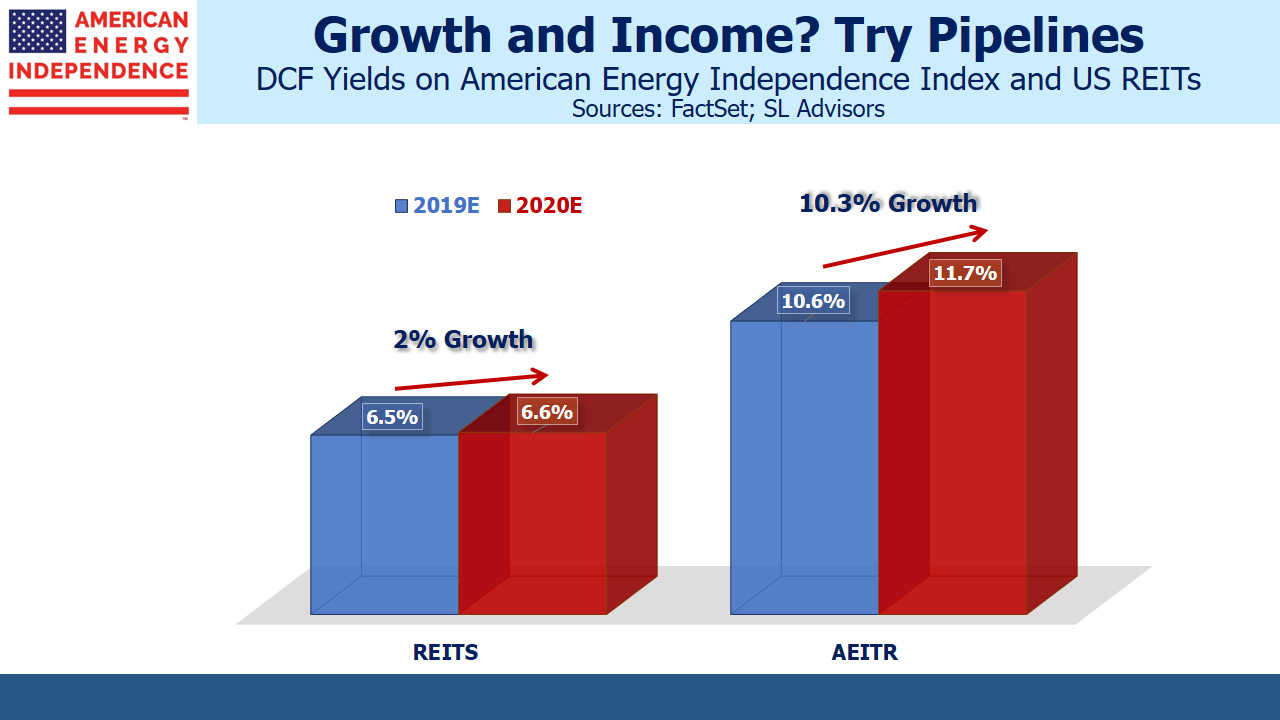

MLPs commonly paid out 90% or more of their DCF in distributions, which left too little cash to fund the growth projects brought on by the Shale Revolution. Attractive DCF yields drew scant attention when payouts were declining, but a consequence of the sector’s loss of favor is that 2019 DCF yields are two thirds higher than for REITs.

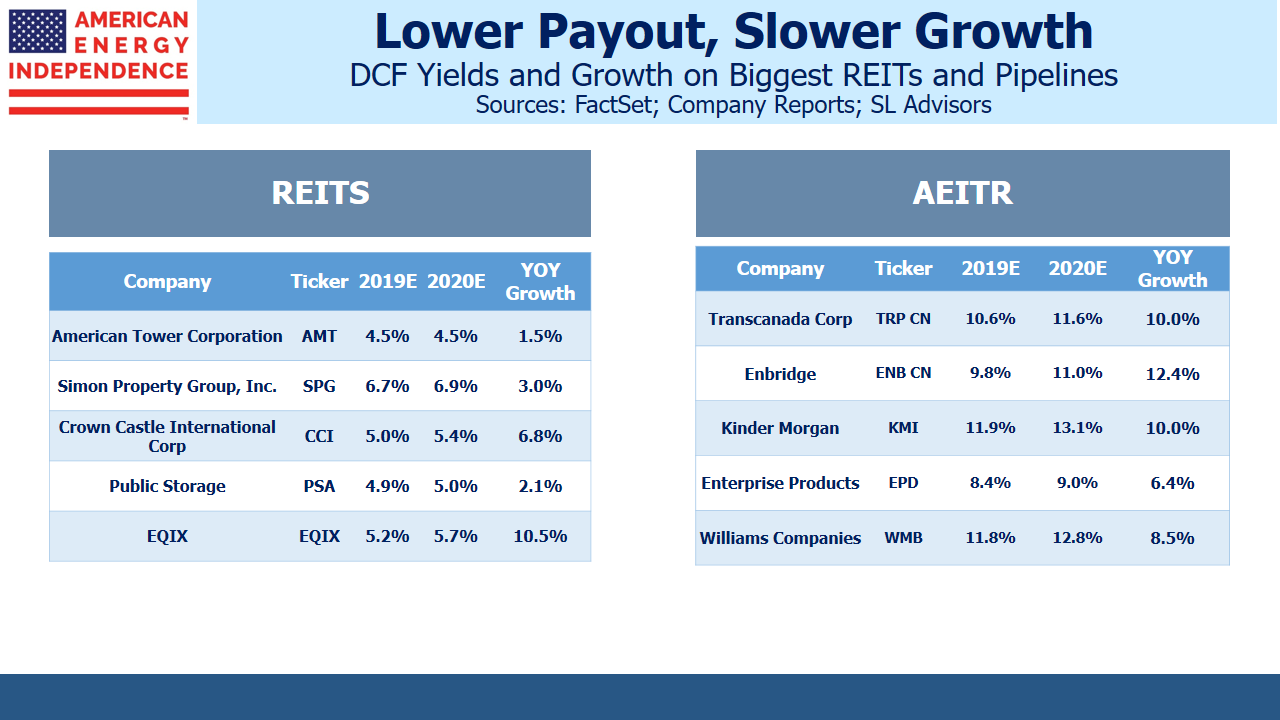

Moreover, they’re set to grow faster. U.S. REIT investors can expect only 2% growth in FFO on a market-cap weighted basis (data from FactSet). We expect 2020 DCF for the American Energy Independence Index to jump by 10.3%. Improving cash flow supports rising dividends, which we expect will be up 10% this year and next (see Income Investors Should Return to Pipelines in 2019).

Much of this is the result of growth projects being placed into production. A pipeline doesn’t generate any cash until it’s completed, so virtually all the expenditure occurs up front. MLP investors suffered the distribution cuts necessary to help fund this – we’re now starting to see the uplift to cashflows. It’s further helped by a likely peak in growth expenditures (see Buybacks: Why Pipeline Companies Should Invest in Themselves, chart #4).

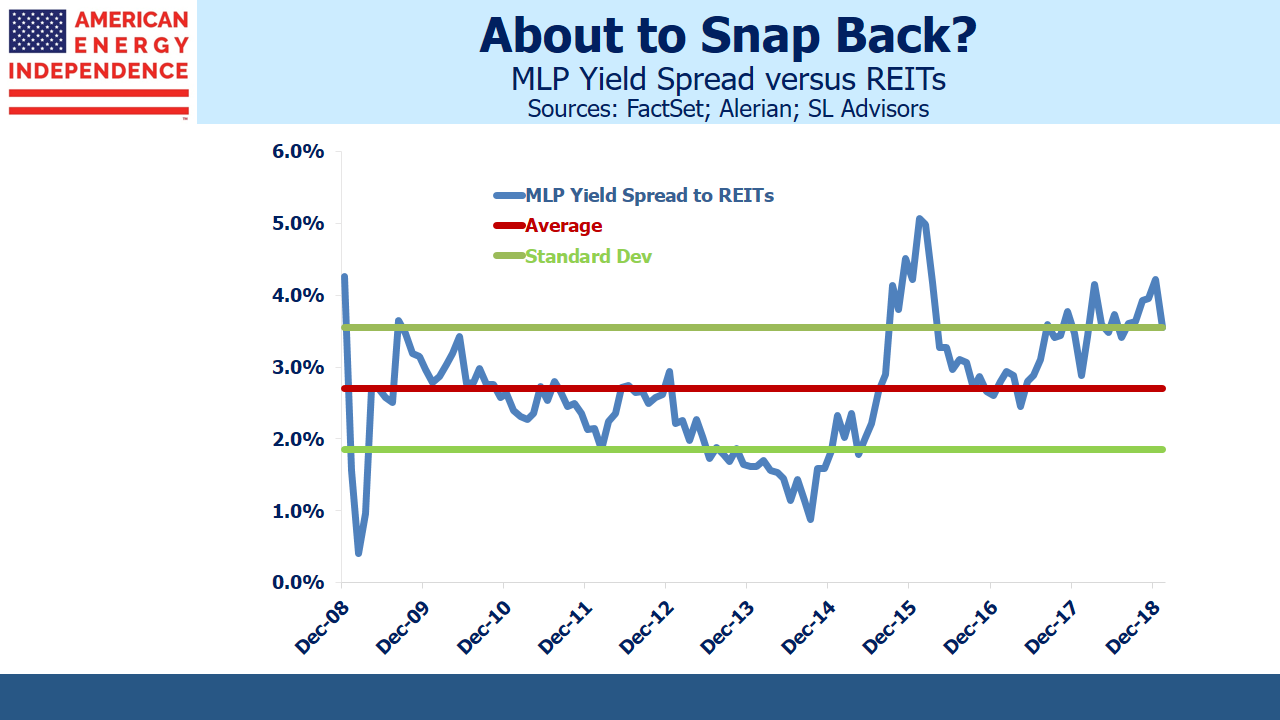

Once REIT investors return to comparing their holdings with energy infrastructure, they’re going to find strong arguments in favor of switching. They’ll find they can upgrade both their income and growth prospects by moving their REIT holdings into pipelines. MLP yields are historically wide compared with REITs, and 85% of the last decade the relationship has been tighter. Just remember to invest in broad energy infrastructure and not to limit your investment to MLPs (see The Uncertain Future of MLP-Dedicated Funds). Four of the five biggest pipeline companies are corporations, not MLPs, which nowadays represent less than half the sector.

The Shale Revolution is a fantastic American success story. The Energy Information Administration expects U.S. crude oil output to reach 13 million barrels per day (MMB/D) next year. The U.S. continues to gain market share. It’s estimated that Saudi Arabia needs a price of at least $80 per barrel to finance their government spending. To this end, the Saudis are cutting production to below 10 MMB/D. They’re slowly ceding market share in the interests of higher revenues.

Investors have little to show for allocating capital towards the Shale Revolution. That is about to change. The American Energy Independence Index is up 18% so far this year, easily beating the S&P 500 which is up 10%. The sector is starting to feel the love.

Disclosure: We are short AMLP.

Join us on Friday, February 22nd at 2 pm EST for a webinar. We’ll be discussing the outlook for U.S. energy infrastructure. The sector has frustrated ...

more