Recommended To Short Breaking 331 SPY - Now What?

We called out that a break of (NYSEARCA:SPY) 331 was a risk. Since then we've mostly had our model portfolio on the short side for subscribers catching a few bounces along the way. The problem is the fundamental situation keeps getting worse. The Fed has used up a lot of ammo and the market goes down anyway. That's a big bearish market call out for now.

Let's review fundamentals, technicals and our game plan.

Quick Review

Here's what we said publicly on Feb. 23, the day before SPY broke our key 331:

"I'm using 331 $SPY as a key support. If we close below that then there's likely further follow through risk to the downside. The market's been straight up so it's very normal if it decides to pull back. We'll see what it wants to do and hopefully react accordingly."

Here's what we said the next day, Monday, Feb 24 (paywall), in our summary after getting our model portfolio net short on chat for subscribers:

"SPY sliced through 331. That tells me there's more follow through downside risk near term. I don't think things are safe. I'm also a little stuck not to want to get long even if the market is up the next couple of days. The way this works sometimes is that the market can hold up and then take another hit. The direction has clearly changed to down.

It's clear there's fear about a health outbreak, but the main thing is respecting the market's direction and protecting gains, and for me, waiting patiently until things set up again to get long (and even big), which they will set up again.

This is a clear time for me to want to be cautious.

We've been saying for a little bit that the Fed is in taper mode. I called out Thursday that the Fed cut the amount of Treasuries they bought last week which caused me to increase the QQQ short hedge. They upped buying today, I guess as a reaction.

So while the Fed's been a support, their taper (reduction of support) showed up. The market could have just as easily looked through more negative media stories. But the Fed pulling back and more media concern globally in unison hit things. Taken that with a big market break of 331, again, I think it's reason to be cautious, not be a hero and not pick bottoms.

These things can cycle concern to slow the economy which can hit the market again. Let's respect the direction of the market to keep things simple.

If you want to try to pick bottoms I think you'd need stop losses to protect you. But I'm biased negative, as you heard me already say, so I'm not trying to pick bottoms until:

1. Stocks look very washed out.

-or-

2. They start turning back up.

You know I can find these opportunities, so I want to wait for them to present themselves... patiently.

And lastly as you know, if you've been with me a while is that I'm risk averse. When I see risk I want to avoid it. When I see things line up I want to get big. Now it's clear we have one big day of risk and usually there's more than one day. Not respecting risk can wipe people out, heaven forbid, so we always have to respect risk and especially "first day down."

I also have looked back at crashes and they are usually predicted by down periods leading ahead of those crashes. So risk usually leads to more risk. Crashes (not that I'm predicting one) happen when there's risk. I don't have a call yes or no on a crash, but I do want to respect markets to avoid risk."

That was Feb. 24, a month ago.

I want to focus on a couple of these key points.

"The Direction Has Clearly Changed To Down"

There's so much noise out there in the media, and it's easy to want to try to be a hero to predict the next move. And everybody wants to call a bottom. That's the jackpot. But I don't think that should be the focus.

Better than predicting the next move or calling the bottom is respecting the direction that the market decides.

This market has been a straight line down. My subscribers know that I'm totally OK with chasing when a stock or market goes the other way without me. There's usually more to go thereafter. So I have no problem sitting on direction until it changes.

But what often happens, like now, is that direction usually can continue. That's momentum. If you've read my tech articles you know I'm earnings-momentum driven. In trading markets and stocks I'm also momentum driven, meaning the market's direction is the most important data point. The market's direction is probably more important than any piece of news.

If the Fed backs up the truck or Trump tweets, the key is what's the market's reacted direction. So the news is one thing, but the direction the market takes after that news is of course more important.

Now we've had a global spread of Conornavirus. If anything, we keep hearing how this thing is mutating and adapting. Patients have turned from recovered to ill again. This is something very different than anything we've faced in our lifetime.

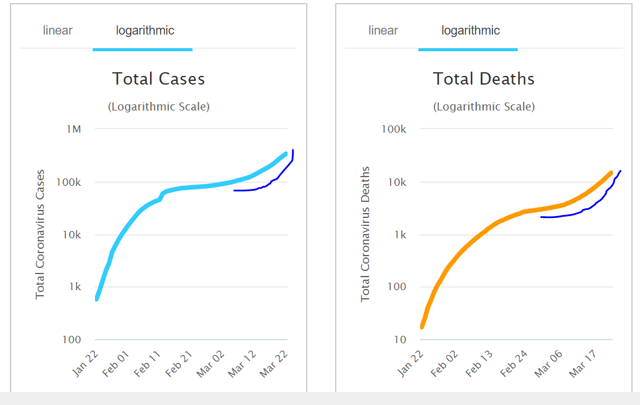

We also see that the number of new Coronavirus cases keeps moving up.

In fact you see the chart accelerating.

You see the log curve is turning up, meaning the percentage rate of new cases is accelerating. The number of deaths also is turning up.

Something's not quite right.

We see every day news about economic support, but the problem here is that this virus is spreading. No amount of economic support is going to help this virus from stopping to spread.

What we need to hear is actually economic-damaging news like total shutdowns and lockdowns to stop this virus from spreading.

As long as we don't hear that and watch these case numbers keep moving up, there's too much risk for markets.

Instead the government and Fed are spending everything they have to keep the economy going. But many of these announcements are met with down markets which is amazing.

Which brings me to an important point about "action."

Markets down on good news is a datapoint telling you there's more downside risk ahead. If you get great news in the market and down stocks that's bearish.

I have a simple formula:

Good News + Bad Action = Bearish

Bad News + Good Action = Bullish

I'll go into the second one in a bit.

But we've been getting great economic stimulus news, but the market's reacting negatively is telling you something much worse is pressing markets lower.

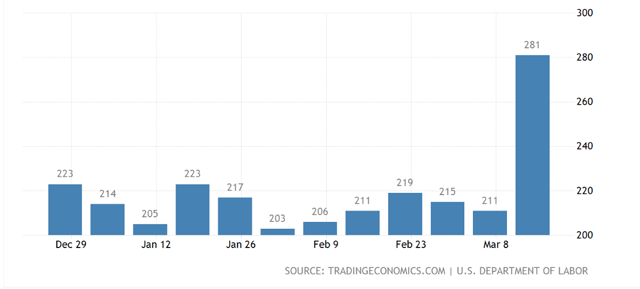

On economics, jobless claims spiking is a clear sign we're probably currently already in a recession.

Jobless claims spiking near-40% were probably predicted by the near-30% drop in stocks. Jobless claims are supposed to spike again this week, meaning there could be more stock price downside.

Jobs and inflation are probably the two most important economic data for the market. And jobs are telling you we're currently in a recession.

As long as there's no end in site to the virus spread and we don't know how bad this virus will end up being it's tough to know when this market onslaught ends. In the meantime respecting direction, still down, helps keep things simple.

Markets hate the unknown and that's where it is.

"I'm not trying to pick bottoms until..."

I mentioned above that to pick bottoms I'd want to see "wash out" and "turning back up." I'd also want to see bullish "action."

Let's go into it.

I don't think we've had a wash out yet. Stocks have been moving down at an orderly rate. Steep but orderly.

We haven't had a turning back up yet either.

One key sign of a bottom can be if we see multiple earnings reports see stocks go up on bad news. When companies pre-announce and stocks go up and stay up that's another sign we're washed out.

Pre-announcement season comes in a little over a week after company quarters are completed. Drops in companies' earnings estimates and guidance should be sharp. The reaction to those announcements will be so key.

If stock reactions to those announcements are up one after another then we're probably at a low. If not, we're not.

Personally I still think there's too much risk unless the number of Coronavirus cases slows down. That's a giant unknown. And even if it slows there's reports that people can have a relapse.

Again, the market hates unkowns and that's where it is.

Defining The Market

So to keep things simple I think there's two basic ways I like to define the market. Direction and speed. Direction simply means is the market moving up or down. I want that to be my bias.

And speed means is the market moving in wide swings (bearish) or moving slow and smooth (bullish)?

This market has been clearly down and whippy with wide swings. That's a bearish market. That means long positions have more risk than shorts.

But markets change all the time and these two stats along with "action" will help us define our direction.

As the markets adjust we hope to as well.

Fundamentals This Time Are Extreme And Need To Be Respected

This market reminds me of 2009. That was a great period for trading.

The fundamental news was extreme then and it's probably more extreme now.

We just ended the longest economic expansion of modern history.

But what follows is also extreme.

Most economic cycles end with a slowdown and then markets get slammed. To add to this extreme, this cycle didn't end with a slowdown it ended with a shutdown.

So you have the longest expansion (extreme) ending in a shutdown (extreme).

The market down 30% sounds fine to me. It probably can be down much more.

Still we'll be watching for direction and action.

Conclusion

This Coronavirus is a big unknown. Cases keep accelerating. Stimulus keeps accelerating. But stimulus can't cure a cold. It holds the market up but it can't cure a cold. So my bias is still down probably until the number of new cases slows and peaks, hopefully soon.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

Ready to Nail Tech Earnings? Start your more