Recession Probabilities (Using Data Through End-2022)

In a project with Laurent Ferrara, we have been examining the properties of financial indicators as predictors of (NBER-defined) recessions. In addition to the term spread, we have considered Financial Conditions Indices (Arrigoni-Bobasu-Venditti, Goldman Sachs), the foreign term spread (a la Ahmed-Chinn) and the BIS debt service ratio (suggested by Borio-Drehmann-Xia). Slides from presentation in June here.

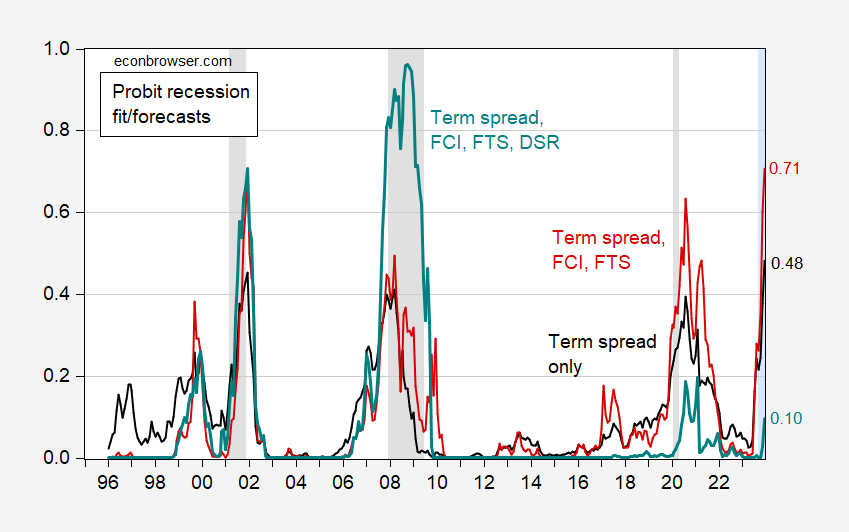

Figure 1: Implied recession probabilities from probit regressions on term spread (black), term spread, FCI, foreign term spread (red), and term spread, FCI, foreign term spread and debt-service ratio (teal). Estimation over 1985-2023M09 (assumes no recession in US as of September 2023). NBER defined peak-to-trough recession dates shaded gray. Light blue shading denotes out-of-sample period. Source: NBER, and author’s calculations.

Of key interest is that the estimates based on term spread and/or FCI and foreign term spread yield pretty high probabilities of recession for December 2023. They are not as high as some other estimates I have presented previously, as the sample period differs. The most important difference is the debt-service ratio of the private nonfinancial sector, which as Borio et al. report has roughly the same predictive power as they financial cycle variable. This variable — available only through end-2022 at the moment — reduces the implied probability to a mere 10%.

The pseudo-R2 of the debt-service ratio alone is higher than that of the term spread alone (or term spread, FCI and foreign term spread).

It’s too early to take too much solace from these results: the debt-service ratio is rising rapidly.

(These results are different relative to June’s in that we now have moreup to date FCI data. Note that one would not necessarily want to apply the same sample period to euro area countries or the UK as we do not have the same level of confidence that a recession has not begun in these economies.)

More By This Author:

The Recession Of 2022H1 – Rec Vehicles, But No SpamTerm Spread Watch – Is This Time Different?

Monthly GDP And Coincident Index