Real Wages During And Post-Pandemic

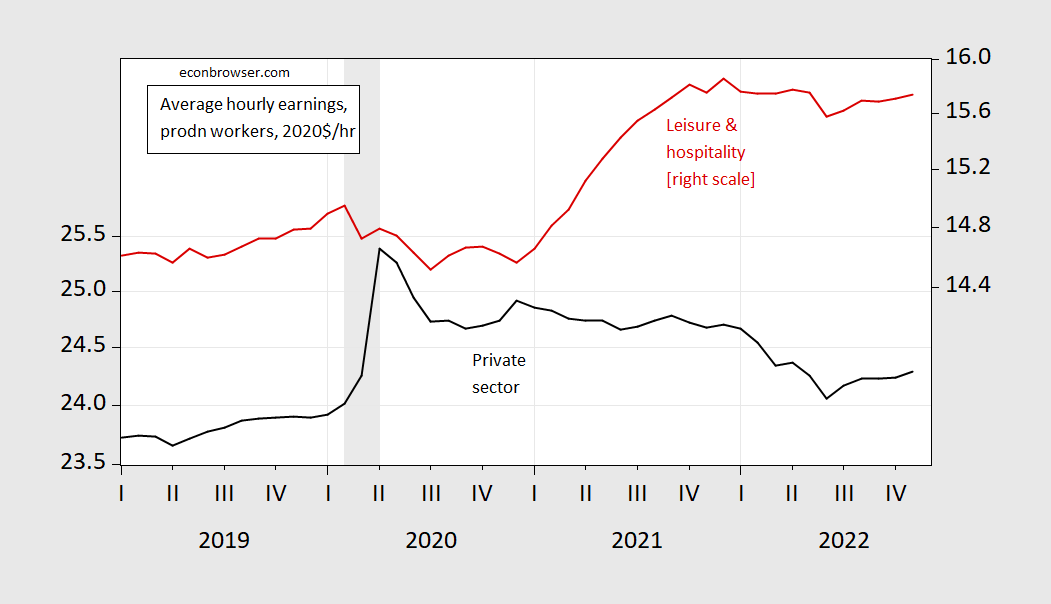

While recent accounts have focused on the erosion of real wages with high inflation, what is true is that average real wages in the private sector, and among the lowest paid segment, leisure and hospitality workers, has risen since 2020M02.

(Click on image to enlarge)

Figure 1: CPI-deflated real wage in private sector (black, left log scale), and in leisure and hospitality (red, right log scale), in 2020$/hour (production and nonsupervisory workers). November CPI using Cleveland Fed nowcast on 12/4/2022. NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NBER, and author’s calculations.

(Click on image to enlarge)

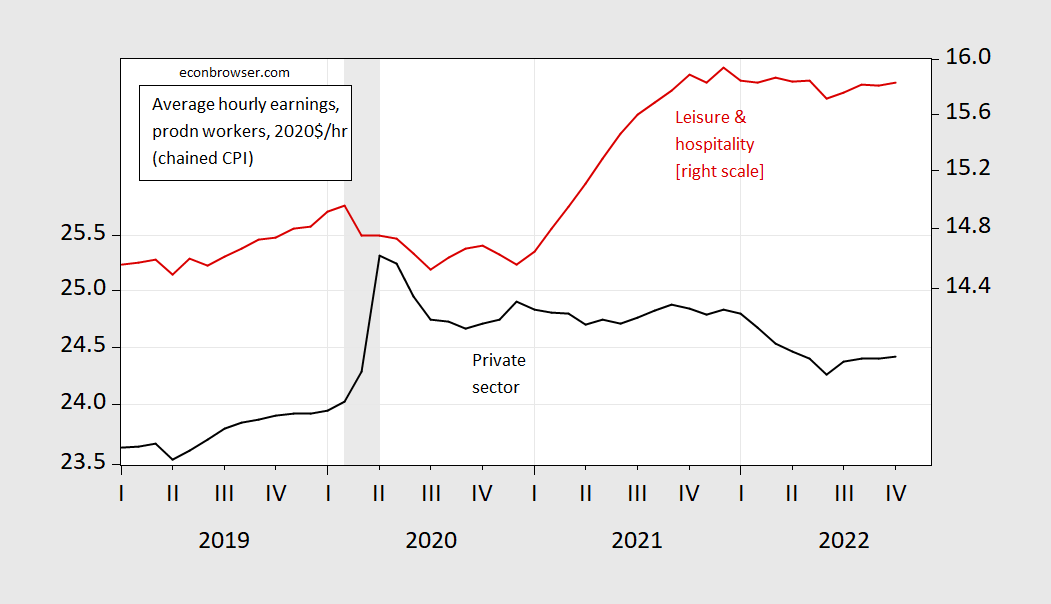

Figure 2: Chained CPI-deflated real wage in private sector (black, left log scale), and in leisure and hospitality (red, right log scale), in 2020$/hour (production and nonsupervisory workers). Chained CPI seasonally adjusted by author using Census X-11 on log transformed data. NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NBER, and author’s calculations.

(Click on image to enlarge)

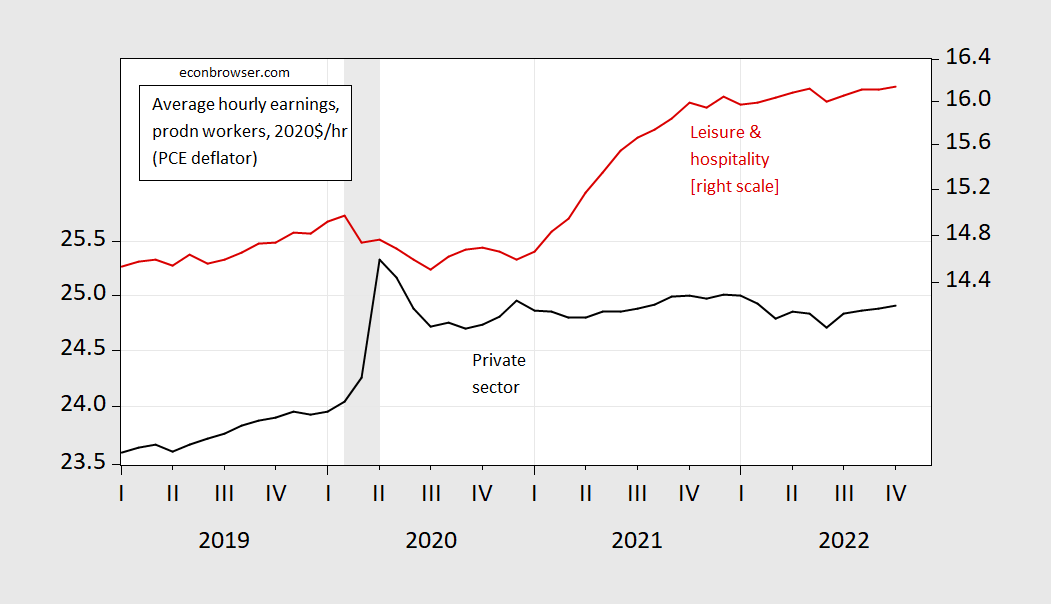

Figure 3: PCE-deflated real wage in private sector (black, left log scale), and in leisure and hospitality (red, right log scale), in 2020$/hour (production and nonsupervisory workers). NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NBER, and author’s calculations.

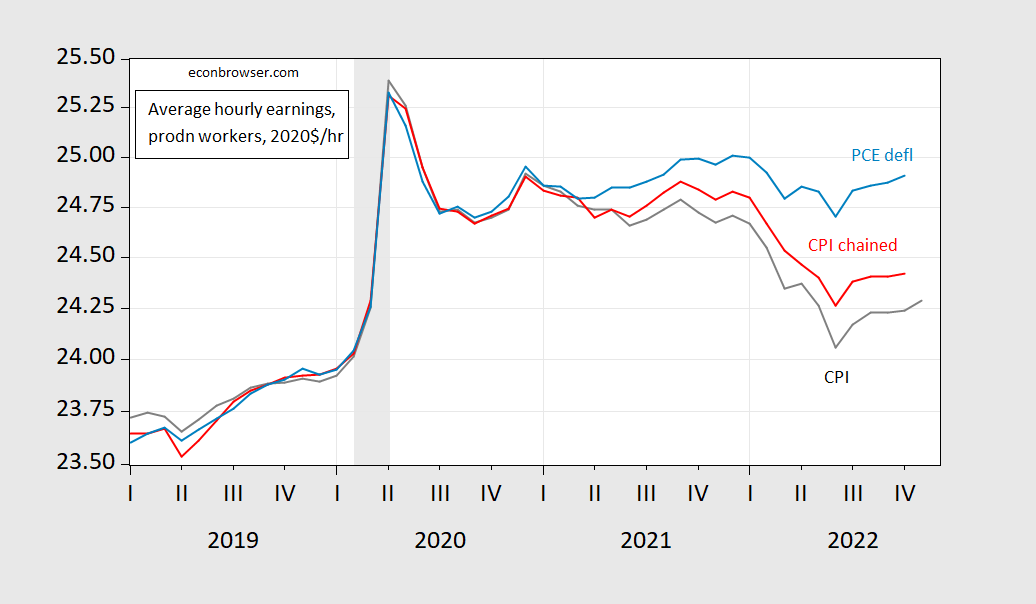

These graphs highlight the importance of deflators. Here is a comparison of total private sector average hourly earnings for production and nonsupervisory workers:

(Click on image to enlarge)

Figure 4: CPI-deflated real wage in private sector (dark gray), chained CPI (red), PCE deflated (light blue), in 2020$/hour (production and nonsupervisory workers). November CPI using Cleveland Fed nowcast on 12/4/2022. Chained CPI seasonally adjusted using Census X-11 on log transformed data. NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, Cleveland Fed, NBER, and author’s calculations.

For a description of the empirically relevant differences between CPI and PCE price deflator, see Johnson (2017). Since the CPI takes into account out-of-pocket expenses, while the PCE deflator takes into account expenditures made for consumers, the differences can be large. Owners equivalent rent and rent of primary residence constitutes a big difference in the weights associated with the CPI and PCE deflator.

More By This Author:

Is The Establishment Series Overestimating NFP Employment?Employment Release And Business Cycle Indicators - Friday, Dec. 2

Month-On-Month Inflation Seems To Have Peaked