Real Retail Sales Contract; Depending On Inflation Report May Signal Further Job Losses

Real retail sales, one of my favorite broad-economy indicators, was finally updated yesterday, although as per most government data releases, it was still somewhat stale, being for September and October. Nevertheless, it does give us some new information, so let’s take a look.

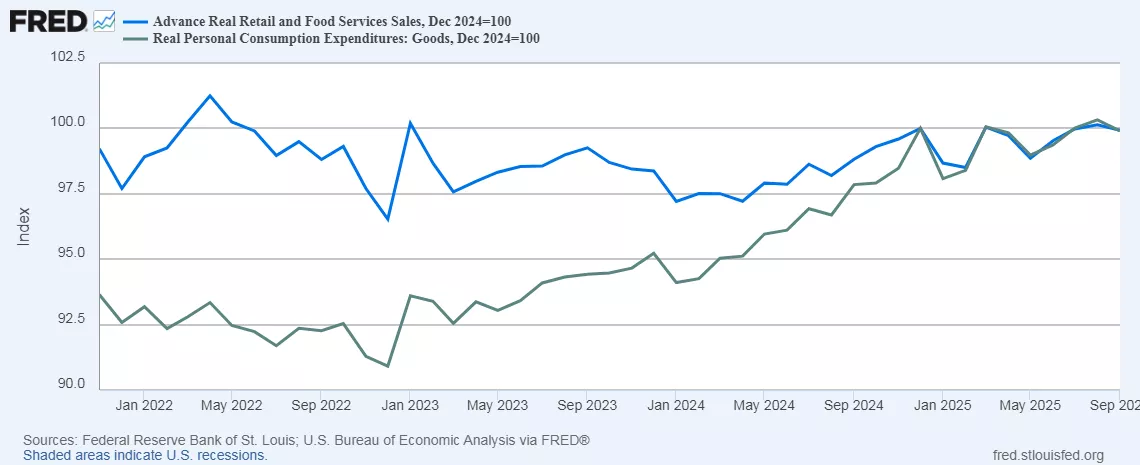

In nominal terms retail sales rose 0.1% in September, and were unchanged in October, but since consumer prices rose 0.3% in September, real retail sales declined -0.2%. CPI for October hasn’t been reported yet, but another 0.3% increase would mean a further -0.3% decline in real sales for October. The below graph, through September, shows real retail sales (blue) and the similar measure of real spending on goods (gray), both normed to 100 as of their peaks in December of last year:

Both have only exceeded that peak by at most 0.1% this year, and in September both were below it by -0.1%, although the 3 month moving average continued to increase slightly.

When real retail sales turn negative YoY, going back 75 years it has almost always meant a recession (with the very notable exception of 2022-23, which was countered by a steep positive supply shock). Here is what the YoY comparison looks like for both of the above metrics:

.webp)

Neither are negative YoY, but both have decelerated sharply since their YoY peaks in early spring. Should the trend continue, they could be negative YoY by December or January.

Finally, because consumption leads employment, here is the update of YoY real sales (/2 for scale) together with employment (red), updated through yesterday’s report:

.webp)

The sharp deceleration in YoY growth in consumption has forecast the slide in employment. Should the October CPI release mean a further deterioration in sales for that month, that would forecast even more deceleration - in fact a downturn,- in employment in the immediate months ahead.

More By This Author:

Combined October And November Jobs Report: A Hairs-Breadth From Recessionary, At Best

What Do Vehicle Miles Traveled And Gas Usage Tell Us About The Economy?

Three Important Fundamentals-Based Indicators Of The Consumer Economy: Are They Turning?