Real Hourly And Aggregate Pay For Nonsupervisory Workers Increased In March

With yesterday’s CPI report, we can update two important measures of ordinary American workers’ well-being, that also serve as short leading indicators: real average hourly earnings and real aggregate nonsupervisory payrolls.

There have been two months since the pandemic lockdowns five years ago, including last June, where there were very slight decreases, but these rounded to unchanged, but yesterday’s -0.06% decline which rounded to -0.1% was reported that consumer prices went down significantly since April 2020.

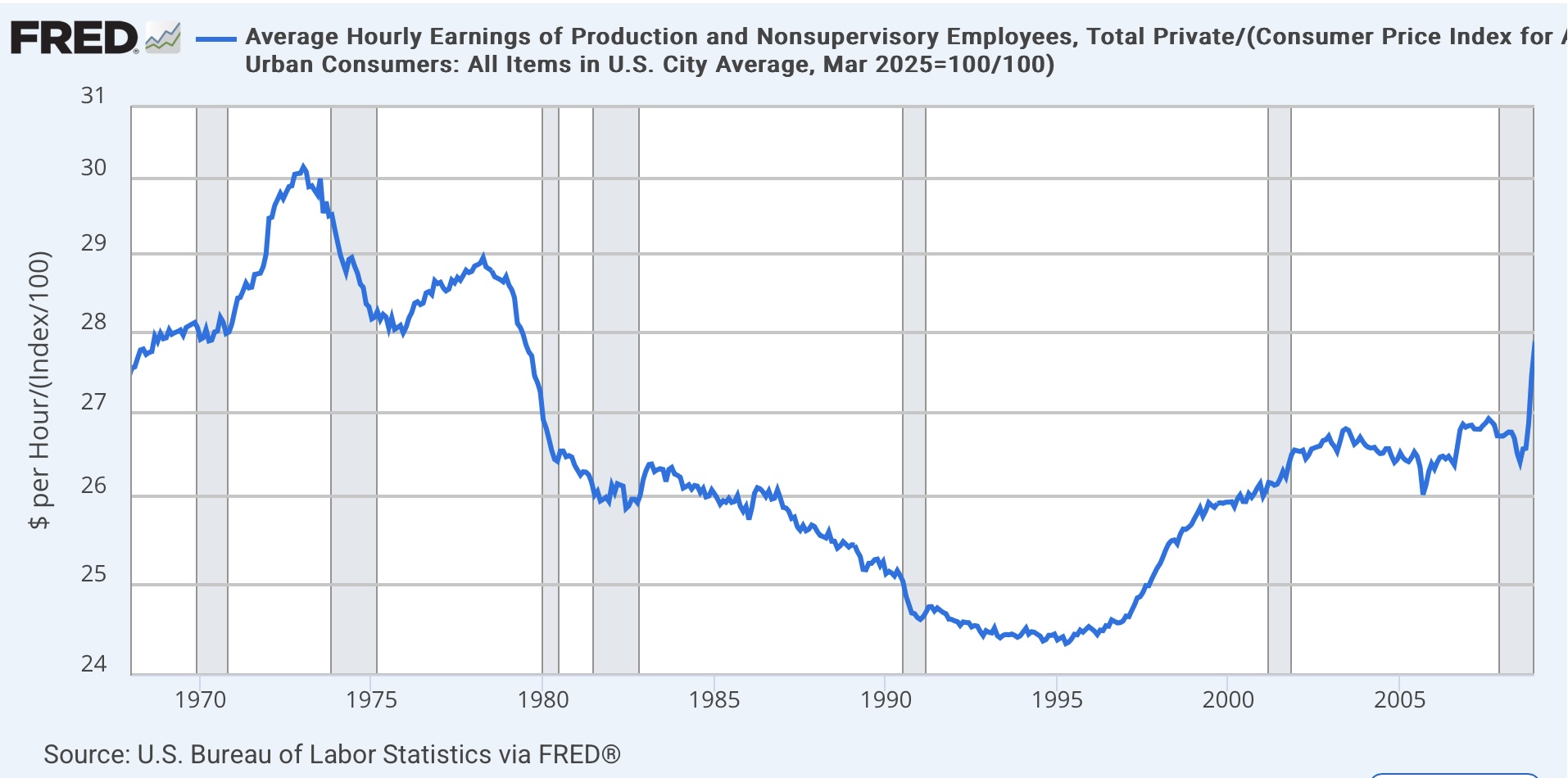

Reported average hourly earnings increased 0.2% nominally in last week’s jobs report, but that also reflected a rounding up from 0.16%. So real average hourly earnings increased 0.2% to the highest ever level except for April and May 2020 - and recall that those months were heavily distorted by the layoffs of millions of low-wage service workers:

(Click on image to enlarge)

With the exception of the pandemic itself, in all cases in the past 60 years, recessions have not occurred until real average hourly wages have either turned down or at least stalled (1970 and 2001):

(Click on image to enlarge)

An even better forecasting metric is real aggregate nonsupervisory payrolls. This tells us how much buying power ordinary American workers have in the aggregate. So long as this keeps increasing, the economy is powered by the added ability to spend. It is only when this stops that a downturn has begun.

In last week’s jobs report, nominally this increased 0.86%, rounded up to 0.9%. Again, due to rounding, the real figure is also 0.9%, which caused real aggregate payrolls to rise to another all-time high, 9.2% above their level just before the pandemic:

(Click on image to enlarge)

In all but one case in the past 60 years, real aggregate payrolls have turned down at least several months before the onset of a recession. In the case of 1970, it was only one month:

(Click on image to enlarge)

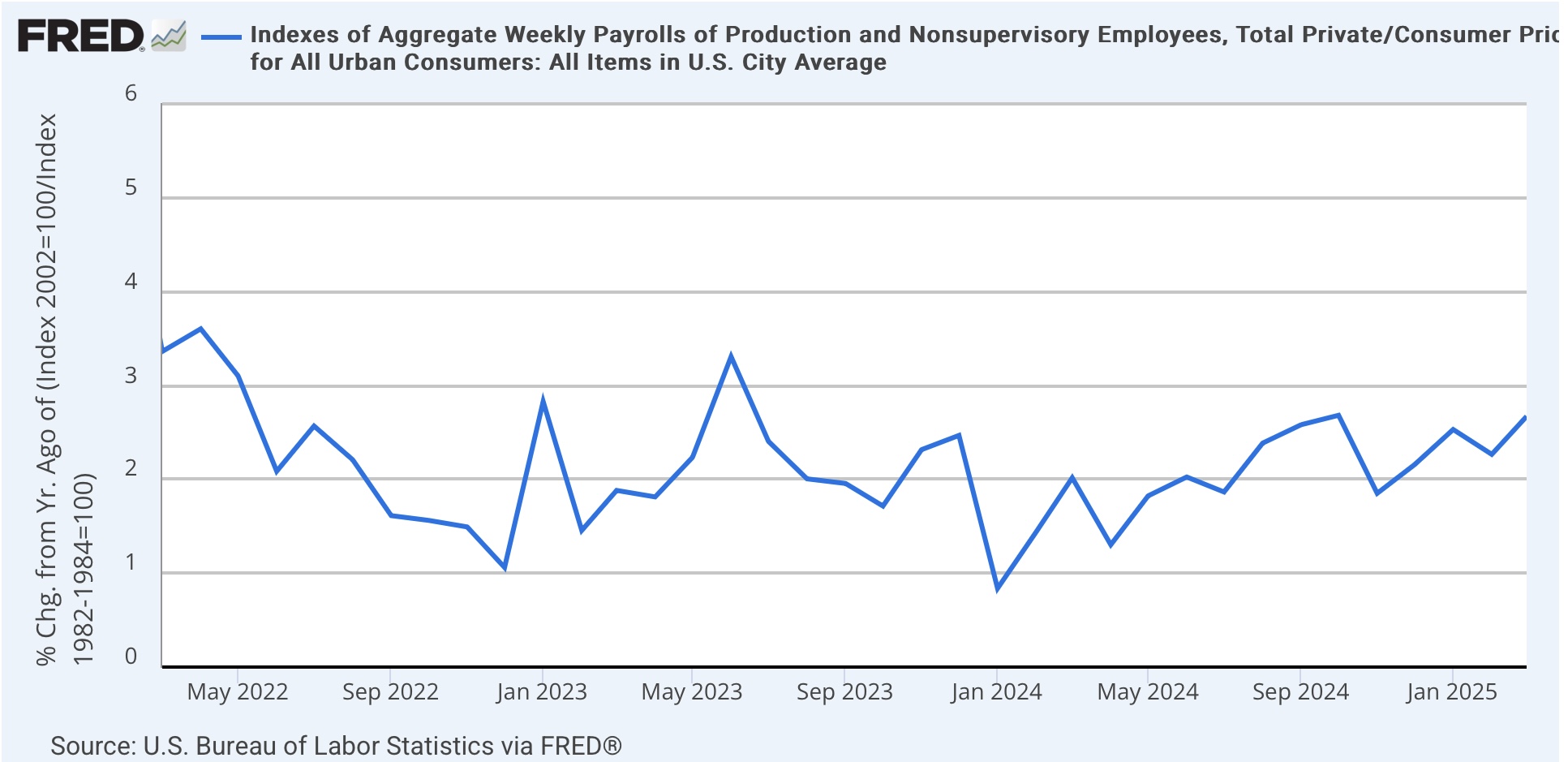

In all cases, the YoY% change in real aggregate nonsupervisory payrolls has deteriorated sharply before the onset of recessions, and turned negative within a month or two of the onset:

(Click on image to enlarge)

Currently these are higher by 2.7% YoY, and show no signs of deceleration - yet:

(Click on image to enlarge)

March is somewhat of the “Before Times,” since the Idiot King’s tariff madness is likely to upend everything, especially inflation. Speaking of which, this morning’s PPI, in which both commodities and final demand producer prices declined -0.4%, is probably about the last gasp of the Before Times as well:

(Click on image to enlarge)

FWIW, there has been no sign this week in any of the high frequency hard data of any sudden deterioration in consumer spending, or increase in layoffs.

More By This Author:

March CPI: This Is The Report We Have Been Waiting For

Jobless Claims Continue To Reflect Slowly Expanding Economy

Tariff Recession Watch: No Evidence Of Hard Data Deterioration To Start