Rates Spark: Issuers Returning After French Distraction

Fed Chair Powell’s testimony didn’t give away much and markets continue to price in around a 75% probability for a September cut. French spreads remain elevated, but issuers are returning to EUR primary markets as events risks are abating. The Bank of England’s short-term liquidity facility still sees rising demand.

Image Source: Unsplash

Fed remains biased towards cuts, but Powell signalled no shift in the baseline

The net market reaction is about right post the Powell statement– an edge higher in yields, on both ends of the curve. There is clearly still a Fed bias towards cuts, but beyond that it’s very balanced, with the underlying economy seen as showing ongoing signs of relative firmness. Inflation figures were pointing to some modest further progress, but stating that “reducing policy restraint too late or too little could unduly weaken economic activity and employment" still shows the Fed’s inclination to ease policy. But Chair Powell is in no rush.

The market is attaching a roughly 75% chance to a September cut and almost fully pricing two cuts by the end of this year. As long as the data – and subsequently Fed comments – does not noticeably point away from this baseline any move lower in market rates will be a slow grind. The 3yr auction went well, coming rich to secondary levels on a strong non-dealer bid. Next up are the 10yr (Wednesday) and 30yr (Thursday) auctions, and the little matter of US CPI on Thursday morning US time. The CPI data is anticipated to be Treasuries-supportive.

French relief has its limits, but enough for issuers to return

EUR markets saw a modest rise in sympathy with US rates over the past session. More notable was a rewidening of French sovereign bond spreads versus Bunds – by around 4bp in the 10yr maturity – as the post-election relief is fading. Over the past few days rating agencies such as Moody’s and S&P have commented on the fiscal challenges facing any new government. The spread at around 67bp is still well off the +80bp peaks, but also well above the pre-election levels of just below 50bp.

While we think the French spread is more likely to stay in these still elevated ranges, markets elsewhere have remained more insulated. The Bund ASW is not budging after it had already reached pre-election levels earlier. With the risk events out of the way, we have seen issuers coming back to the primary market, using the limited time ahead of the summer break. In SSAs, next to the EU which held its scheduled sale on Tuesday, €9bn in a dual tranche deal, we have now seen German Laender Rheinland-Pfalz and Baden-Wuertemberg test the waters as well as EBRD mandating a 7yr green bond.

Bank of England's liquidity facility sees uptake rising

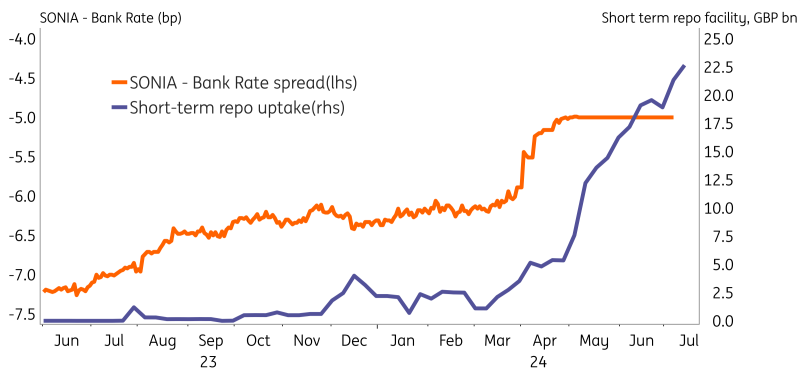

In the UK the uptake from the Short Term Repo facility rose again this week (see chart), suggesting that more liquidity is sought at a premium above the Sterling Overnight Index Average (SONIA) rate. Since March the Bank of England (BoE) liquidity facility has shown a sharp increase, which hints at tighter liquidity conditions in some parts of the GBP market. Initially the SONIA also rose but stabilised at exactly 5bp below the Bank Rate.

An increase of the Short Term Repo uptake was anticipated against a backdrop of Quantiative Tightening (QT), but the increase is faster and earlier than we would have expected. With still plenty of bank reserves in the system, liquidity at a headline level still seems ample. The uptake of BoE liquidity could potentially be attributed to smaller players, such as building societies, which do not have the same ease of access to market-based liquidity but are eligible for the BoE facility.

BoE liquidity facility continues to see strong demand

Source: Bank of England

Wednesday's events and market views

Markets will already be eyeing the CPI reading on Thursday, with no notable data releases on Wednesday besides weekly MBA mortgage application numbers from the US. Instead the various central bank speakers may get more interest. From the Fed we have Powell's testimony before the House Financial Services Committee and Nagel will be speaking from the ECB.

Germany will auction 12yr and 14yr Bunds totalling €2bn and the US has a 10yr Note auction scheduled for a total of $39bn.

More By This Author:

3 Reasons For Weak Investment In The Eurozone

Core Inflation Remains A Red Flag In Hungary

Taiwan Export And Import Growth Surge To 28-Month Highs In June

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more