Core Inflation Remains A Red Flag In Hungary

Although overall monthly repricing was flat, core items surprised to the upside and this resulted in higher-than-expected underlying inflation. This unfavourable outcome might lead the central bank to err on the side of caution at its July rate-setting meeting.

| 3.7% |

Headline inflation (YoY)ING estimate 3.7% / Previous 4.0% |

Once again, core elements surprise on the upside

The year-on-year (YoY) Hungarian inflation figure fell slightly in June, matching our expectation but below market consensus. Compared to May, headline inflation declined by 0.3ppt to 3.7% YoY. The monthly repricing was 0.0%, implying that favourable base effects were not the main reason behind the deceleration in the main price indicator.

While, at first glance, it might seem that inflation has turned favourable again the details show that the overall picture is not nearly so rosy. We highlight the stronger-than-expected repricing of core items, which led to an upside surprise in the core inflation measure. This suggests that underlying price pressures remain intact, which in our view might lead the central bank to remain cautious when deciding on the level of the base rate at its upcoming rate setting meeting.

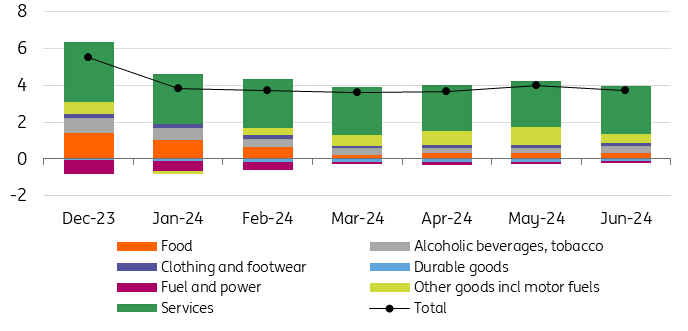

Main drivers of the change in headline CPI (%)

(Click on image to enlarge)

Source: HCSO, ING

The details

- Food prices fell by 0.3% MoM, bringing the annual food inflation rate to 1.1%. On a monthly basis, prices of unprocessed foods decreased while prices of processed foods increased - illustrating a continued divergence within the food component.

- Fuel prices decreased by 3.4% MoM, one of the most important drivers behind the monthly repricing. Household energy prices also decreased on a monthly basis, as warmer weather conditions contributed to cheaper utility bills.

- Prices of durable goods fell by only 0.1% on a monthly basis, while prices of alcoholic beverages and tobacco increased significantly, by 1%. Overall, there has been a decline in the prices of goods, offset by continued significant increases in the prices of services.

- Services inflation came in at 1.0% MoM, bringing the annual rate up slightly to 9.7%. Within services, the main increases were in housing-related costs (rent, maintenance costs at private houses) and recreational services. In terms of annual headline inflation, the services component explains 69% of total inflation.

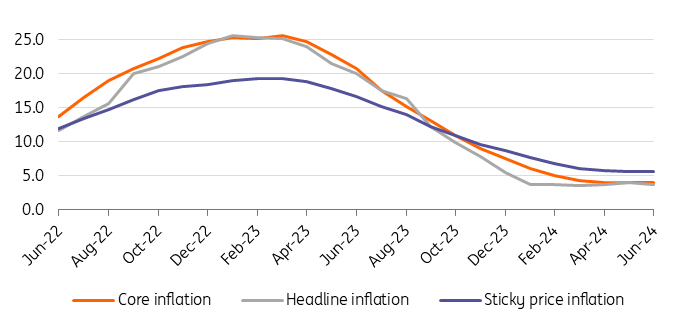

Composition of headline inflation (ppt)

(Click on image to enlarge)

Source: HCSO, ING

Underlying inflation remains an issue

Core inflation rose by 0.1ppt to 4.1% YoY in June, as a result of a 0.5% MoM increase in prices of core items. This is the first time in 18 months that an underlying inflation measure is moving higher. The monthly repricing is in line with the month-on-month dynamics we saw in May, which means that we haven't seen a slowdown here. What's more, the 0.5% monthly repricing is double what would be compatible with the central bank’s 3% inflation target.

The overall inflation picture is therefore rather unfavourable. This is also evidenced by the National Bank of Hungary's measure of sticky price inflation, which remained unchanged at 5.6% YoY in June. To put this into perspective, this is the first time since the start of disinflation that the sticky price measure hasn't fallen further. An important short-term indicator, the 3M/3M core inflation measure, also increased, while retail price expectations remain elevated. We can therefore conclude that, despite the subdued repricing of the headline rate, underlying inflation indicators signal that Hungary still has an underlying inflation problem.

Headline and underlying inflation measures (% YoY)

(Click on image to enlarge)

Source: NBH, ING

Inflation remains on an upward trend

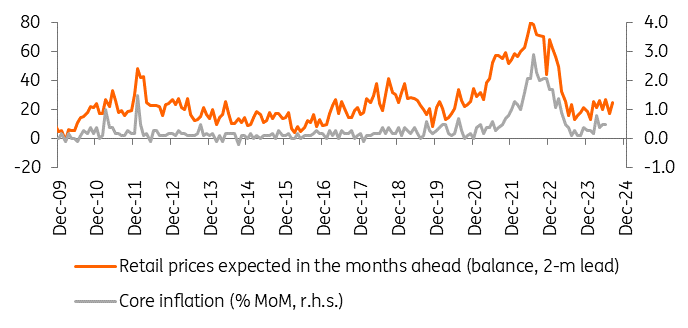

Looking ahead to July, we expect monthly repricing to be stronger than we are seeing now. On the one hand, the phasing out of ‘mandatory discount sales’ could lead to some food price increases. On the other hand, if there is no significant turnaround in fuel prices then the July inflation report could show a significant increase in the price level here. The rise in prices of seasonal services could well continue. As a result, annual inflation could rise again and approach 4%. The next big jump in inflation is expected in October, when inflation could be well above the upper limit of the central bank’s tolerance band. Looking at current underlying inflation trends, we expect the headline rate to creep back above 5.0% by December 2024. The correlation between retail price expectations and core inflation also suggests that monthly repricing should remain elevated in the coming months, resulting in an inflation uptrend.

Correlation between retail price expectations and core inflation

(Click on image to enlarge)

Source: Eurostat, HCSO, ING

Based on the latest data, the performance of the Hungarian economy looks weak. On the domestic demand side, inflationary pressures are unlikely to be significant in the short term. On the other hand, the labour market remains strong and wage outflows are higher than expected, which could put further upward pressure on prices of services . The recent tax increases announced by the government are likely to be passed on to consumers in the form of higher prices sooner or later. These risks to the inflation outlook are therefore two-sided, with perhaps a slight bias to the upside.

The structure of inflation might warrant a pause in the easing cycle

From a monetary policy perspective, the latest inflation data supports the central bank's continued cautious stance. A lot can happen between now and the July rate decision (23 July), but financial market volatility and a deterioration in the structure of inflation (sticky, with elevated repricing in underlying inflation) could prevent the central bank from cutting rates in July, leaving the policy rate unchanged at 7.00%.

More By This Author:

Taiwan Export And Import Growth Surge To 28-Month Highs In JuneFX Daily: Macron And The Euro Face A Stalemate

The Commodities Feed: Hurricane Concerns Ease

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more