Pullback Not A Bubble – How To Manage Positions

Not much new since Monday, just more talk about an AI bubble which continues to be nonsense. I do enjoy reading the tweets and emails about how wrong I am, warning me of impending doom. Same folks who warned me about recession in early April and back in 2022 and 2023 because of inflation. These folks have become excellent contrary indicators.

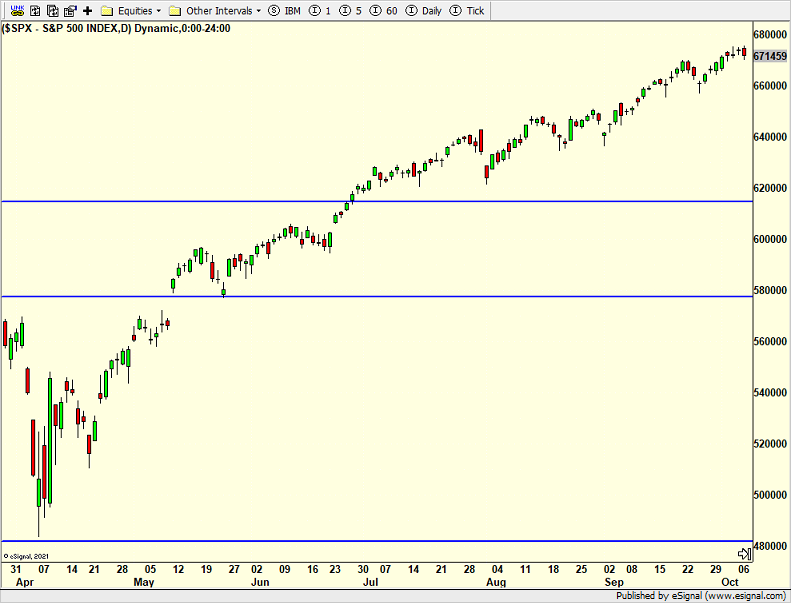

The markets are stretched. 100%. They have grinded and crept higher since mid-April without more than a mild pullback. And the masses remain stuck with cash and lower risk positions that have woefully trailed. A pullback is coming, but I think it will be difficult to have magnitude of any consequence this quarter without an exogenous event.

(Click on image to enlarge)

Some of our models have been very active of late. I want to highlight, yet again, what good, sound portfolio management looks like which is very different from stock picking. A full stock position in our Unloved Gems is 2.5% of the portfolio. When a stock goes in our favor 2.5% can potentially grow to 3%, 4% or higher. And if the stock market also powers higher, I am not comfortable with higher risk in the overall market and an outsized position. So, we may prune .25%, .5% or even 1% to move back towards the 2.5% position size.

Last week, I showed Tesla and how we pruned some. I think I have shown Intel as well. here it is again. We bought INTC several months ago when it was ignored and unloved. If my memory is correct we sold a little in mid-September. The stock has a quick pullback and then powered higher. On Tuesday we sold a little more. Our position size is back to our original 2.5% of the portfolio and we booked some profits.

(Click on image to enlarge)

On the flip side, it doesn’t always go well. We bought Grocery Outlet (GO) last quarter, first a 1.25% position and then 2.50%. I expected the strength to continue. It has not so we sold half of our position at a loss. If the stock doesn’t hold and rally, we will likely sell the other half and move on. You can see what else we have done this week below.

(Click on image to enlarge)

On Monday we bought TSPY, XLC, BXHYX, more QLD, more AMZN and more DXHYX. We sold XLP and some RFRAX. On Tuesday we sold IGV, RFRAX, some GO, some INTC, some SNOW, some CVS, some COIN and some TSLA.

More By This Author:

A “Bubble”?

Conflicting October Stats, Heightened Risk, Dow 50,000 And Something Shutdown

Ryder Cup Process Needs To Change

Disclosure: Please see HC's full disclosure here.