Profit Taking And Discount Shopping

We're just five trading days into the second half of 2025, but so far this month, the average stock in the large-cap Russell 1,000 is up a solid 1.84%. If you did well in the first half of the year, however, you're likely seeing red, while those that lagged in the first half are finally seeing some green.

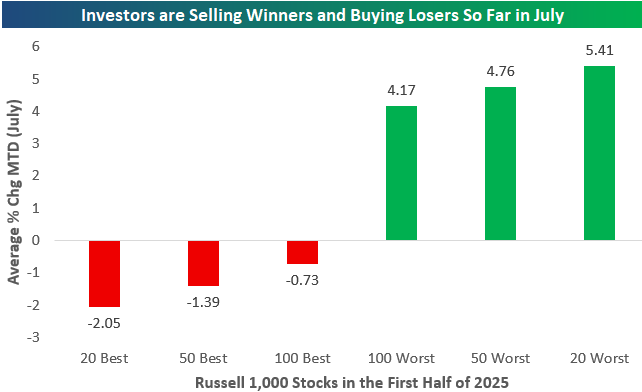

The chart below highlights a sharp reversal in investor behavior so far this month, with a clear rotation out of the first-half winners and into the biggest losers. Looking at average month-to-date returns for Russell 1,000 stocks, the 20 best-performing names from the first half are down an average of 2.05%, while the top 50 and 100 from the first half are also in negative territory this month. In contrast, the worst performers from the first half are seeing a surge in buying interest: the 20 worst names are up an average of 5.41% MTD, followed by the 50 worst at 4.76%, and the 100 worst at 4.17%. This pattern reflects classic mean reversion trading, where investors rotate into beaten-down names in hopes of a rebound, while locking in profits on stocks that have already had big runs. It also suggests that investors are bottom-fishing in laggards in search for value or speculative bounce plays. Whether this is a short-term rebalancing or the start of a more sustained shift in market leadership remains to be seen, but it's interesting that we saw similar pullbacks in first-half market leaders in July 2023 and July 2024 as well.

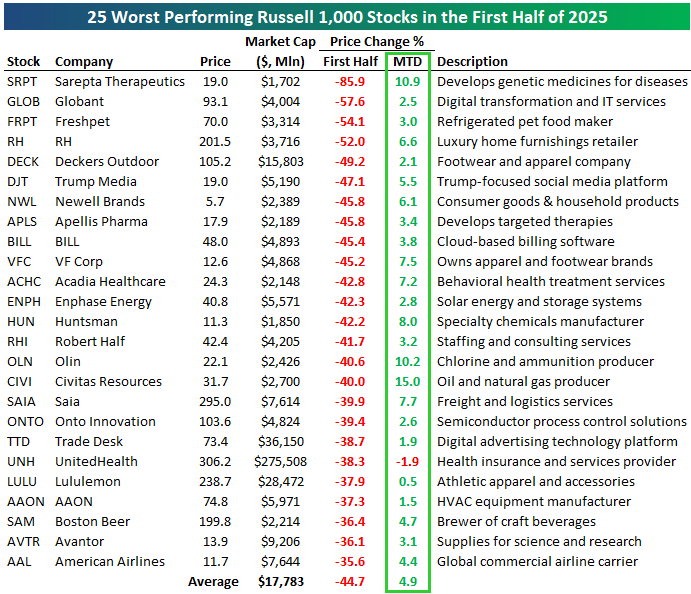

Of the 25 worst-performing Russell 1,000 stocks in the first half, all but one are up so far this month. On average, these stocks fell 44.7% in the first half, and they're up 4.9% already in the first five trading days of July.

Take a look at the first-half losers below, of which you'll likely be familiar with most.

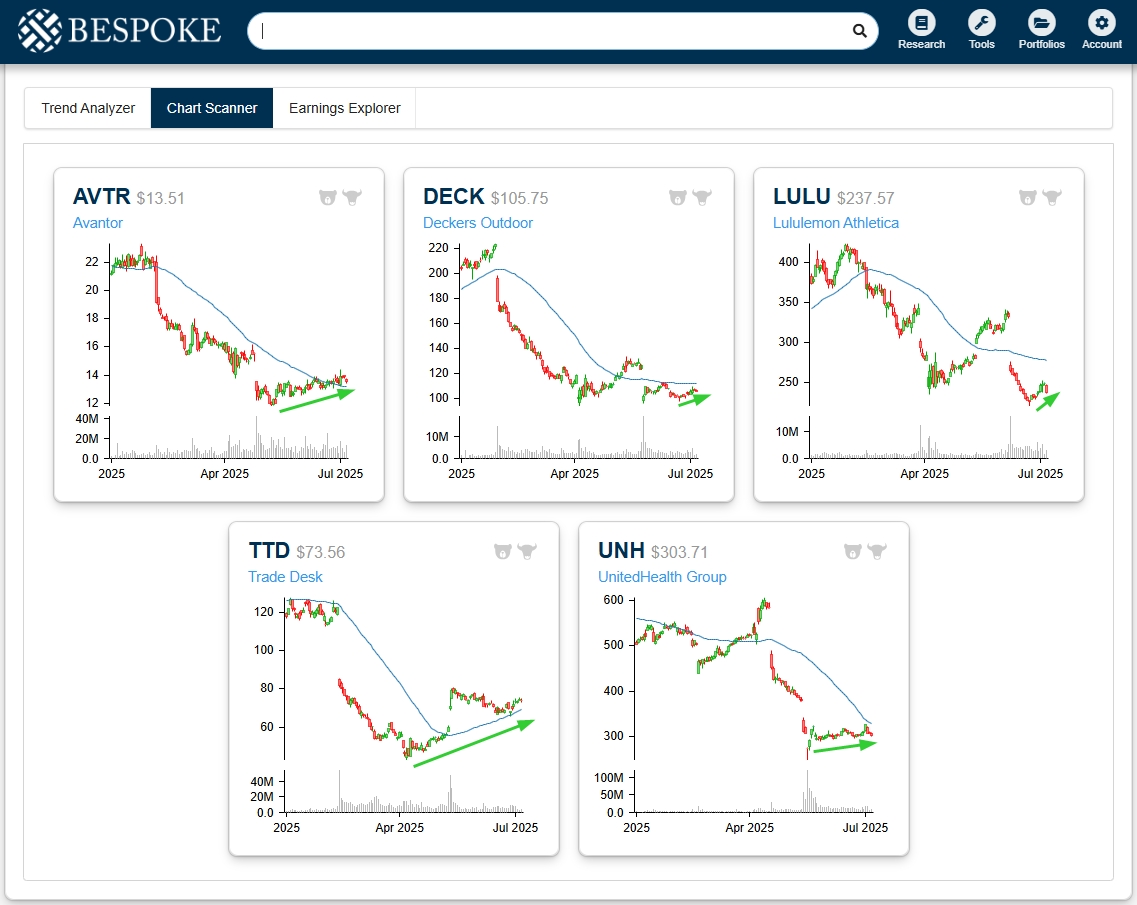

Below are price charts of the five biggest stocks on the list of first-half losers shown above: Avantor (AVTR), Deckers Outdoor (DECK), Lululemon (LULU), Trade Desk (TTD), and UnitedHealth (UNH). All five fell off a cliff at some point in the first half, but they're currently attempting to round out a bottom. Trade Desk (TTD) has been trying to turn things around for the longest, as it bottomed back in April and now has a rising 50-day moving average again.

(Click on image to enlarge)

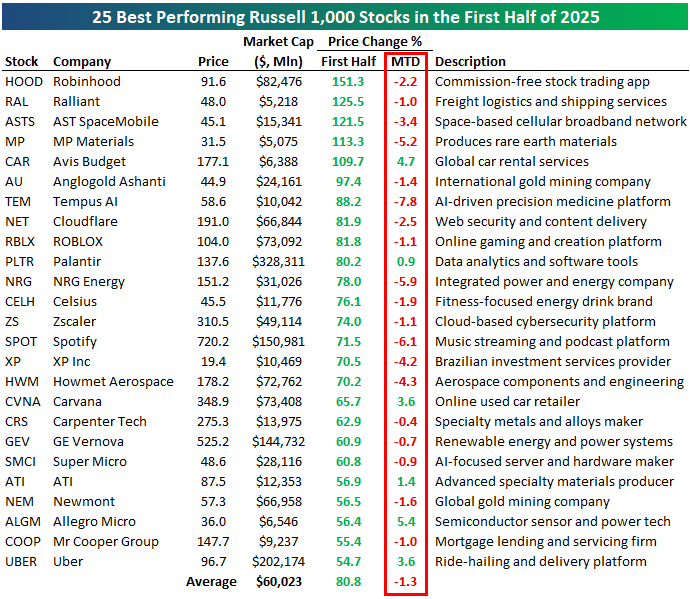

Of the 25 best performers in the first half, only six are in the green so far this month: CAR, PLTR, CVNA, ATI, ALGM, and UBER. On average, these stocks, which all gained at least 50% in the first half, are down 1.3% month-to-date. None are down more than 8%, though, so the selling hasn't been that extreme.

With earnings season on the horizon, maybe some investors are cashing in on high-beta winners to try and avoid earnings blow-ups.

More By This Author:

Small Business FoiblesBeating The Odds

International Revenues

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more