Preferred Shares Pummeled

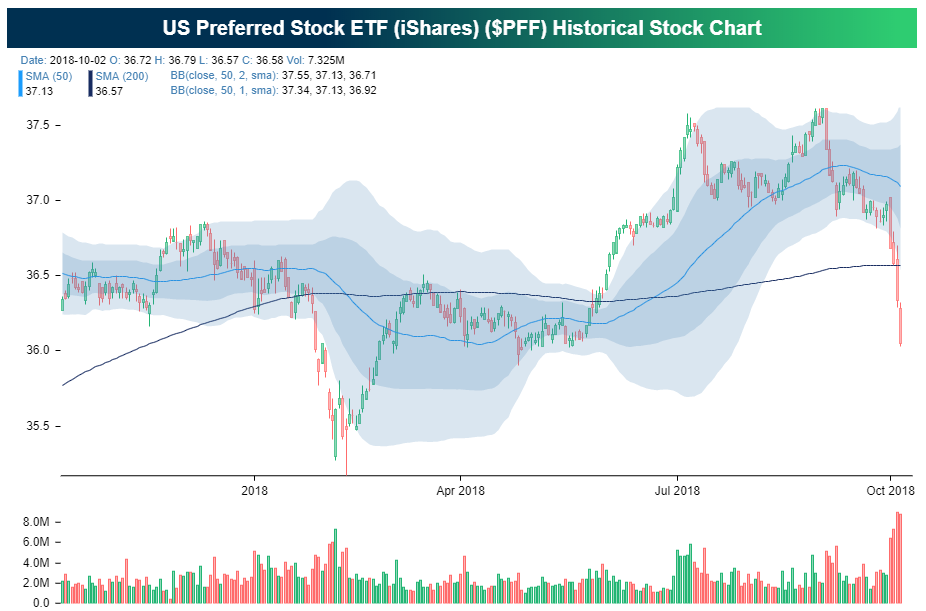

One area of fixed income that’s gotten hit especially hard in recent days has been preferred shares. Preferred shares are hybrid securities that are similar to equity (with no obligation to return capital) with fixed income characteristics (a steady stream of coupon payments). They are also generally callable, giving issuers the option to buy them back. Their various features give them a return profile that gives them low volatility in most situations but can drive big declines when rates spike or credit spreads widen sharply. In recent days, it’s been the former. As shown, PFF (a preferred stock ETF) closed down more than 3.5 standard deviations below its 50-DMA, an extreme oversold reading if there ever was one.

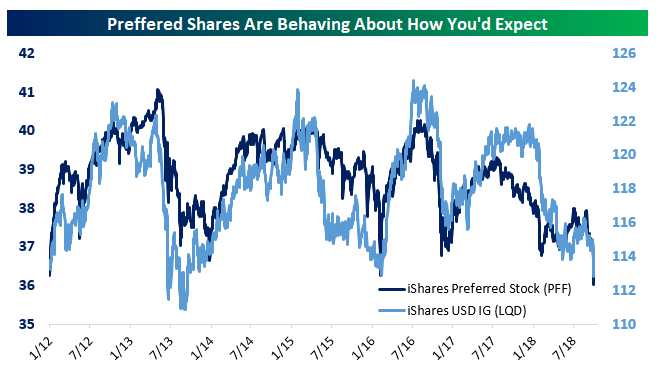

To illustrate the relationship between PFF and credit/rates risk, in the chart below we show how PFF tends to track the price of LQD, an ETF comprised of US investment-grade corporate bonds. While PFF and LQD don’t trade in lockstep, their general exposures are similar at different magnitudes.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more