Poor 30Y Auction Tails As Foreign Buyers Flee

The week's final coupon auction just priced and after a mediocre 3Y, and a solid 10Y auction earlier this week, today's 29 Year, 11 Month reopening was somewhere inbetween.

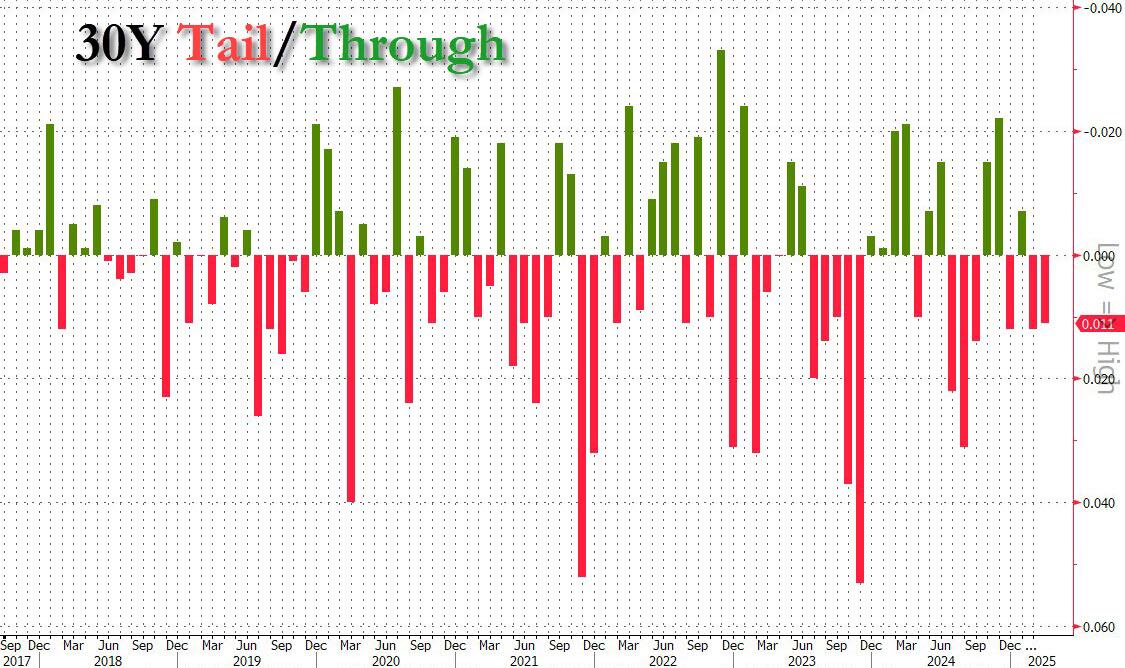

Pricing at a high yield of 4.623%, today's 30Y reopening was down about 12 bps from last month's 4.748%; and like last month, today's auction tailed the When Issued 4.612% by 1.1bps, making it 3 tailing auction out of the past 4.

(Click on image to enlarge)

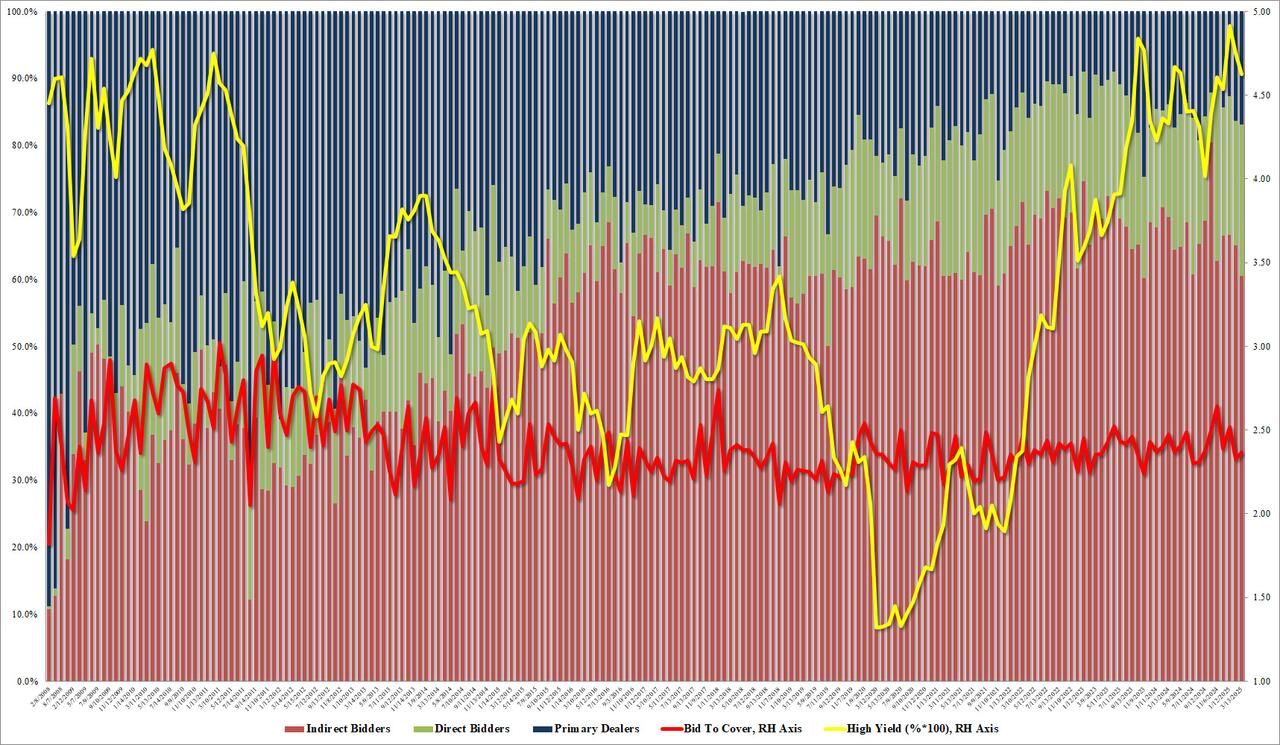

The bid to cover was solid at 2.37, up from 2.33 in January but below the recent average of 2.46.

The internals, however, were much uglier as indirects were awarded just 60.5%, down from 65.1% last month and the lowest since Nov 2023. This however was offset by Directs being awarded 22.3%, the highest since November, which meant Dealers were left with 16.9%, above last month's 16.3% an the highest since August 2024.

(Click on image to enlarge)

Overall, this was a soft auction and the weakest auction of the week, however with rollercoaster markets dumping again, yields were sliding both before and after the auction, which nobody seems to have noticed as everyone remains transfied on each and every latest headline out of the White House.

More By This Author:

U.S. Deficit Hits Record $1.1 Trillion In First 5 Months Of 2025

Solid 10Y Auction Enjoys First Stop-Through Of 2025

Bitcoin - What Next?

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more