Solid 10Y Auction Enjoys First Stop-Through Of 2025

Image Source: Pixabay

One day after a subpar, tailing 3Y auction, some were concerned that today's 10Y auction (a reopening of 9-Y, 11-Month cusip MM0) would be even uglier considering the move higher in yields. It was however just the opposite, because today's auction was a case study in primary market strength.

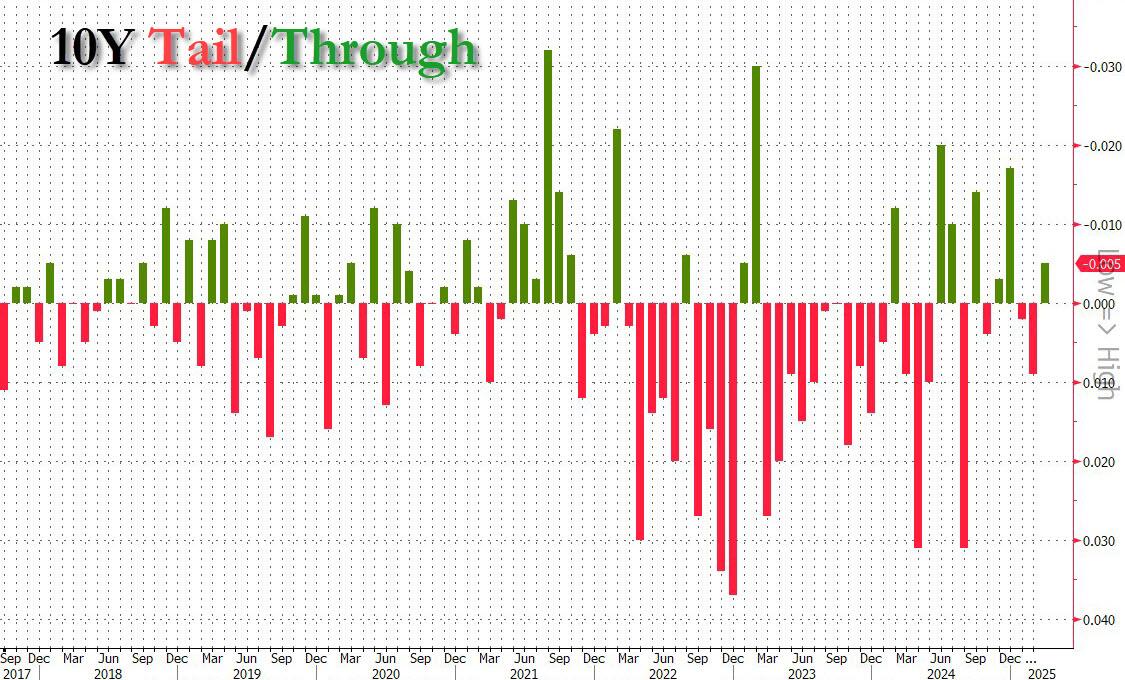

The auction priced at a high yield of 4.310%, down sharply from the 4.632% last month and the lowest yield this year; it also stopped through the 4.315% When Issued by 0.5bps, the first non-tailing 10Y auction of 2025.

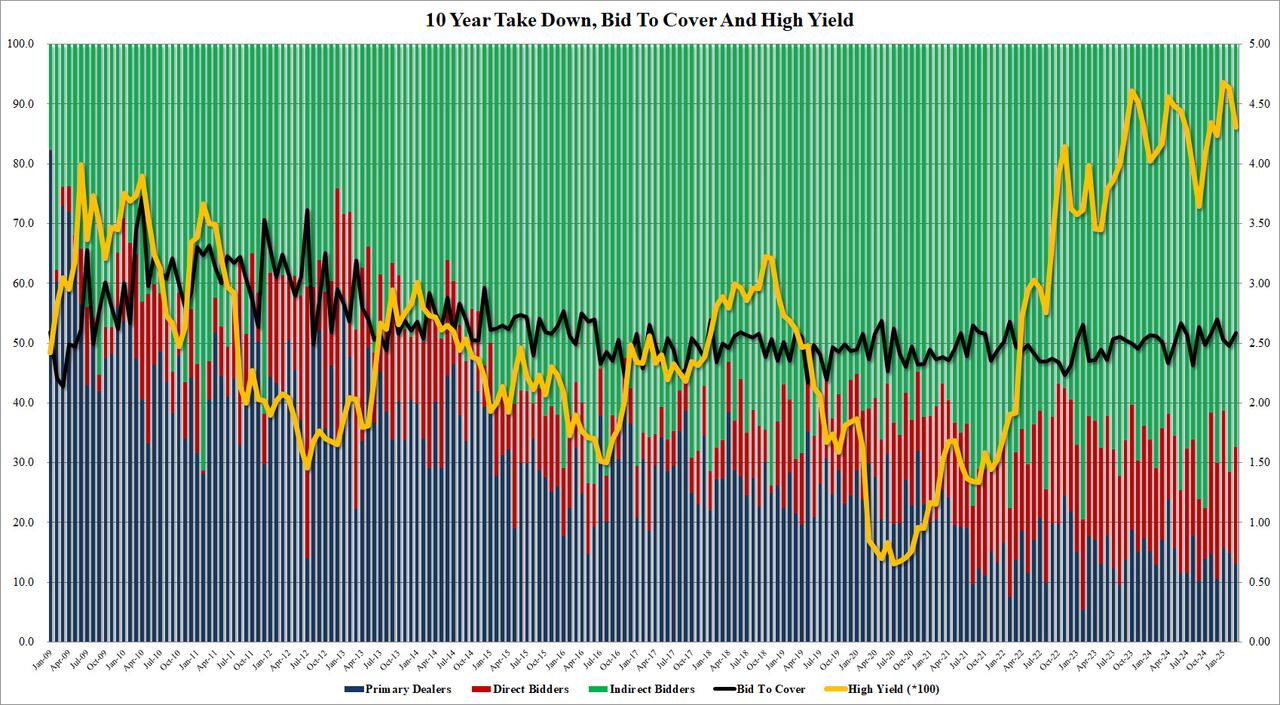

The bid to cover jumped from 2.479 last month to 2.588, the highest since December, and just above the six-auction average of 2.57.

The internals were ok, with Indirects awarded 67.4%, down from 71.6% and below the 69.7% recent average. And with Directs taking 19.5%, or up notably from 13.6% in February, Dealers were left holding just 13.1% of the auction, the lowest this year.

(Click on image to enlarge)

Overall, a solid if hardly spectacular stopping through auction, which is probably good news for a day when many were worried that a hot CPI print could lead to sharply higher yields and a far uglier auction.

More By This Author:

Bitcoin - What Next?Bitcoin Slides After Trump Signs Strategic Reserve Executive Order

Beige Book: Economic Activity, Employment And Prices Rose Since January, Economic Expectations Are "Optimistic"

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more