Pockets Of Strength In Emerging Markets

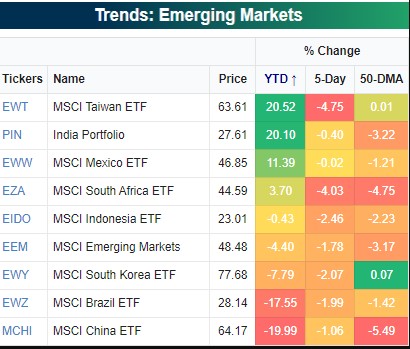

So far this year, the US has outperformed every other country on the planet. Broadly speaking, developed economies have outperformed emerging economies. The iShares MSCI Emerging Markets ETF (EEM) has declined 6.8% in 2021, but this does not necessarily mean that performance across every emerging economy has been negative. Although China, Brazil, and South Korea have been particularly weak (three of the top six countries of exposure for EEM), countries like Taiwan, India, Russia, Mexico, and South Africa have experienced positive returns this year.

Just like individual sectors in the US cannot be expected to perform equally, emerging economies don’t always perform in unison with each other. Differences include natural resources, political & legal structure, trading partners, and much more. Although EEM has declined on a YTD basis, the average performance of the nine countries that we tracked was a modest loss of 0.1%, and the spread between the best performer (Taiwan) and the worst (Brazil) is currently 41.3 percentage points. Moving forward, investors may want to consider selecting individual countries to gain emerging market exposure, as the broader ETFs tend to have a large concentration in just a few countries. Emerging markets are inherently higher-risk investments in comparison to developed nations due to uncertainty in future prospects, but in the long run, there are excellent opportunities within pockets of emerging markets, although not all countries will see the same performance.

Disclaimer: For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our ...

more