Peeking At The Future: Using CoT To Assess Hedge Fund, Noncommercial Positions

Following futures positions of non-commercials are as of November 19, 2024.

10-year note: Currently net short 907.5k, up 91.7k.

The 10-year treasury yield began the week strong with Monday touching 4.49 percent intraday but only to reverse and close at 4.41 percent, which is where the week ended as well. In the end, bond bears (on price) were unable to push through a falling trendline from October last year when these notes yielded five percent. This was the third week in a row this resistance denied the bond bears. Odds favor this will continue to be the case.

The 10-year has come a long way since September 17 when these notes yielded 3.6 percent. Immediately ahead, there is support at 4.3s. In fact, this level was successfully defended on Tuesday, as the rates ticked 4.34 percent intraday.

In the meantime, non-commercials, who had otherwise been reducing their massive holdings of net shorts, added this week. A breach of 4.3s can lead them to rethink their bias – at least near term.

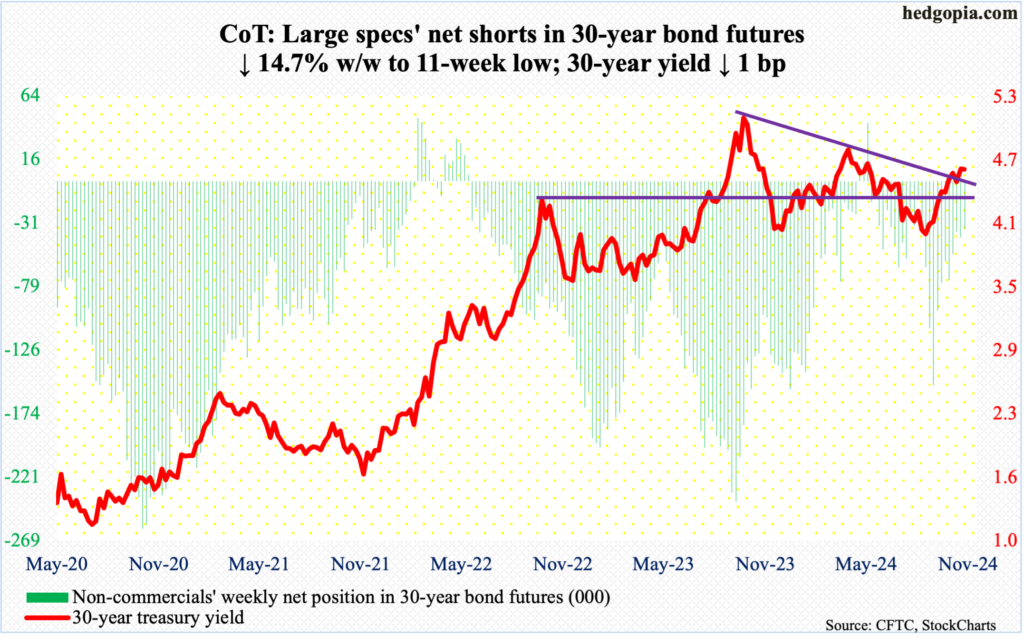

30-year bond: Currently net short 35.6k, down 6.1k.

Major US economic releases for next week are as follows. Markets are closed Thursday for observance of Thanksgiving Day!

Tuesday brings the S&P Case-Shiller Home Price Index (September) and new home sales (October).

In August, home prices nationally appreciated at a rate of 4.3 percent year-over-year. This was the slowest rate of annual price increase in 11 months.

September sales of new homes were up 4.1 percent month-over-month to a seasonally adjusted annual rate of 738,000 units – a 16-month high.

On Wednesday, durable goods orders (October), GDP (3Q24, 2nd print), corporate profits (3Q24) and personal income/spending (October) are on schedule.

Orders for non-defense capital goods ex-aircraft – proxy for business capex plans – rose 0.7 percent m/m in September to $74.1 billion (SAAR). This set a record.

The first print showed 3Q24 real GDP grew 2.8 percent (SAAR). This was the 10th consecutive quarterly expansion after a one-percent contraction in 1Q22.

In the June quarter, corporate profits with inventory valuation and capital consumption adjustments jumped 10.8 percent from a year ago to $3.82 trillion (SAAR) – a record.

In the 12 months to September, headline and core PCE (personal consumption expenditures) increased 2.1 percent and 2.7 percent respectively. In 2022, they peaked at 7.3 percent and 5.7 percent in June and February, in that order.

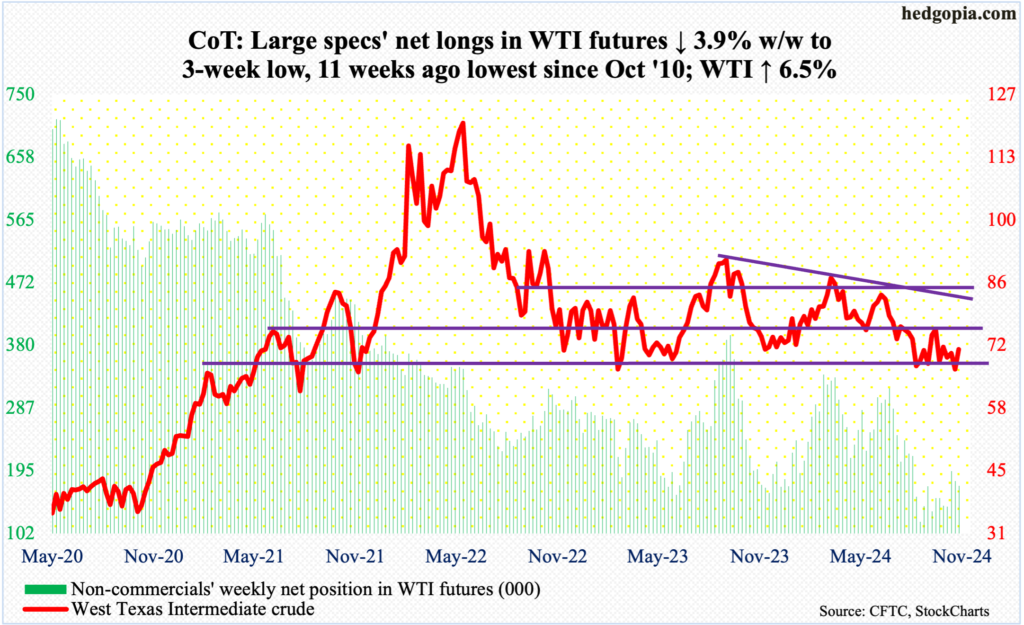

WTI crude oil: Currently net long 172.4k, down 6.9k.

Once again, oil bulls defended crucial support on West Texas Intermediate crude, which the past couple of months routinely found buyers at $66-$67. After closing last week at $66.92, it fell as low as $66.53 intraday Monday before trending higher to close the week up 6.5 percent to $71.24/barrel.

With this, the crude is on the verge of entering a well-established range. For months, WTI played ping pong between $71-$72 and $81-$82. The support was lost early September. Since then, for the most part, the support-turned-resistance has held. There is also trendline resistance just north of $78; since September last year when the crude ticked $95.03, it has made lower highs.

There is room for the crude to continue higher, with the 50-day moving average ($70.56) slightly rising. The upper line of the daily Bollinger bands lies at $72.62.

In the meantime, US crude production in the week to November 15 dropped 199,000 barrels per day to 13.2 million b/d; in the prior week, the crude dropped 100,000 b/d after remaining unchanged for four consecutive weeks at record 13.5 mb/d. Crude imports increased 1.2 mb/d to 7.7 mb/d. As did inventory of crude and gasoline, which respectively grew 545,000 barrels and 2.1 million barrels to 430.3 million barrels and 208.9 million barrels. Distillate stocks, on the other hand, fell – down 114,000 barrels to 114.3 million barrels. Refinery utilization declined 1.2 percentage points to 90.2 percent.

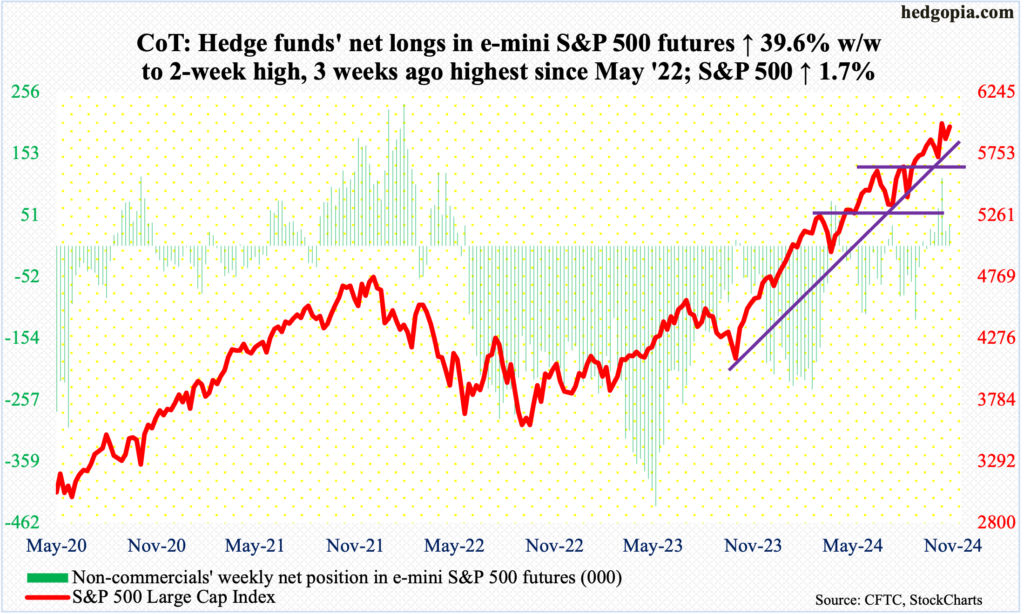

E-mini S&P 500: Currently net long 34.9k, up 9.9k.

Equity bulls successfully defended a crucial price point this week. On the 6th this month – after Donald Trump was elected president – the S&P 500 gapped up to rally 2.5 percent and in the process take care of horizontal resistance at 5870s going back to mid-October. By the 11th, the large cap index went on to post a new intraday high of 6017 before coming under slight pressure. Selling stopped at 5850s last Friday. The level – or 5860s – kept attracting bids in the first three sessions this week. When it was all said and done, the week finished up 1.7 percent to 5969.

The November 11th high is 48 points away. Odds strongly favor the index in the sessions ahead trudges higher toward that. Amidst this, momentum – as measured by the RSI – continues to act weak.

In the event of downward pressure, the November 6th gap gets filled at 5780s, which the bulls are likely to fight tooth and nail to save. Just above lies the 50-day at 5810. The index has remained above the average since September 11.

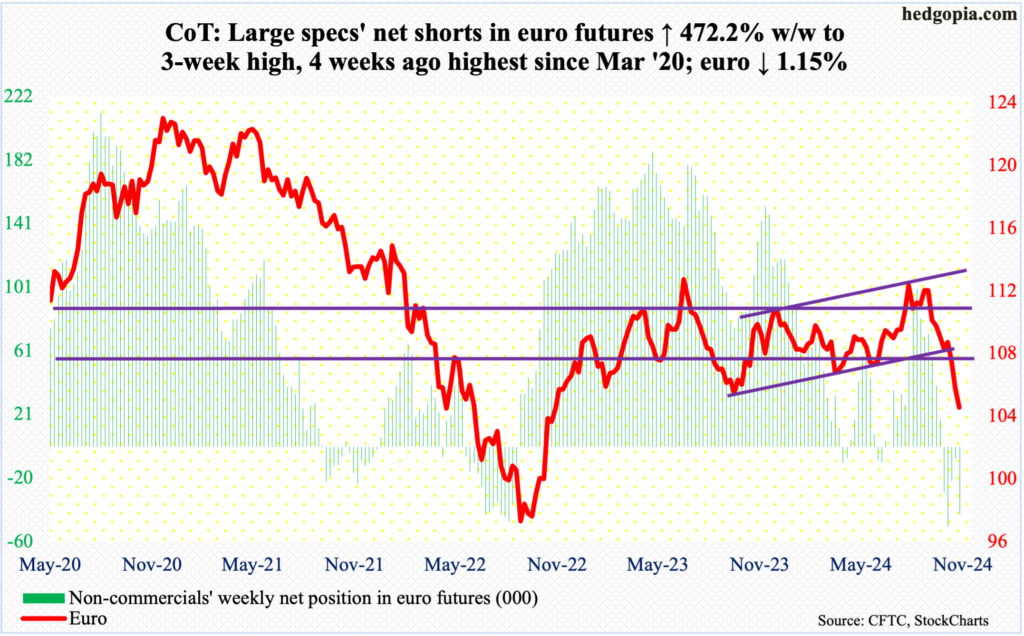

Euro: Currently net short 42.6k, up 35.1k.

The euro just cannot get it going, dropping in seven of the last eight weeks, including this week’s 1.2 percent decline.

On September 30, after facing rejection at $1.12 for six consecutive weeks, the currency sharply fell, proceeding to breach crucial lateral support at $1.10 by the 4th last month. Three weeks ago, it breached a rising channel from October last year when it bottomed at $1.0448, which has now been undercut. This week, the euro closed at $1.0418, falling as low as $1.0332 intraday Friday.

So, from the bulls’ perspective, Friday’s low was bought, which is good. That said, they have now lost horizontal support at $1.05, which goes back nearly a decade. This level is the one to watch now. A rally is possible in the near term, and if the bears successfully used this strength to reload, it is only a matter of time before parity is reached, which last occurred two years ago.

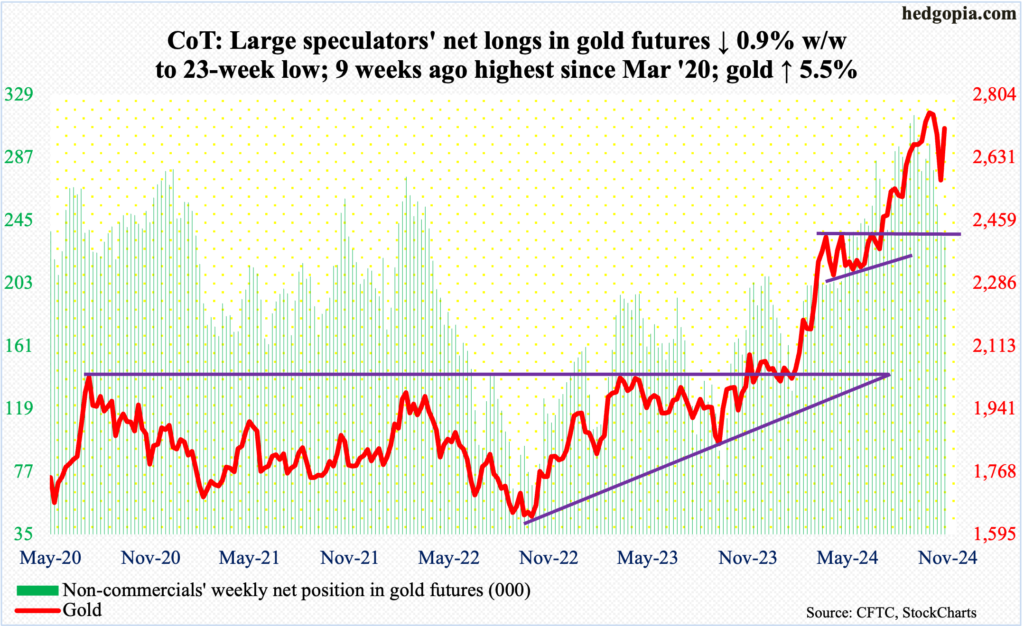

Gold: Currently net long 234.4k, down 2.1k.

Four weeks ago, after rallying in six of seven weeks, a gravestone doji showed up on the weekly. Gold then dropped the next couple of weeks. Last Thursday, it ticked $2,542 intraday, and that generated buying interest.

Earlier, on October 30, gold reached a new high of $2,802, having begun to rally in June at $2,305. On the way to that peak, there were several breakouts – $2,610s, $2,540s-50s and $2,440s-50s.

Last Thursday’s defense of $2,540s-50s laid the foundation for this week’s 5.5-percent jump to $2,712/ounce. More gains are likely ahead, with immediate resistance at $2,740s, which was decisively breached on the 6th.

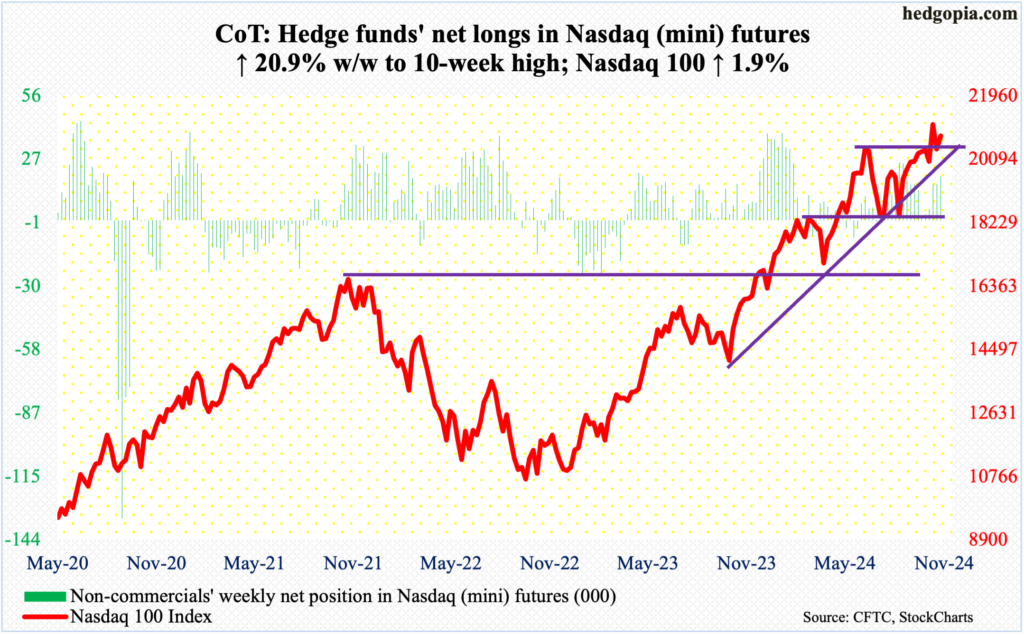

Nasdaq (mini): Currently net long 19.8k, up 3.4k.

Nvidia (NVDA) – the most valuable public company – reported its October quarter on Wednesday, and investors were not sure which way to bet, as the stock closed the week essentially unchanged, rising as high as $152.89 and closing at $141.95, thereby leaving behind a large upper wick on the weekly. Fatigue could very well be a factor. The stock is up 187 percent year-to-date. If profit-taking begins in NVDA, the Nasdaq 100 will take its share of pain.

This week, though, the tech-heavy index rallied 1.9 percent to 20776. The all-time high of 21182 was posted on the 11th (this month) and is within reach. Rally odds grow so long as the index remains above 20500s.

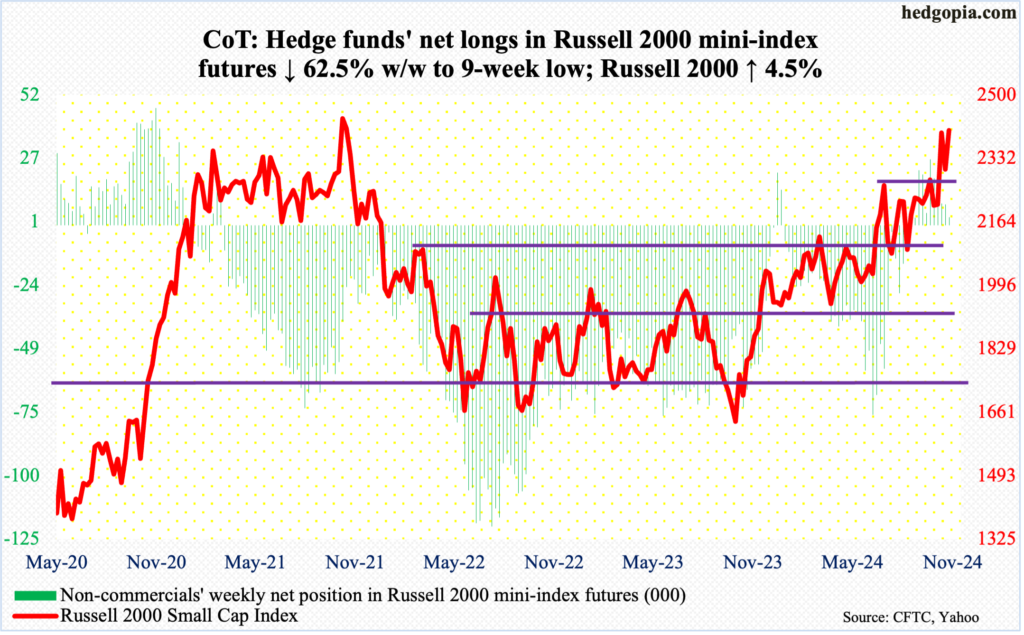

Russell 2000 mini-index: Currently net long 3.1k, down 5.2k.

Tuesday’s drop to 2280s was as close as the Russell 2000 got to testing 2260s. This horizontal resistance going back to mid-July was taken out on the 6th when the small cap index gapped up post-election, followed by last Monday’s intraday high of 2442. At that high, the index was merely 17 points from the all-time high of 2459 posted in November 2021 before sellers showed up. But it must be encouraging for small-cap bulls that they were able to absorb the supply before 2260s was breached. Provided that this remains the case, it is their ball to lose.

The index closed this week up 4.5 percent to 2407.

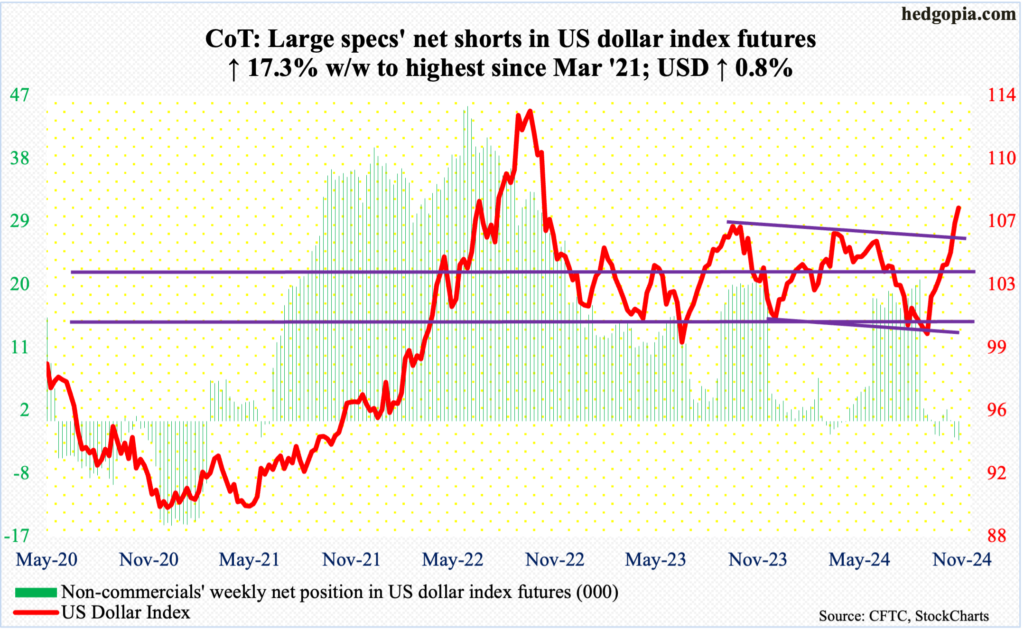

US Dollar Index: Currently net short 2.7k, up 401.

Last week, the US dollar index broke through trendline resistance going back to October last year when it ticked 107.05 and headed lower. It began to reverse higher on September 30 this year, after having gone sideways just under 100 for several sessions.

This week, the October 2023 high was taken out as well. For the week, it added 0.8 percent to 107.51, touching 108.07 intraday Friday, with the session leaving behind a large upper wick.

The daily is extremely overbought, so a giveback is possible, with 107 the nearest point where a bull-bear duel is likely to occur.

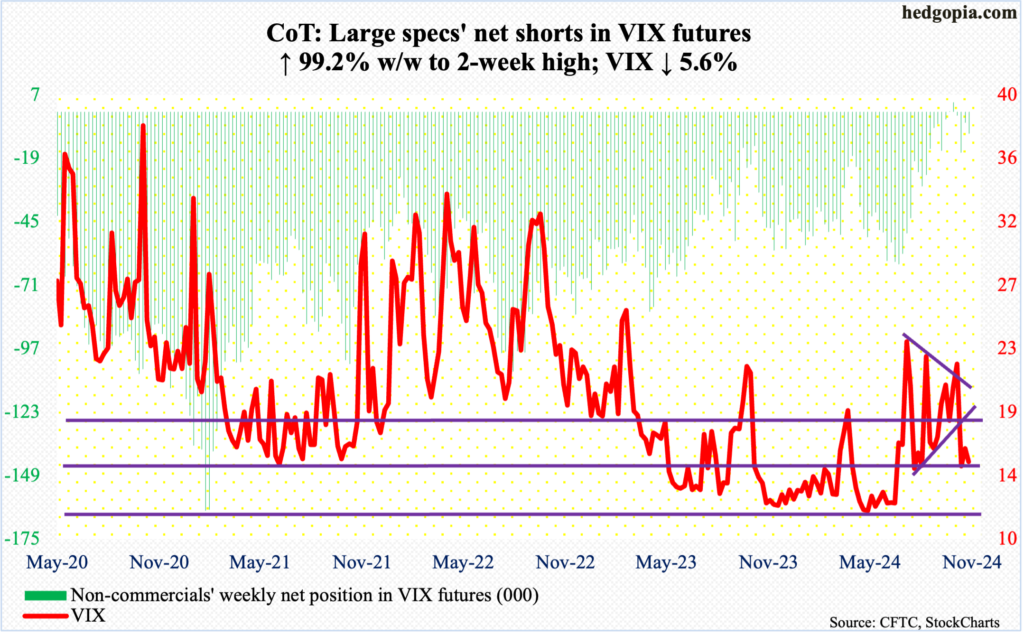

VIX: Currently net short 8.8k, up 4.4k.

The rally off the November 14th low (13.59) petered out Wednesday as VIX tagged 18.79 and went the other way. By the end of the week, the 200-day (15.91) was slightly breached, ending the week lower 0.90 points to 15.24. This is a support zone. If the index does not stabilize soon, volatility bears will be eyeing 12, or thereabouts.

Also on Wednesday, the daily RSI (41.86) was rejected at the median and looks to want to head lower.

Thanks for reading!

More By This Author:

Russell 2000 Retreats After Coming Ever So Close To Nov ’21 Record

Peeking Into The Future Via CoT - Futures, How Hedge Funds Are Positioned

After Last Week’s Massive Gains, Equity Indices Likely To Trudge Higher

This blog is not intended to be, nor shall it be construed as, investment advice. Neither the information nor any opinion expressed here constitutes an offer to buy or sell any security or ...

more