Palantir’s Secretive Business Is Priced For Perfection

Palantir (PLTR) as expected began trading September 30 via a direct listing of its stock. Existing shareholders were to be able to sell 20% of their existing shares, and the company was not seen to be raising any additional capital.

The lack of traditional IPO process makes it difficult to predict how shares will trade initially. Making it even more challenging, Palantir shares have traded on the private market as low as $4.17/share all the way up to $11.50/share in 2020.

To help investors find more solid valuation footing, we present our reverse discounted cash flow model analysis of the future cash flow expectation’s baked into the stock, assuming it begins trading at ~11.50/share. We also present our proprietary analysis of the firm’s core earnings[1] and other important fundamental metrics.

Revenue Growth but Large Losses

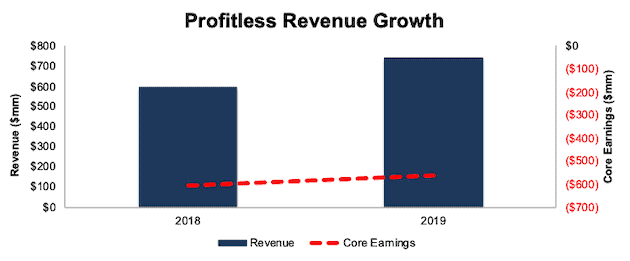

Palantir follows an all-too-familiar trend of recent IPOs (or direct listings): large revenue growth with equally as large losses. From 2018-2019, Palantir grew revenue 25% while core earnings[2] only improved from -$606 million to -$564 million.

Palantir’s profitability is improving but breaking even looks a long way off. The firm’s core earnings margin improved from -102% in 2018 to -76% in 2019 while its return on invested capital (ROIC) improved from -49% to -46%. The firm burned through -$540 million in free cash flow in 2019, but with nearly $1.5 billion in cash on hand as of June 30, 2020, Palantir has some flexibility to forgo the traditional capital raise of an IPO.

Figure 1: Palantir Revenue & Core Earnings: 2018-2019

Sources: New Constructs, LLC and company filings

Government Contracts Represent a Unique Risk

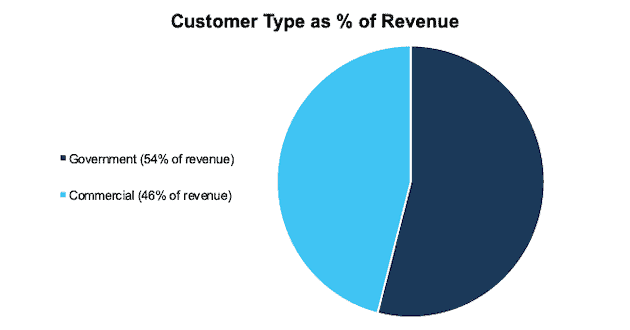

During the six months ended June 30, 2020, governments provided 54% of revenue while commercial customers provided the rest.

This revenue mix provides unique challenges in the form of a rather murky process for winning government contracts and potential backlash for working on controversial government projects, many of which other tech giants like Apple (AAPL) and Google (GOOGL) have chosen to avoid.

In 2018, Palantir provided Immigrations and Customs Enforcement (ICE) digital profiling tools to aid in identifying undocumented immigrants. Due to the controversial nature of the business, employees of Amazon (AMZN) Web Services requested the firm stop supporting Palantir’s technology in the Amazon Cloud. In the months prior, Alphabet faced similar employee backlash, which resulted in the firm cancelling a previous government contract. While Palantir has committed to continuing its work, it is not without risk of public and internal backlash.

Furthermore, the firm’s government work often falls into programs that are classified for security purposes, which means the firm cannot be as transparent about its revenue as other software providers. The nature of this work also exposes the firm to additional geopolitical risk. It’s not beyond the realm of possibility that Palantir’s work with the United States government makes other governments around the world balk at contracting the firm, whether for national security issues, or just bad public relations.

Figure 2: Palantir Revenue by Segment: First Half of 2020

Sources: New Constructs, LLC and company filings

For some investors, these additional risks may not be a dealbreaker. Investors with fiduciary responsibilities, on the other hand, should be mindful of the additional risks related to the lack of transparency and higher potential for backlash from employees or the public.

Customer Concentration Represents Another Risk

Despite generating over $740 million in revenue in 2019, Palantir’s customer base is rather small. In 2019, the firm reported 125 customers, and 20 of them generated 67% of total revenue. Through the first half of 2020, one government customer is 11% of total revenue and one commercial customer is 10% of total revenue.

Palantir’s Market Is Large – but the Firm Must Execute

Palantir estimates its total addressable market (TAM) across the commercial and government sectors is ~$119 billion. This estimate coincides with third-party estimates that the artificial intelligence software market will reach $126 billion in worldwide revenue by 2025 and grow at a compounded annual growth rate of 43% from 2018 to 2025. As industry research provider Tractica notes “the global AI market is entering a new phase in 2020 where the narrative is shifting from asking whether AI is viable to declaring that AI is now a requirement for most enterprises that are trying to compete on a global level.”

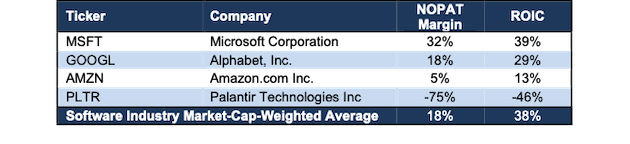

Given the huge projected growth, it’s not surprising to see a fast growing firm such as Palantir receive valuations upwards of $20 billion in recent years. However, such a valuation invites more competition. For example, large and highly-profitable firms, such as Microsoft (MSFT), Amazon, and Google, still compete for government contracts. Figure 3 ranks Palantir’s NOPAT margin and ROIC against three tech giants and the market-cap-weighted average of the entire software industry[3].

Figure 3: Palantir Profitability Vs. Larger Software Competitors

Sources: New Constructs, LLC and company filings

Public Shareholders Have No Rights

Investors are familiar with the dual-class share structure that allows founders and insiders to maintain voting control of a firm despite not owning a majority of shares. Palantir takes this normal structure and adds an additional layer that preserves Alexander Karp, Stephen Cohen, and Peter Thiel’s (collectively the “Founders”) voting power.

Palantir will directly list Class A shares, which receive one vote per share. Palantir already has Class B shares, which hold 10 votes per share. The firm is going to authorize a third class of shares, Class F, which will have a variable number of votes pursuant to the Founder Voting Trust Agreement.

Under the Founder Voting Trust Agreement, the Class F shares, when combined with the Class A and B shares they already own, ensure the Founders maintain majority control of voting power, even if they sell some of their Class A shares.

DCF Model Reveals PLTR is Priced for Perfection

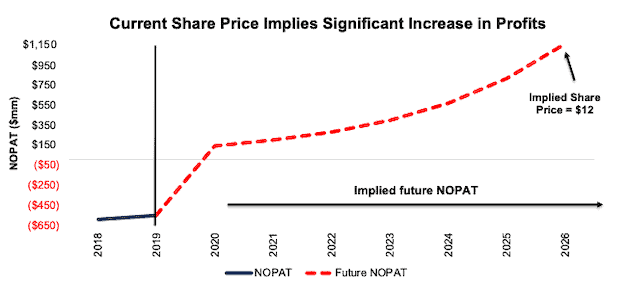

When we use our reverse DCF model to analyze the future cash flow expectations baked into PLTR at ~11.50/share, we find that shares are priced for perfection.

Scenario 1: In order to justify its current price, Palantir must achieve a 13% NOPAT margin (average of all Software firms that earn a positive margin, compared to Palantir’s -75% in 2019) and grow revenue by 43% compounded annually (in-line with industry expectations through 2025) for the next seven years. See the math behind this reverse DCF scenario.

In this scenario, Palantir would earn $9 billion in revenue in 2026, or more than 12 times the firm’s 2019 revenue. This scenario also implies Palantir achieves an estimated 7% of the AI software market compared to its current market share of less than 1%.

Figure 4 compares the firm’s implied future NOPAT in this scenario to its historical NOPAT.

Figure 4: Current Valuation Implies Drastic Profitability Reversal

Sources: New Constructs, LLC and company filings.

Scenario 2: We review an additional DCF scenario to highlight the downside risk should Palantir not achieve the profits implied by its current valuation. If we assume Palantir can achieve a 10% NOPAT margin (given that smaller companies struggle to reach scale and achieve outsized margins in the software industry) and still grow revenue by 31% compounded annually (43% per year through 2025, 20% per year each year thereafter) for the next decade, the stock is worth just $8/share today, a 30% downside to the estimated ~$12/share. See the math behind this reverse DCF scenario.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper,"Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in Palantir’s S-1:

Income Statement: we made $94 million of adjustments, with a net effect of removing $34 million in non-operating expenses (5% of revenue). You can see all the adjustments made to Palantir’s income statement here.

Balance Sheet: we made $386 million of adjustments to calculate invested capital with a net increase of $344 million. One of the most notable adjustments was $310 million in operating leases. This adjustment represented 36% of reported net assets. You can see all the adjustments made to Palantir’s balance sheet here.

Valuation: we made $4.2 billion of adjustments with a net effect of decreasing shareholder value by $4.2 billion. There were no adjustments that increased shareholder value. The largest adjustment to shareholder value was $3.5 billion in outstanding employee stock options. This adjustment represents 19% of Palantir’s estimated market cap. See all adjustments to Palantir’s valuation here.

Editor's note: On September 30, Palantir stock closed at $9.50 per share giving it a value of $20.6 billion.

This article originally published on September 28, 2020.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Our core earnings are a superior measure of profits, as demonstrated in Core Earnings: New Data & Evidence a paper by professors at Harvard Business School (HBS) & MIT Sloan. The paper empirically shows that our data is superior to “Operating Income After Depreciation” and “Income Before Special Items” from Compustat, owned by S&P Global (SPGI).

[2] Core earnings provide a better measure of profitability and truer insights into valuation than other measures of profits from legacy data providers.

[3] Includes 116 firms in the Software industry, such as Microsoft, SAP SE (SAP), Oracle (ORCL), ServiceNow (NOW), Workday (WDAY), Splunk (SPLK), Coupa Software (COUP), Alteryx (AYX), Blackbaud (BLKB), and more.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, style, or theme.