On The Recession Indicator Watch: Retail Sales

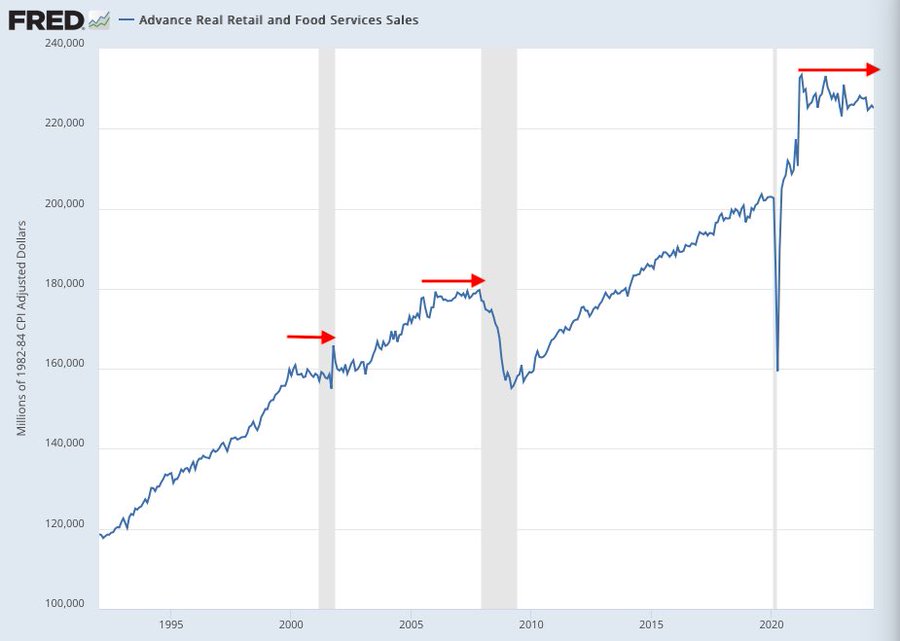

Out of curiosity, I peruse the web to see who is still saying a recession is coming (with an open mind). This tweet suggests retail sales are the indicator de jour:

Source: Alex Joosten (2024).

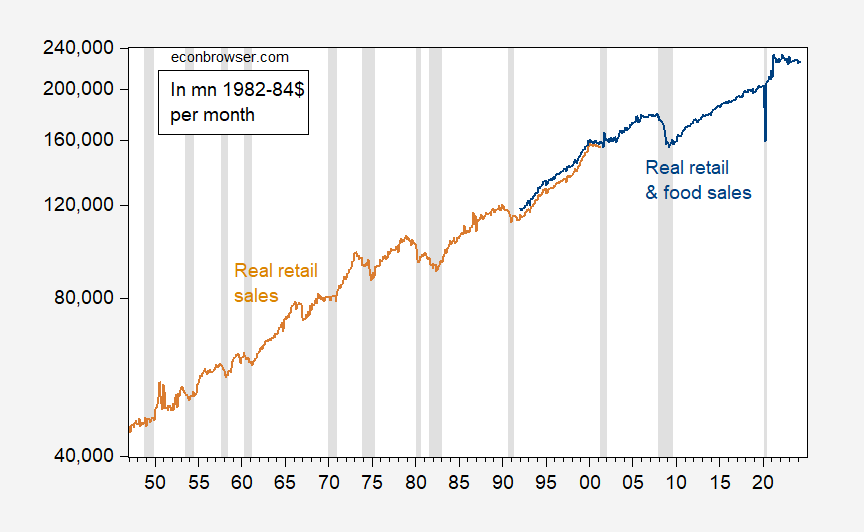

Pretty convincing, for the past 3 recessions. However, the post-pandemic boom in consumption and retail spending is quite remarkable, so I thought it might be useful to consider a longer span of data, using inflation-adjusted retail sales. This is the picture I got, for 1947-2024M04.

Figure 1: Real retail sales (FRED series RSALES) (tan), and real retail and food service sales (FRED series RSAFS) (blue), in mn.1982-84$, deflated using FRED series CPIAUCSL. NBER defined peak-to-trough recession dates shaded gray. Source: FRED, NBER.

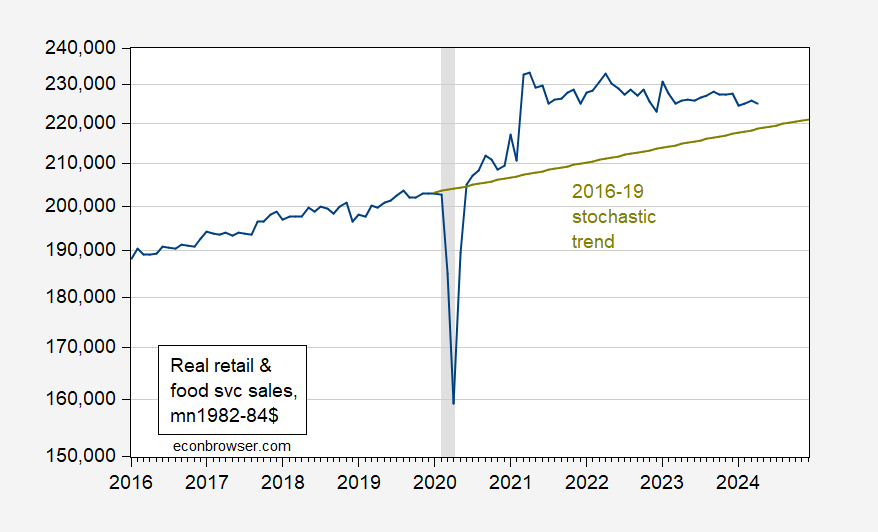

It’s certainly true that retail sales flatten and even decline in some cases before a recession (as defined by the NBER). On the other hand, each of the previous cases, retail sales was deviating from a pre-recession trend. Is this true in this case? Without knowing if an incipient recession is just upon us, I can’t answer that. However, I can evaluate whether retail and food sales, deflated by the CPI, was deviating from the 2016-19 (stochastic) trend.

Figure 2: Real retail and food service sales (FRED series RSAFS) (blue), in mn.1982-84$, deflated using FRED series CPIAUCSL. NBER defined peak-to-trough recession dates shaded gray. Source: FRED, NBER.

So, by one metric, we should be worried. By another (deviation from trend), maybe not.

More By This Author:

“Why The Recession Still Isn’t Here”6 Measures Of Employment Over The Past Year

Monthly GDP For April, And Other Indicators