Oil Market: There Will Be Blood

This article is intended to give a general overview of the oil and natural gas markets. In the interest of full disclosure, I am not a commodities expert, but I want to convey my view on the energy markets as I seem to be more bearish going forward than many of the analysts on The Street as well as those who work for large organizations such as the IEA.

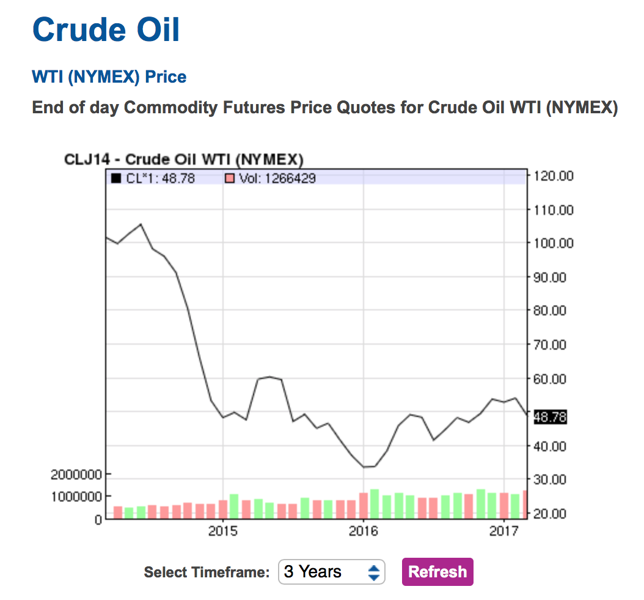

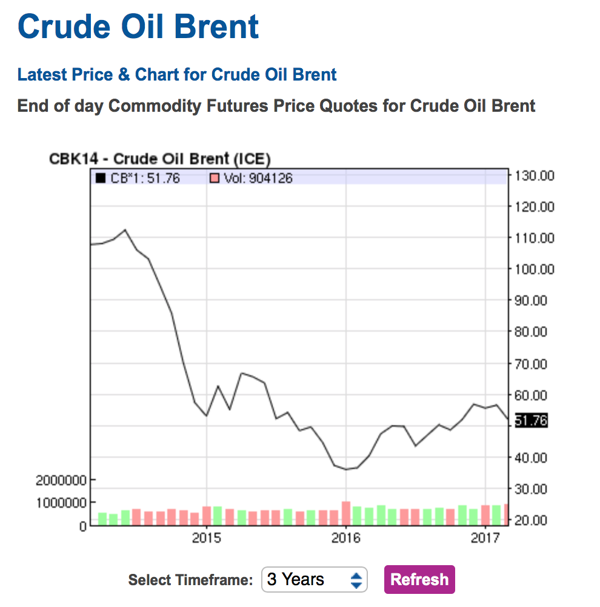

For the last few months, many people have appeared on TV saying that they were comfortable seeing WTI Crude trading between 45-55 dollars a barrel. As oil quickly shot up from the lows of $30 a barrel in January of last year, many revised their forecast closer to $60, with some even as bullish as $70 by 2018.

The collapse:

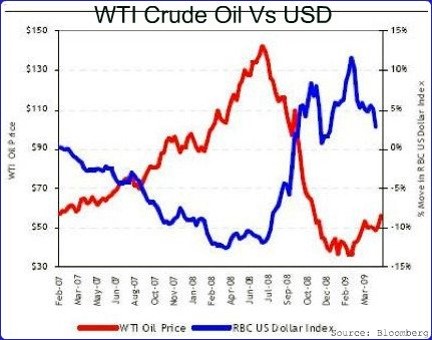

Why did the price of crude (WTI & Brent) crash in the first place? That’s a long and multi-faceted answer. One of the major reasons for the decline was that the dollar has strengthened tremendously over the last few years. For those who don’t know, the price of crude is denominated in US dollars, so when the price of the dollar increases the value of oil relative to the dollar falls. This is why we have generally seen an inverse correlation over time.

There is actually an interesting conspiracy theory contorting that the US toppled Gaddafi because he was planning on creating a new currency backed by gold that all the oil rich nations would adopt to move away from the dollar, which would subsequently make it enormously more expensive for western countries to import oil which is readily apparent. Another huge event was that the US Congress removed the export ban on oil in 2015, which had been in effect for 40 years.

This action allows the US to add more oil supply to the international market making it harder to do business. While demand continues to increase, the rate at which it is increasing is slowing. The Saudi’s saw an opportunity to put US oil companies out of business, so they tried to glut the market by pumping as much oil as they could and steal market share.

What immediately followed was a race to the bottom (in the price of oil). The US shale oil and gas boom made Saudi Arabia nervous and they planned to do whatever it took to ensure they maintained dominant position. While most people think of Saudi Arabia as a wealthy oil kingdom, in reality it is more of a social welfare state. The citizens are almost entirely dependent on the Kingdom for their healthcare, job, education, and infrastructure costs as well as numerous other subsidies they receive. The problem is that the money to support all of these costs comes almost exclusively from oil revenues.

With the price of oil on the decline, they were making a lot less money. To support their welfare programs, Saudi Arabia sold billions of dollars worth of foreign reserves. The strategy was working, leaving oil companies in the US with horrible balance sheets as though they might all be destined for bankruptcy. On a daily basis, talk of widespread bankruptcies continued, citing that the banks may not give companies extensions of their loans. Major well-positioned oil companies would wait for the bankruptcy period so that they could go on an M&A bonanza. But it never happened.There weren’t sweeping bankruptcies, and their wasn’t an M&A frenzy, most likely due to three reasons:the first is that the banks gave generous extensions on company’s short term debt which allowed them to regroup.

The second is that the companies went into panic mode and began immediately ceasing drilling of new wells, stopping operations on unprofitable wells, slashing costs, and selling assets in a fire sale. Finally, the private equity market began to swoop in and acquire finance businesses it thought had become very attractive. There were some bankruptcies, and a few acquisitions, but by and large, not on the magnitude, which was anticipated, the reason being that the Saudi’s didn’t deal a deathblow. The title of this article comes from the movie featuring Daniel Day-Lewis that follows a California man in the 1800’s whose thirst for fortune leads him to create an oil empire, while employing ruthless tactics and murdering people in the process. In a more metaphorical sense, the Saudi’s were out for blood too. But unlike Daniel Plainview (the main character), the Saudis were unwilling to do whatever it took.

I believe that if Saudi Arabia had been willing to endure more pain, burn more foreign reserves, and pump as much and as fast as they could, the price of oil might have continued into the teens ($10-20). This certainly would have created the outcome they were looking for, as the American companies could not backpedal fast enough, and Iran was beginning to pump more for the first time since the sanctions were lifted. Instead, Saudi Arabia met with the other members of OPEC, and, after several months of negotiations, came to an agreement to cut production and create a price floor. This increased optimism.

The resurgence:

The newfound optimism led to an absolute tear. The price of oil went from $30 a barrel in January of 2016, to $55 a barrel in January 2017. Hedge funds began taking record long positions in oil companies both in equities and bonds. Deep value and value investors began swooping in on assets they felt had fallen too far. The shift from active to passive investing continued in the billions with much of the money flowing into products such as XLE, XOP, CRAK, OIL, USO, and UNG. OPEC had cut a deal that attempted to stabilize the oil markets which many doubted would be possible. US companies had aggressively slashed costs, improved their balance sheets, and re-configured strategies to be profitable at lower crude prices. This was the painful repercussion of Saudi Arabia’s inability to bankrupt many American companies, which were now much stronger.

The occasional M&A deal popped up from time to time, and some companies that went into bankruptcy were even able to renegotiate with their creditors, come out of bankruptcy, and get back on the major exchanges. The election of Donald Trump was monumental in encouraging the price of crude as investors now felt that that the industry would become much more de-regulated and that pipeline deals with Canada would be expedited.

The reversion:

The problem I see going forward is the ever-expanding supply of crude oil, natural gas, and new products such as LNG. While it is no secret that Saudi Arabia is looking to diversify away from oil, it is still the country’s bread and butter. There has been chatter that OPEC may not renew oil cuts and I’m inclined to believe them.The first problem with the cut is that many countries (such as Russia) are notorious for cheating (pumping more barrels than the agreed upon number). Secondly, oil rich nations in the Middle East are envious of the blooming shale revolution in the United States and wonder why they should be forced to limit their production, while non-OPEC countries continue to pump away. This is why I don’t think there will be a renewal of the OPEC agreement, leading to an increase in production from the usual suspects.

However there are some players that are returning to the fray which have been sidelined due to conflict or sanctions. While the fight is not over yet, it seems that Iraq is close to defeating ISIS and regaining a grip on its country. This will allow it to resume control of its oil facilities and return to its 2013 production levels which are much needed to boost its economy and pay for reconstruction of the war torn country. Another similar situation is Libya. I rarely hear discussion on Libya these days, but ISIS is being pushed out of Tripoli by local commanders and warlords. I’m not sure how (or if) the government will stabilize and restructure going forward, or if the warlords who are not Islamic fundamentalists will carve out small portions of the country and rule their respective territories while occasionally fighting other local factions.

However, I think that practically whatever comes after ISIS, the situation will lead to more stabilization, and a return to Gaddafi-level oil production in due time. Iran is also ambitiously looking to become a major player in the region. They reluctantly agreed to the OPEC cut, but should they not renew, I believe Iran is capable of suffering that extreme pain needed to take market share from Saudi Arabia, and to do it out of spite. It also has received increased investment from European oil companies which bolsters it’s capability to develop projects.

Natural gas is also becoming increasingly more important. With decreased regulation, the US is now manufacturing large amounts of natural gas that are sent to refineries in Shreveport, Louisiana where it is converted into Liquefied Natural Gas and exported to Europe by companies like Cheniere Energy (LNG).

For the first time, US companies are competing against countries like Russia and the European natural gas market. As I mentioned earlier the Keystone XL Pipeline will increase oil and natural gas trade between the US & Canada, and the Dakota Access Pipeline will increase access to oil across the United States. A double-edged sword also exists in regards to American companies hedging the price of oil. On one hand, if the price of oil declines (as I believe it will), then the hedge will be extremely beneficial in protecting its losses. On the other hand, if the price heads north towards $70 a barrel, they will not be able to take advantage of the higher price of oil because they have locked in the price with which they can sell their oil. Many of these companies have chosen to lock in the price for close to a decade instead of for a shorter time frame. By hedging so far into the future, they take a large gamble. It is possible that there will be a sharp decline which cleans out all of the weak hands, consolidating the industry, and eventually pushing the price of oil higher in the midterm future (3-5 years).

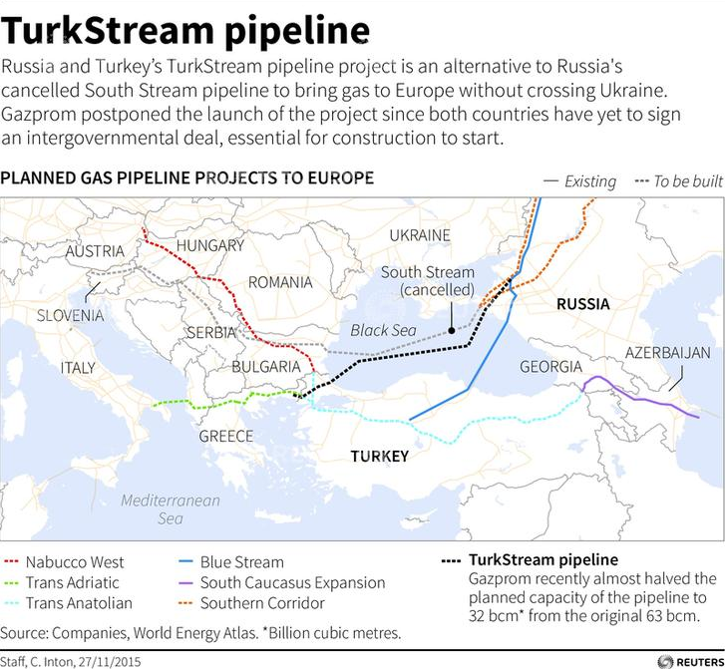

In the last 10 years, Israel has discovered two large natural gas reserves, which became known as the Tamar and Leviathan fields. Israel plans on building a pipeline into Egypt and Turkey, which conflicts with Russian interests. Russia has entered into an agreement with Turkey to create a new pipeline called TurkStream. TurkStream is important because it will link into another pipeline project known as the TransAdriatic pipeline that will go from Turkey through Greece and Albania all the way to Italy.

This is important for Russia because it gives them another connection into Europe to pump its oil and gas. The connection to the TransAdriatic pipeline is also a contentious issue because Turkey’s TransAnatolian pipeline is already connected to the TransAdriatic pipeline. The problem is that Turkey has signed an agreement with Azerbaijan to help develop and connect the TransAnatolia pipeline to the South Caucasus Pipeline which will bring natural gas from Azerbaijan through Greece into Turkey, and will attempt to sell to the same markets as Russia. As I noted in a prior article which describes the growing conflicts internationally, I think the Caucasus and the Balkans could become a real hotbed again.

Conclusion:

I believe that both the price of crude WTI & Brent, as well as natural gas, will continue to trend lower and that the temporary shutdown of rigs and investment in oil projects will not lead to a supply shortage like the IEA has in its forecast. While many companies are now positioned better than they were only 3 years ago, the extreme decline in which the price of crude dips below $20 a barrel and natural gas declines to below $2 a British Thermal Unit ultimately becomes too difficult of an environment for many companies to operate in. While the high beta levered oil and gas names provide the strongest results in a commodities bull market, they also decline the most. In an environment where “lower for longer” may be a stark reality, the diversified multinational conglomerates with strong balance sheets are the safer way to continue to invest in this industry.

I finish with a famous quote from the 18th century that ties in to the title of this article. While most people have heard the first part of this quote, I don’t believe that most know the second half, which I find to be equally as important.

“The time to buy is when there’s blood in the streets, even if the blood is your own.” -Baron Rothschild

Disclosure: None.

Hi Alex, nice article. Probably turn out be closer to reality than many might imagine. I think that since we topped in 2008 we have a potential leading diagonal (with Elliottwave structure defined as 3-3-3-3-3 in which every swings are series of 3) in development as shown on my chart. If this holds true, then we are not going to see price above much above $60 for a decade or more. Here is the link to my chart with the details - https://www.tradingview.com/x/3ba6tcZ9/

Thanks for reading! Will check out your chart.

Thanks for reading! Will check out your chart.