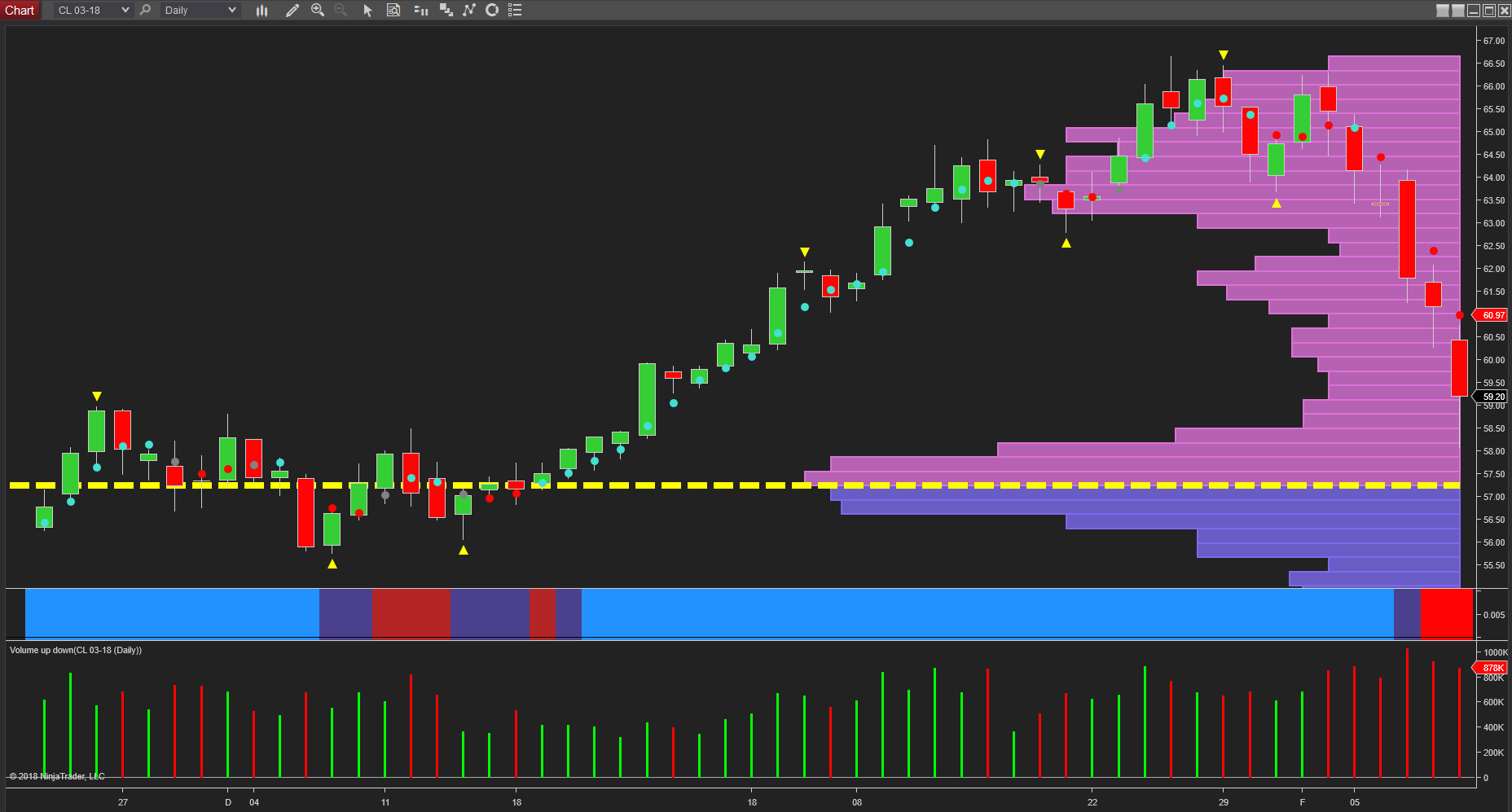

Oil Bears In Control But Expect A Bounce

For oil traders and investors, this market has followed a similar path to that for gold with the bullish momentum of late 2017 and early 2018, finally running out of steam at the end of January, and February’s price action then taking on a very bearish tone. And to this, we also have to consider several fundamental drivers.

First is the recovery in the US dollar which has seen the currency of first reserve move off the lows of 88.39 of the 1st of February, to close on Friday at 90.22. Second, the growth in US shale extraction is now increasing dramatically with US weekly crude production surging to over 10 mbpd, and with US production set to increase still further, this is now starting to impact traditional oil extraction, and indeed has now moved above that of Saudi Arabia, so worrying times ahead for OPEC. Third, and to add additional pressure to the supply chain, Libya’s oil production reached its highest level in five years, which was also against the backdrop of the recent announcement by Iran to boost its own production. And whilst the recently agreed supply targets continue to remain in place, the above factors have done little to quell concerns regarding oversupply which are now rising once more, and a tightrope which OPEC will continue to have to walk as the alternative energy suppliers continue to gain increasing market share, driving prices as a result.

From a technical perspective, the $66.50 per barrel region was tested on several occasions both in late January and early February, but held firm before rising volumes in the move lower signaled the onset of heavy selling by the big operators. In particular, the candle of the 2nd February and associated volume was a clear signal of further weakness to come which duly arrived the following day on a widespread down candle and very high volume. However, Friday’s gapped down candle on high volume, but with a deep wick to the lower body suggests the buyers are moving back in at the $58 per barrel level, with the market then closing the week at $59.20 for the WTI contract for March.

Whilst the current picture is bearish for oil, Friday’s big operator buying may see crude oil bounce off the lows of last week, and recover the $60 per barrel price region, but with the volume point of control now sitting below at $57.20 per barrel, this is the downside level that is likely to be tested in due course.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more

In my opinion, all these factors indicate that #oil will continue to drop. With Libya and Iran and the US all ramping up production, it's only a matter of time before the #OPEC members start turning on themselves again.