Image Source: Unsplash

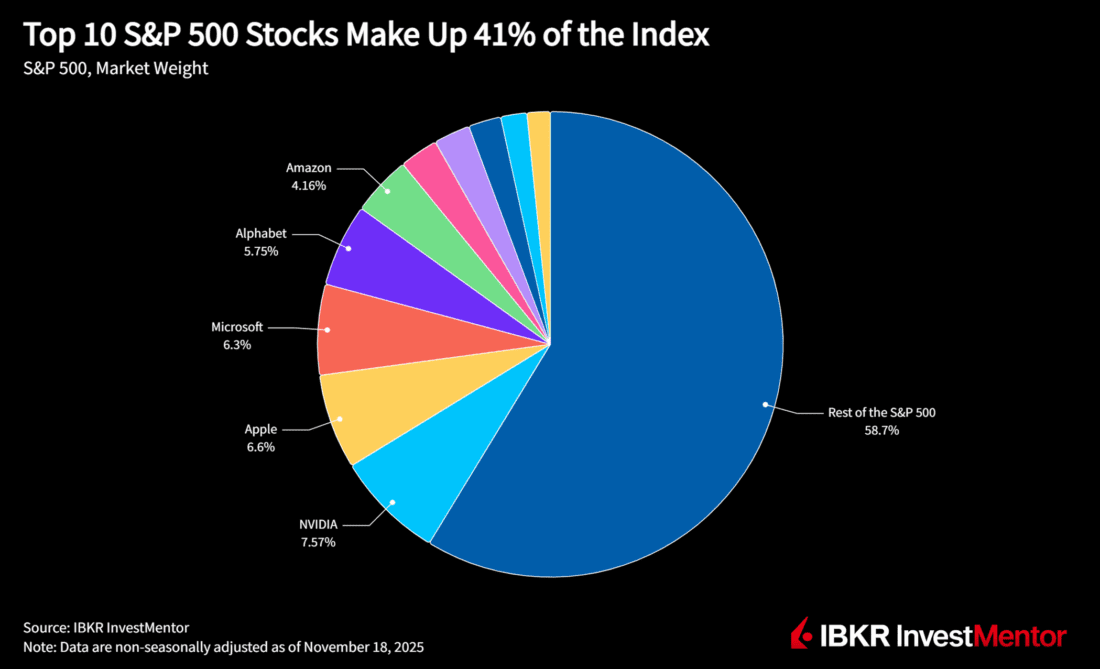

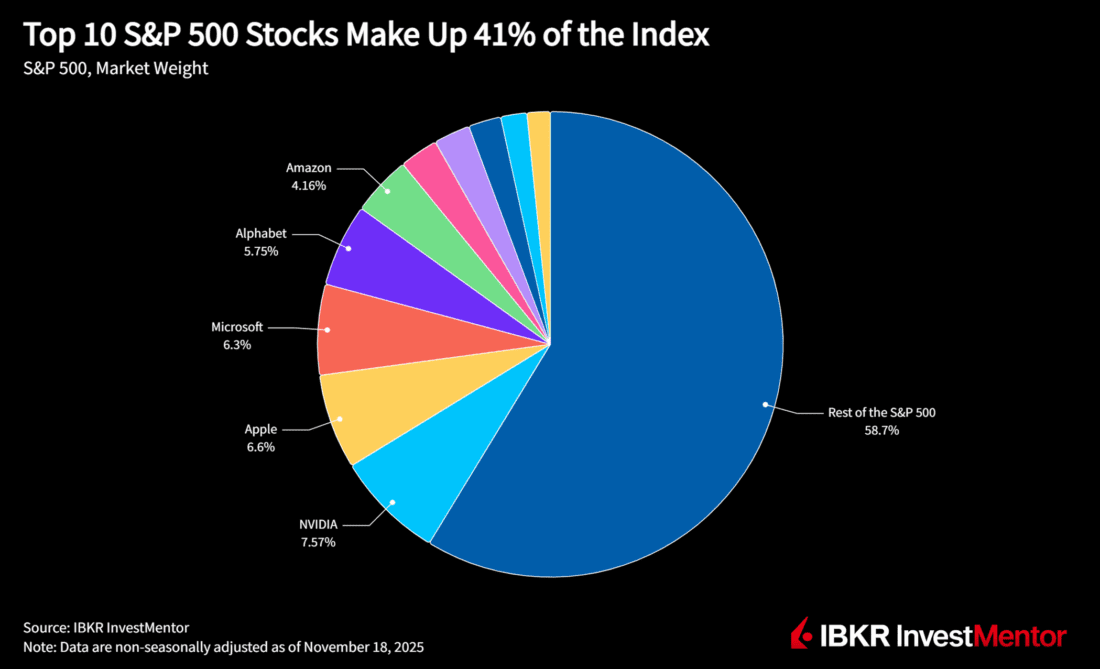

A small group of mega-cap companies now steers the S&P 500. The top 10 control more than 40% of the index, according to LSEG data, making markets more sensitive to single-company moves than at any point in decades.

Typically when these firms rally, the whole index typically surges. When they stumble, everything often shakes. For traders, this concentration means overall index strength can mask weakness in the other 490 stocks, and portfolios lean heavily on a handful of winners.

(Click on image to enlarge)

The Power of the Few

The S&P 500 heavyweights form a tight club of tech names: Nvidia NVDA, Apple AAPL, Microsoft MSFT, Alphabet GOOGL, Amazon AMZN, Broadcom AVGO, and META. Even the “outsiders” tie back to tech.

Tesla is a car company, but its investments in AI and robotics keep it aligned with the sector. Warren Buffett’s investment juggernaut Berkshire Hathaway BRK-B has large stakes in Apple and Alphabet. Pharmaceutical Eli Lilly’s LLY rise is powered by weight-loss drugs, amplified by viral social media buzz.

Much rides on the performance of the largest of them, Nvidia. A beat or miss at earnings can swing the entire index, a dynamic that will be on full display when Q3 results arrive on Wednesday.

The Passive Flow Engine

Passive investing has reinforced this concentration. Funds tracking indices like the S&P 500 buy the largest companies simply because they are already large, adding to their weight and widening the gap with the rest of the market.

With nearly half the index sitting in ten stocks, the buying loop becomes self-strengthening.

Market-cap weighting means even broad funds can hinge on a few names. Equal-weighted indices avoid this bias by giving each stock the same weight.

Backed by Fundamentals

Concentration isn’t just a quirk of index mechanics. It reflects genuine fundamentals. Big tech delivers massive earnings growth, global reach, and innovation in areas like AI. Their digital models scale almost without limit: once platforms, chips, or clouds are built, each extra user costs very little.

That creates high margins, huge cash reserves, and tough-to-disrupt moats. These entrenched advantages give dominant firms the power to widen their lead, reinforcing their influence on the index.

Echoes of Past Bubbles

History shows concentrated markets magnify booms and busts. In the late 1990s, tech stocks dominated indices before the dotcom crash. But even then, the top 10 peaked at just 27% of the S&P 500, according to Goldman Sachs.

Today’s setup is different: megacaps are profitable and well-established. Yet the lesson remains — when a handful of companies drive the market, volatility rises. Investors should watch whether the AI boom broadens leadership to new winners or keeps spoils confined to a few names.

More By This Author:

Investors Bought The Rumor But Sold The News

Stocks Jump As Investors Stand To Benefit From An Imminent Reopening, Favorable Seasonals

Selloff Accelerates After Consumer Sentiment Drops Near Record Lows

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract ...

more

Disclosure: Interactive Brokers Affiliate

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR InvestMentor, an affiliate of Interactive Brokers LLC, and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR InvestMentor and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

IBKR InvestorMentorSM

IBKR InvestMentorSM is a service of Interactive Academy LLC, an affiliate of IB LLC and majority-owned by IBG LLC. All content provided by IBKR InvestMentorSM is for informational and educational purposes only and should not be interpreted as implying any sponsorship, partnership, endorsement, recommendation, or approval by IB LLC or its affiliates.

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers LLC, its affiliates, or its employees.

Any trading symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

In accordance with EU regulation: The statements in this document shall not be considered as an objective or independent explanation of the matters. Please note that this document (a) has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and (b) is not subject to any prohibition on dealing ahead of the dissemination or publication of investment research.

If this page contains information regarding Options Trading, you must acknowledge that you have received the Characteristics & Risks of Standardized Options, also known as the options disclosure document (ODD). Options involve risk and are not suitable for all investors. For more information read the “Characteristics and Risks of Standardized Options”. For a copy, call 312 542-6901 or click here.

less

How did you like this article? Let us know so we can better customize your reading experience.