Not A Market To Chase

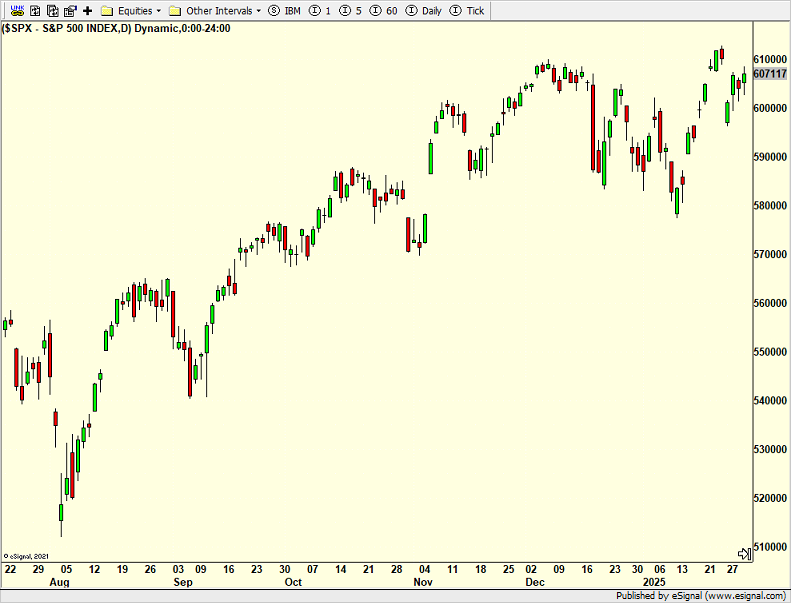

Since Monday’s plunge the stock market has recovered “nicely”. However, the S&P 500 hasn’t gone anywhere in two months. The Nasdaq 100 either. Lots of chop in a trading range which is pretty much what I laid out in my 2025 Fearless Forecast, the year momentum died. Up, down, sideways, lots of frustration.

(Click on image to enlarge)

I see it in our models. Some are full bore exposed at 200% and 300%. Others have very low exposure. And they’re moving all the time. It’s much easier, even when they’re wrong, if they all line up. I think that is coming, but after a more meaningful pullback.

Sentiment remains greedy and giddy. I saw that anecdotally this week. Every market conversation was about buying something AI related after Monday’s plunge, especially Nvidia (NVDA) which I have previously mentioned isn’t even in the top five. My view on the stock is that it is a “sell the rally” theme until proven otherwise. The backbone of the rally is broken and it could fall all the way back to $100. Everyone knows it is one of the most overowned companies out there.

(Click on image to enlarge)

I am not wavering at all from my forecast. Selling rallies and buying declines remains the theme.

On Wednesday we bought FXI and SSO. We sold EWS. On Thursday we bought TQQQ. We sold SSO, some KRE and some DWAS.

More By This Author:

All-Time High S&P 500 – Is It The Selling Opp I Forecast?

Fearless Forecast 2025 – Calm Before The Storm

S&P 500 Poised For New Highs

Please see HC's full disclosure here.