Non-Federal Statistic Of The Day: Recession Predictor?

Image Source: Pexels

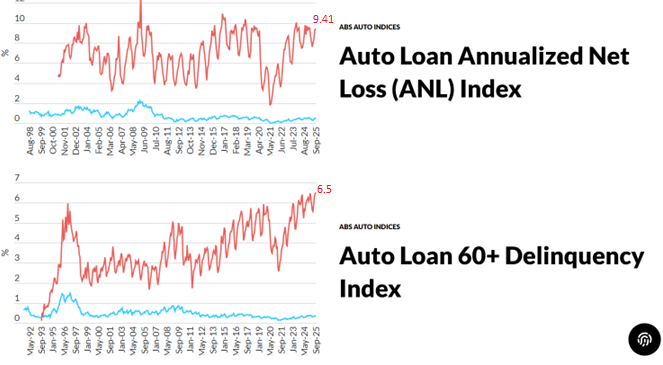

We would’ve gotten Q3 advance GDP yesterday, and September personal income and outlays today, ordinarily. What indicators do we have for the state of the macroeconomy? Here’s one: delinquincies on auto loans (for pools of asset backed securities).

Source: Fitch, accessed 10/31/2025.

Auto loan delinquencies (60+ days) on pools of loans in subprime ABS have surged to 6.5% in September. Since there appears to be seasonality, it’s useful to compare against September 2024: 6.12%. (Delinquency rates for the prime ABS pool is relatively unchanged over the year, at 0.37%).

The ABS deliquency rate is much higher than at any period of the 2007-09 recession, and higher than on the eve of the Covid recession, arguably when the economy was slowing drastically.

The annualized net loss (ANL) index is slightly down, 9.41 vs. 9.79 in September of 2024. This index is partly supported by the increase in used car prices, e.g. Manheim Index, which has risen from 202.96 to 207.03, or 2%, over the corresponding period.

Is the delinquency rate of use in predicting an incipient recession? If the characteristics of the loans were constant, perhaps so. However, as Adams et al. (2024) point out, the post-Covid loans were of larger size than for previous origination years, and this factor appears to be an important factor in delinquencies. Hence, I would be wary of extrapolating from previous episodes the predictive power of the delinquency rate, at least in levels.

More By This Author:

ACA Premiums Without Extension Of Expanded Tax Credit

Trump: China To Buy A “Tremendous” Amount Of Soybeans

Everyday Prices Up 2.2% Since Jan. 2025