No Plans?

TGIF. One last day of work for many frustrated by the sharp turn of mood from bull to bear for equities and from hawk to dove for monetary policy over the week. While we are preached to live in the moment and be mindful, the empathy of the now overwhelms any plan or hope for change. The yield curves in Europe are telling us something about the future as the negative yields in Germany creep out from 5-years to 9-years. The flattening of hope means that dreams for normalization and growth are eroding fast. Overnight, the two drivers for markets came from the Trump dour quip that a meeting with China Xi before March 1 was “highly unlikely” and from the RBA SOMP, which cut growth outlooks even sharper than the BOE and EU Commission yesterday. Between Brexit and US/China trade wars, there is no room for investor error and no plan for bonds to be anything but bid by central bankers. The push of positions against a grim reality mixed with unflappable faith in the magic of the Powell Put may explain January price action, but it fails in February. Today is about something else, future planning and how the present troubles can linger longer than anyone wants or hopes – witness the weakness in Italy and Sweden data, the rise of German trade surpluses and the trouble in Japan EcoWatchers. Consider the AUD as the bellwether for adjustments as rates plummet with the dovish RBA and the AUD reflects how yields matter to FX. The lack of FX moves other than AUD might be an important point to consider as the price adjustments are in fixed income now, equities second and FX third. Global flows are confused and likely to stay that way until we get more clarity on trade policy and Brexit plans.

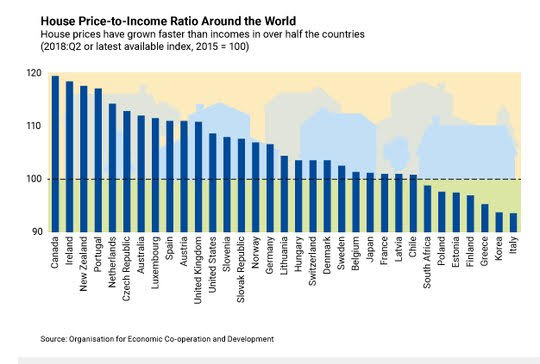

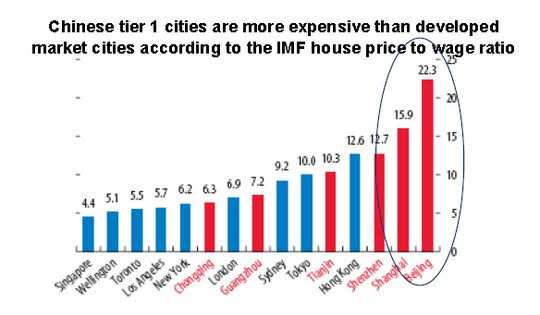

Question for the Day: Is there a global housing bubble risk? The scars of the US subprime mortgage crisis and the great recession that followed it are still in the memory of markets. The event overnight was in the return of fear about US/China trade talks stalling and in the Australian SOMP being gloomier on growth. The risk of a housing bubble and pop globally rests on the balancing act of wage growth hopes against housing price reversals. The chart from the IMF gets to the point and to the risks where many central banks have uses LTV rules and macro-prudential rules to push off property bubbles. House prices to income ratios matter as we all remember and the Australian SOMP highlights this risk today as well.

The role of housing in consumer credit and domestic demand globally matters significantly. It may even outstrip the trade sector doubts in the medium term. While many are focused on the US/China trade noise, the process of normalization in rates from 2018 and the payback on markets in 2019 is underway in other sectors – like housing. The risk of a pullback in consumer credit and so to global growth is also in play. It may outstrip Chinese targeted stimulus and any hopes for a larger trade accord.

What Happened?

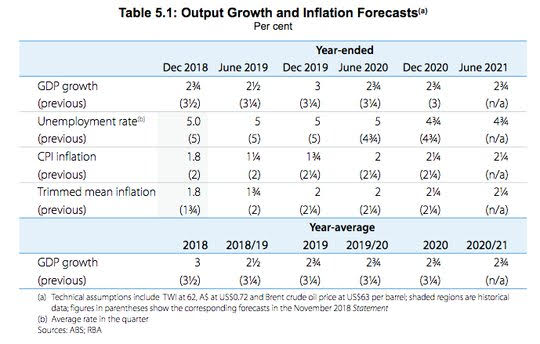

- Australia RBA Statement on Monetary Policy: Cuts growth forecasts sharply. The SOMP was more dovish than the RBA Lowe speech and the shift to neutral bias. The key focus is on China/US trade and domestic consumption. The RBA noted the balancing of wages against house prices: “In light of recent data and revisions to past outcomes, the Bank’s forecasts for consumption growth have been lowered. The outlook for consumption growth hinges on household income growth picking up, and by enough to offset households responding to falling housing prices by reining in their spending. Such a pick-up in income growth seems probable given the improving labour market, but is not assured. In the context of high household debt, currently weak income growth and falling housing prices, the resilience of consumption growth is a key uncertainty for the overall outlook.”

- Japan December household spending rose -0.1% m/m, +0.1% y/y after -0.6% y/y – better than -0.1% y/y expected – first gain in 4-months. The average real monthly income rose 2.3% y/y to Y1,026,628.

- Japan January EcoWatcherscurrent conditions drops to 45.6 from 46.8 – worse than 48.6 expected– however the outlook index bounces to 49.4 from revised 47.9 (pre 48).

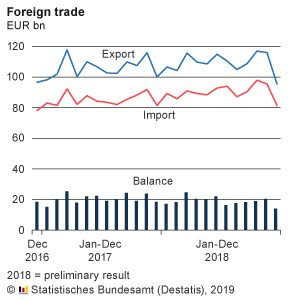

- German December trade surplus widens to E19.4bn after revised E18.9bn (pre E18bn) – better than E18bn expected. The exports rose 1.5% m/m, +3% y/y to E96.1bn after -0.3% m/m – better than -0.3% m/m drop expected. The imports rose 1.2% m/m, 0% y/y to E82.1bn after -1.3% m/m – also better than 0.2% m/m expected. The unadjusted balance of trade was E13.9bn from E20.4bn. The current account surplus narrowed to E21.0bn from E21.6bn.

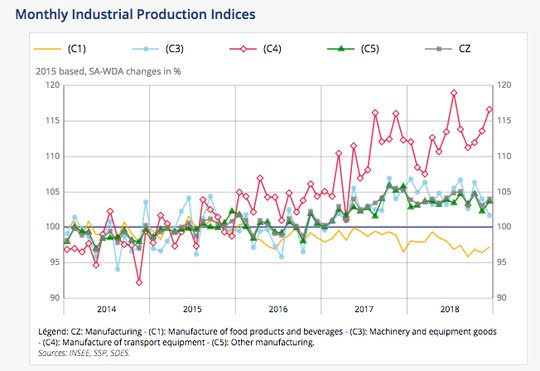

- French December industrial production bounces up 0.8% m/m after -1.5% m/m – better than the +0.6% m/m expected. Manufacturing rose1% m/m after -1.5% m/m. Mining and energy was 0% after -1% m/m. Construction rose 1.9% m/m after +1.3% m/m.

- Italy December industrial production slips -0.8% m/m, -5.5% y/y after -1.7% m/m, -2.6% y/y – worse than the 0.4% m/m, -3% y/y expected.

- Sweden December household consumption -0.8% m/m, -1% y/y after 0% m/m – weaker than +0.4% m/m expected. Transport, retail sales and auto services led to the annual weakness.

Market Recap:

Equities: The US S&P500 futures are off 0.6% after losing 0.94% yesterday. The Stoxx Europe 600 is off 0.4%. The MSCI Asia Pacific is off 1.8% with return of Hong Kong and others post holiday.

- Japan Nikkei off 2.01% to 20,333.17

- Korea Kospi off 1.2% to 2,177.05

- Hong Kong Hang Seng off 0.16% to 27,946.32

- China Shanghai Composite on holiday

- Australia ASX off 0.37% to 6,136.20

- India NSE50 off 1.14% to 10,943.60

- UK FTSE so far off 0.25% to 7,076

- German DAX so far off 0.75% to 10,941

- French CAC40 so far off 0.25% to 4,973

- Italian FTSE so far flat at 19,471

Fixed Income: Risk-off drives further bid to bonds – but pain in periphery stalls. The German 10-year Bund yields are off 1bps to 0.11%, the French OATs are up 1bps to 0.56% while UK Gilts are flat at 1.18%. The periphery mixed with Spain off 1bps to 1.23%, Portugal off 1bps to 1.66%, Italy off 1bps to 2.94% and Greece up 2bps to 3.99%.

- US Bonds are bid waiting for more 4Q earnings, more US/China news– 2Y off 1bps to 2.47%, 5Y off 1bps to 2.45%, 10Y off 1bps to 2.64%, 30Y off 1bps to 2.99%.

- Japan JGB rally back with global mover, China worries and BOJ– 2Y off 1bps to -0.16%, 5Y off 1bps to -0.16%, 10Y off 2bps to -0.03%, 30Y off 2bps to 0.59%.

- Australian bonds extend rally on RBA SOMP– 3Y off 4bps to 1.61%, 10Y off 6bps to 2.08%.

Foreign Exchange: The US dollar index is up 0.1% to 96.60. USD mixed in emerging markets: EMEA – RUB off 0.15% to 66.026, ZAR off 0.1% to 13.622, TRY up 0.3% to 5.245; in Asia– INR flat at 71.288, KRW up 0.3% to 1120.50.

- EUR: 1.3340 flat. Range 1.1323-1.1345 with 1.13 still the key support – waiting for more on US/China trade, politics.

- JPY: 109.80 flat. Range 109.65-109.90. EUR/JPY 124.55 flat. No big push for 108 despite equities – rates driving.

- GBP: 1.2960 up 0.05%. Range 1.2921-1.2972 with EUR/GBP .8750 off 0.1%. Still about Brexit and May/Tusk talks.

- AUD: .7080 off 0.25%.Range .7061-.7104. NZD flat at .6745. Focus is on rate spreads and China with .7050 pivot for .68 retest risk.

- CAD: 1.3320 up 0.1%.Range 1.3298-1.3329 with 1.3350 for 1.35 risk in play – jobs and oil key.

- CHF: 1.0015 off 0.05%.Range 1.0013-1.0028 with EUR/CHF 1.1355 off 0.1%, minor demand but risk for 1.00 pivot to .9880 in larger equity risk-move.

Commodities: Oil mixed, Gold up, Copper off 0.15% to $2.8125

- Oil: $52.38 off 0.5%. Range $52.08-$52.69 with focus on weaker growth driving. Brent up 0.2% to $61.75 with focus on $62 as the pivot – OPEC/Russia vs. US supply.

- Gold: $1316.20 up 0.15%. Range $1311.50-$1316.70 with safe-haven demand back tracking equities, trade fears – focus is on $1310-$1325. Silver up 0.3% to $15.77, Platinum up 0.15% to $798.30 and Palldium up 1.15% to $1374.

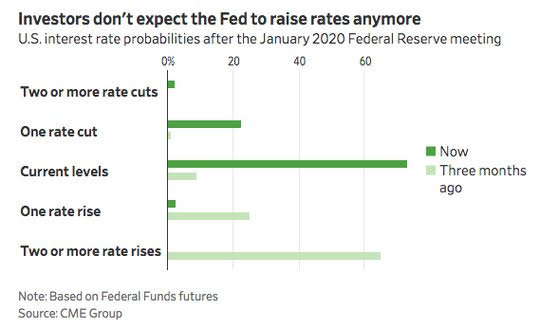

Conclusions: Is the FOMC going to have to do more? The flip of market expectations about global growth and geopolitical risks from China trade and UK Brexit are clearly back on the news agenda. The January rally back in risk was helped by the sharp repricing of FOMC rate hikes to being on extended hold – but is that enough to support markets in February? This will be the key part of the puzzle for the USD and bonds as we watch equities today.

Economic Calendar:

- 0830 am Canada Jan employment 9.3k p 6ke / unemployment rate 5.6%p 5.7%e / participation rate 65.4%p 65.4%e

- 0115 pm San Fran Fed Daly on economic forecasts

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.