NFIB Nuances

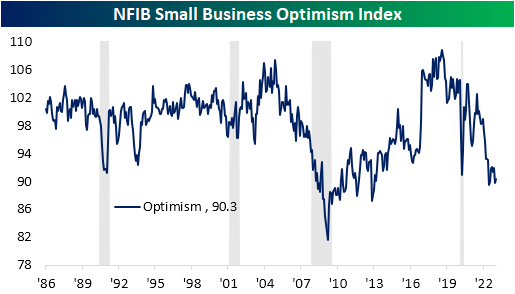

This morning’s release of the NFIB‘s survey of small business sentiment showed only a modest rebound. Whereas the index was expected to rise from 89.8 up to 91, the index only rose to 90.3. Albeit higher sequentially and off the lows from last fall, the January reading also remains below the worst levels from the onset of COVID.

In addition to optimism remaining weak, the most recent month also saw a surge in economic policy uncertainty. Rising 5 points month over month to 76, that index is at the highest level since July 2021 and saw its biggest one-month jump since last July.

Looking across the individual components of the report, breadth was mixed with six of the ten inputs into the headline optimism number moving higher while the other four fell. Multiple categories—in addition to the headline index—are in the bottom decile of their historical ranges. As we discussed in today’s Morning Lineup, while in aggregate some aspects of the report remain weak, there is some nuance. In general, this month’s report saw improvement in categories measuring realized changes (i.e. actual earnings changes, actual sales changes, actual employment changes, etc.) while expectations were much worse (i.e. plans to make capital outlays, plans to increase inventories, etc.). In other words, small businesses appear to have pessimistic outlooks contrary to reporting actual improvements in their businesses.

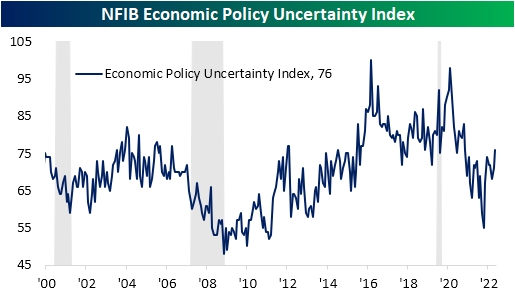

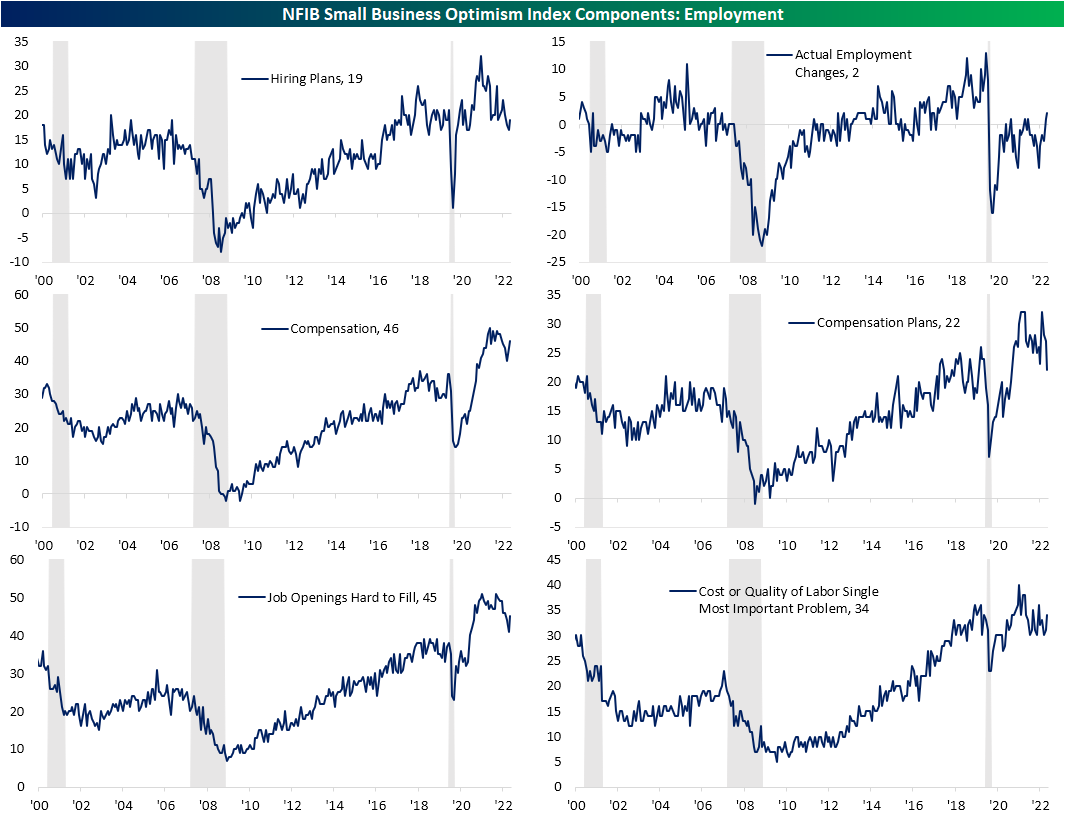

The employment situation showcases that divergence between actual changes and plans. Hiring plans remain at the low end of the pandemic range even after a slight rebound versus the December reading. Meanwhile, compensation plans have plummeted to a new low and the weakest level since April 2021. That was in spite of actual employment changes showing net hirings at the highest level since March 2020 with a coincident uptick in compensation to the highest level in six months.

(Click on image to enlarge)

Albeit on net more firms are seeing declines rather than increases, this month also saw an improvement in actual sales and earnings. Part of that change is likely thanks to alleviation in inflation as the higher prices index hit a new post-high low of 42. In turn, the percentage of respondents reporting now as a good time to expand has modestly recovered. With that said, sales expectations continued to reverse lower after peaking two months ago.

(Click on image to enlarge)

As for expenditure indices, again the dichotomy of plans and actual changes is apparent. While plans experienced a 13th percentile month-over-month decline to the low end of its pandemic range, reported capital expenditures have surged with a top decile month-over-month reading. In fact, that sharp rise during the month of January resulted in the joint highest reading of the post-pandemic period (March and May 2021 saw identical readings).

Meanwhile, plans to increase inventories are rapidly declining. The index for inventory accumulation has now reached the lowest level since 2009. However, even though inventories are rapidly declining, businesses on net report satisfaction with current inventory levels. Following the very high readings in inventory satisfaction earlier in the pandemic (meaning on net a higher percentage of respondents reported inventories were too low), the huge drop in inventory accumulation would indicate some supply/demand mismatches are working themselves out; likely in part thanks to weakening sales.

(Click on image to enlarge)

Turning back to capital expenditures, the NFIB also surveys on what these small businesses are spending their money on. January saw a broad uptick across categories with the exception of furniture or fixtures.

More By This Author:

Inflation Expectations Trending LowerNew 52-Week Highs In 2023

Jobless Claims Above Expectations

Click here to learn more about Bespoke’s premium stock market research ...

more